(Bloomberg) -- The Federal Reserve, European Central Bank and Bank of England all left interest rates unchanged this week, but signaled different paths for policy going forward.

Officials in the US are prepared to cut interest rates in 2024, while those in Europe said they'd step up their exit from pandemic-era stimulus. Meantime, policymakers in the UK were more hawkish, with several still supporting a rate hike at Thursday's meeting.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

US

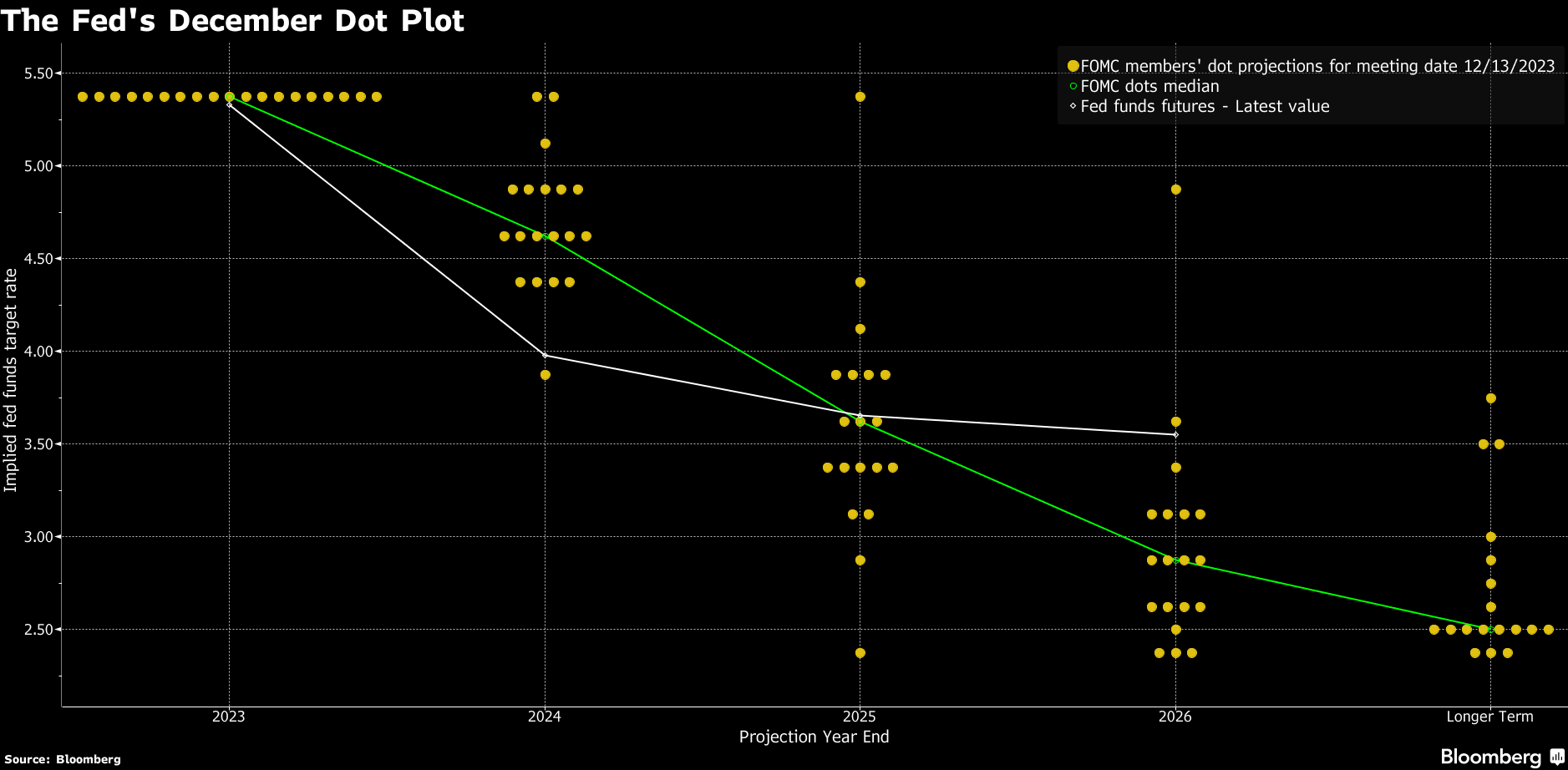

The Federal Reserve pivoted toward reversing the steepest interest-rate hikes in a generation after containing an inflation surge so far without a recession or a significant cost to employment. While Chair Jerome Powell said Wednesday policymakers are prepared to resume rate increases should price pressures return, he and his colleagues issued forecasts showing that a series of cuts would be likely next year.

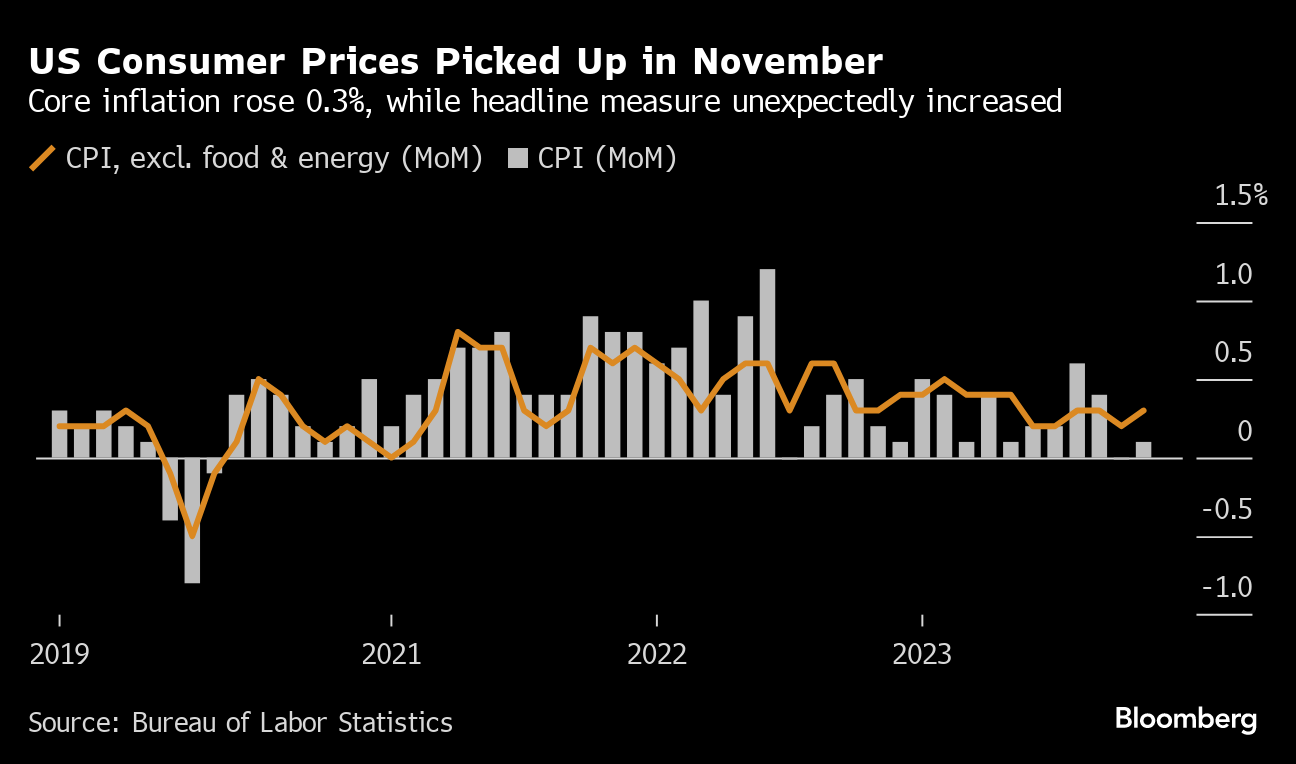

US consumer prices picked up in November on increases in housing and other service-sector costs, keeping inflation stubborn enough to thwart any Federal Reserve interest-rate cuts soon.

Europe

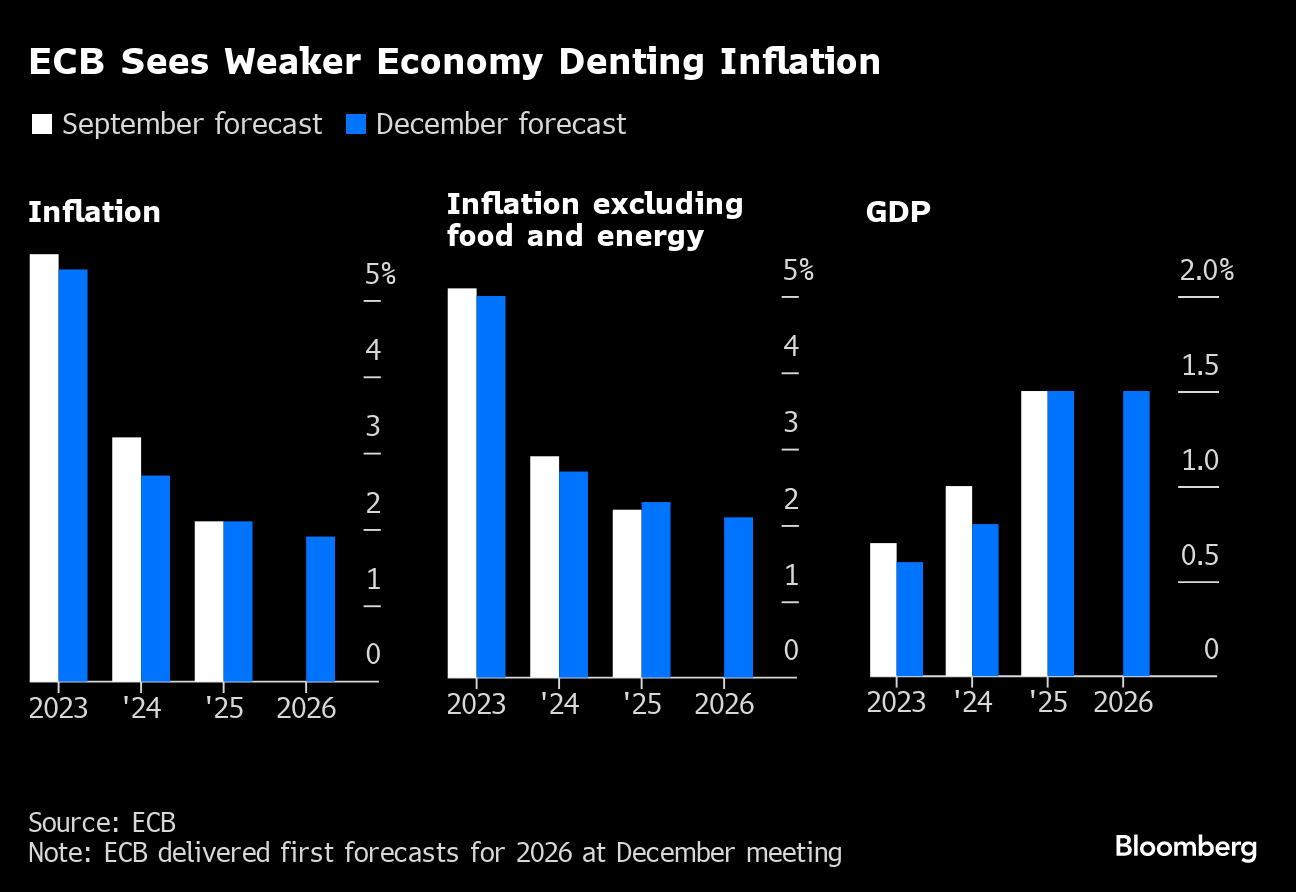

The European Central Bank kept interest rates on hold for a second meeting with inflation tumbling, but said it will step up its exit from €1.7 trillion ($1.8 trillion) of pandemic-era stimulus. Officials, meanwhile, said they'd accelerate the end of reinvestments under the PEPP bond-buying program. That will put all policy tools into tightening mode, even as fresh projections showed a weaker economy softening the inflation outlook.

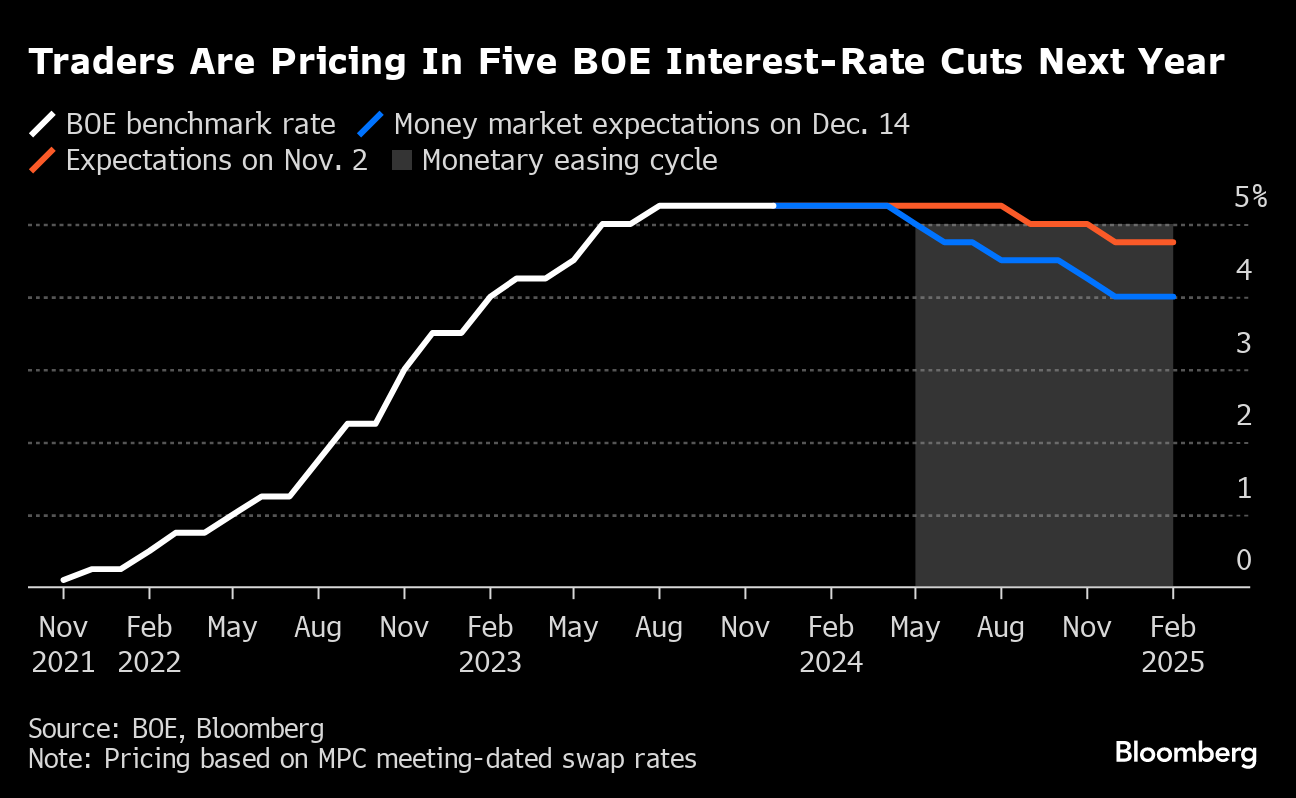

The Bank of England kept interest rates at a 15-year high, sticking with its message that borrowing costs will remain elevated for some time despite growing bets on a wave of cuts in 2024. Governor Andrew Bailey said in a statement released alongside the decision that “there is still some way to go” in the fight to control inflation.

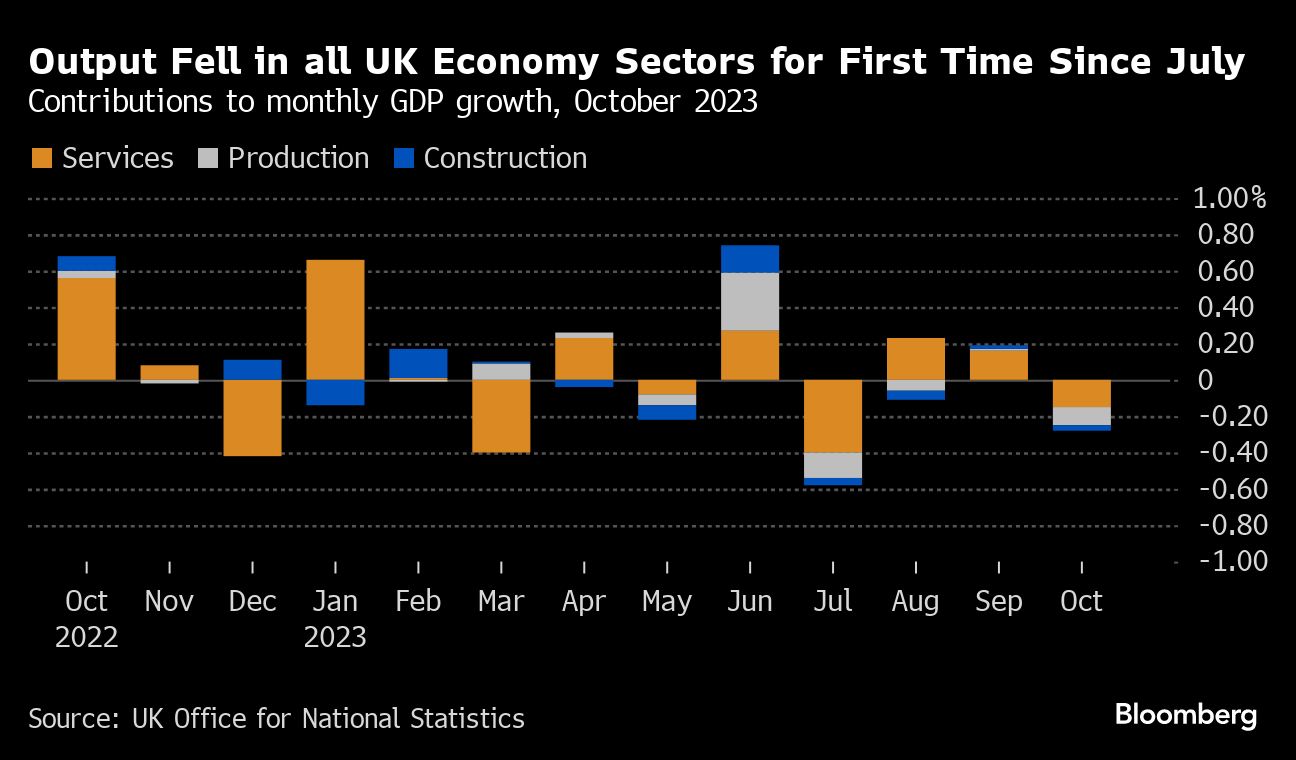

The UK economy shrank more than expected in October as elevated borrowing costs and wet weather took their toll, setting the stage for another quarter of stagnation that is widely forecast to persist through 2024. With the full impact of Bank of England interest-rate increases yet to be felt, the economy is forecast to eke out a small gain at best in the fourth quarter, with some even predicting the start of a shallow recession.

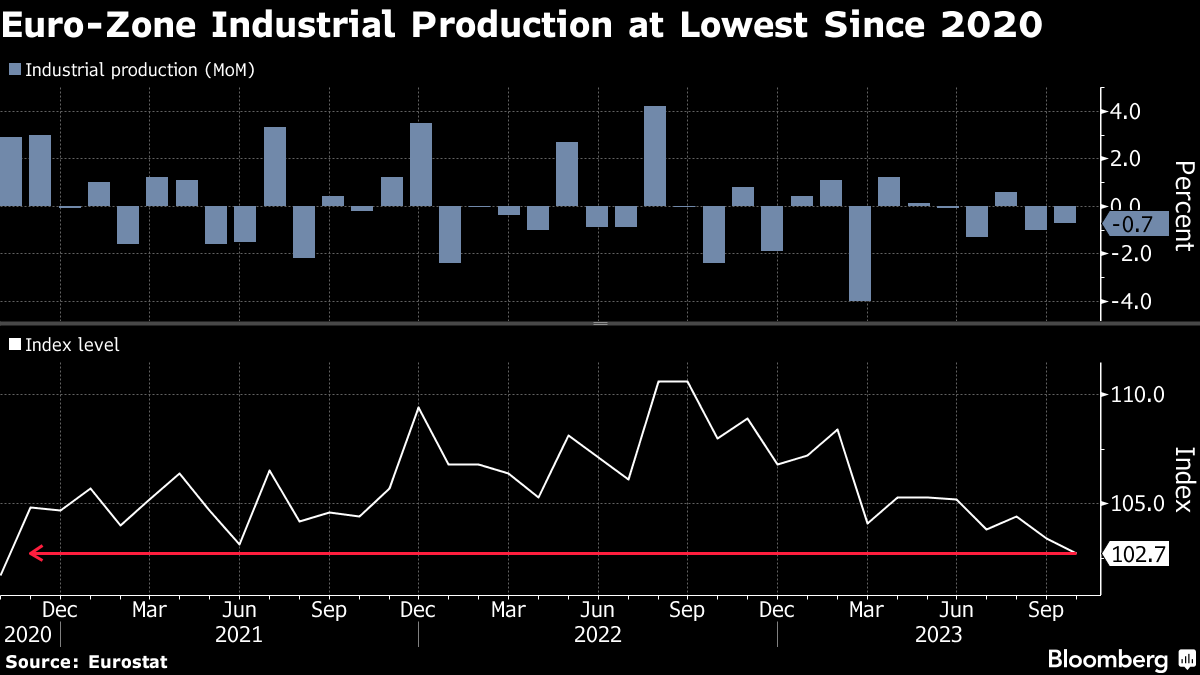

The euro zone suffered a bigger-than-expected drop in industrial production in October, a sign of weakness that could mean the economy is in a recession. Such a drop at the start of the final three-month period of 2023 means that manufacturing and the rest of the economy have more ground to cover to avoid two consecutive quarters of contraction that would amount to a downturn.

Asia

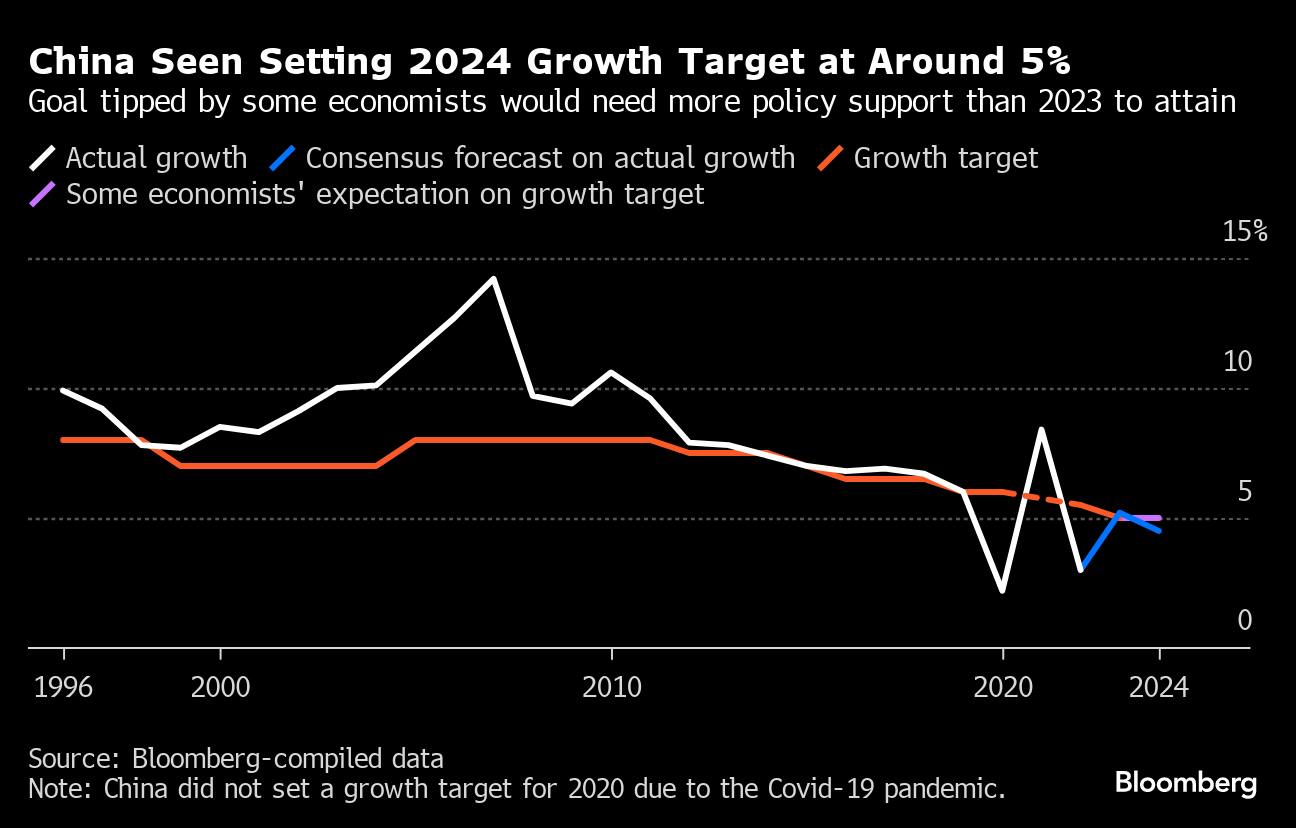

China's top leaders including President Xi Jinping vowed to make industrial policy their top economic priority next year, a letdown for investors hoping to see more forceful stimulus to boost growth. The meeting's emphasis on supporting companies to produce higher-value products above trying to spur consumer spending is unlikely to significantly juice growth in the near-term.

Singapore is closing in on Hong Kong's lead in real estate deals as the city-state benefits from its status as a wealth haven, while distressed property sales afflict the rival Asian financial hub.

Emerging Markets

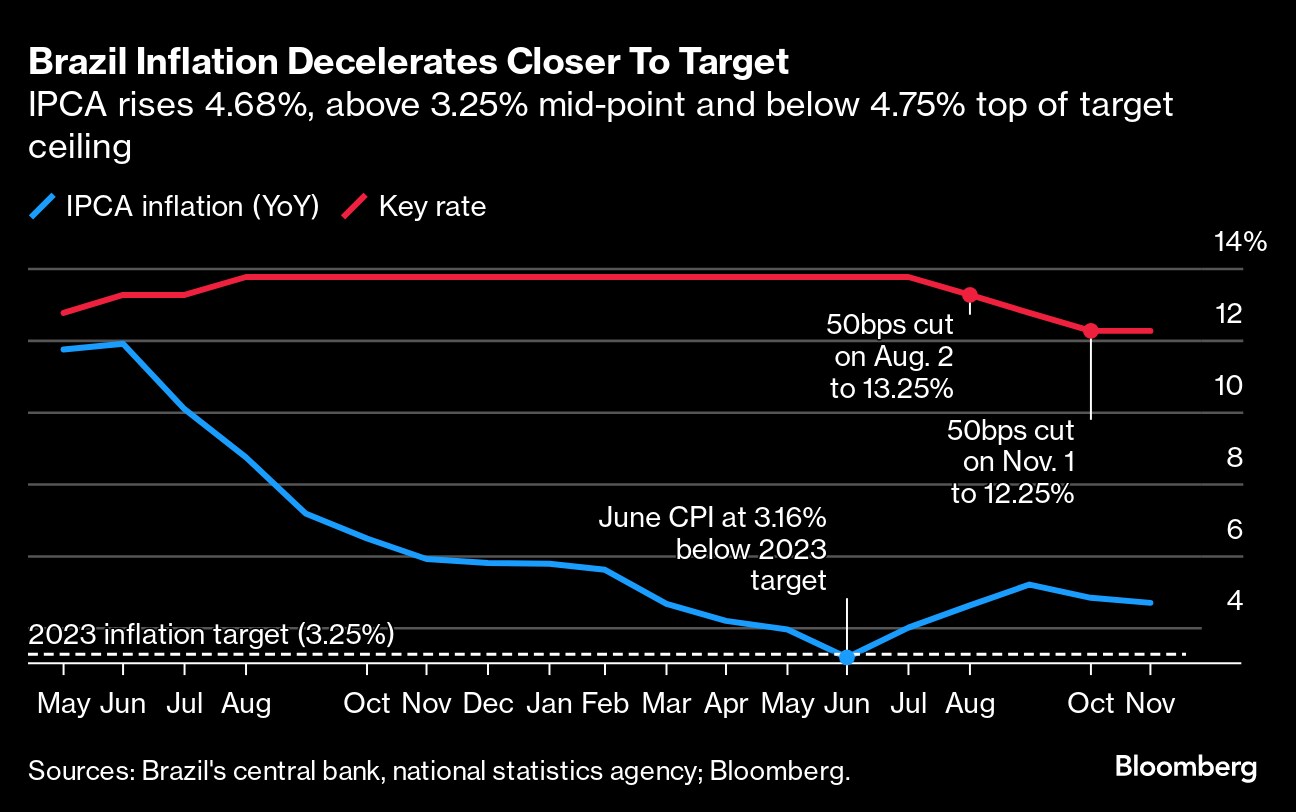

Brazil's annual inflation rate fell to within the central bank's target range, preceding a fourth-straight cut to borrowing costs by policymakers. The country's central bankers are forging ahead with plans to ease monetary policy with “serenity” and “moderation” as annual inflation is seen ending the year within the target range for the first time since 2020.

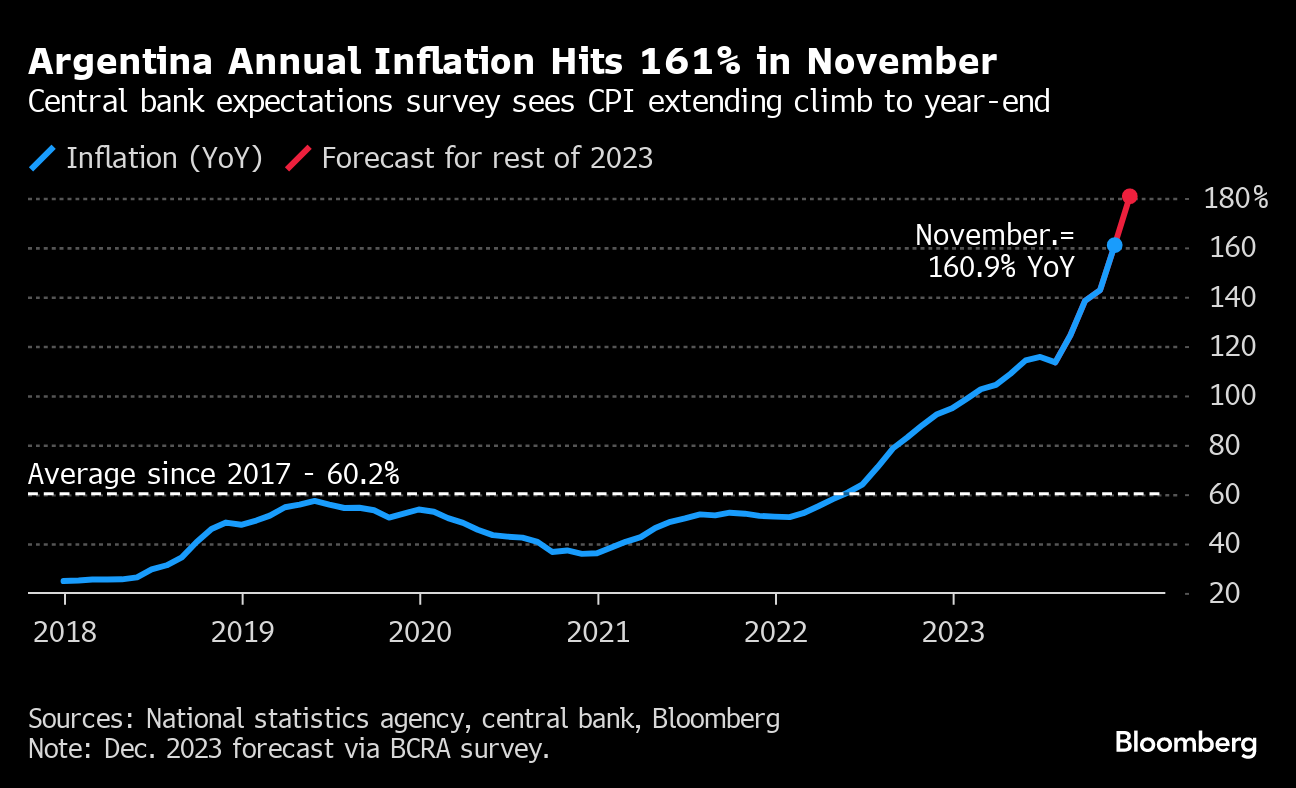

Argentina's inflation soared above 160% in November ahead of President Javier Milei's massive currency devaluation that's likely to accelerate price increases ever further this month. The first days of December have already seen price increases of 15% compared with a month earlier, and may end the month up around 20%, according to consulting firm C&T Asesores.

World

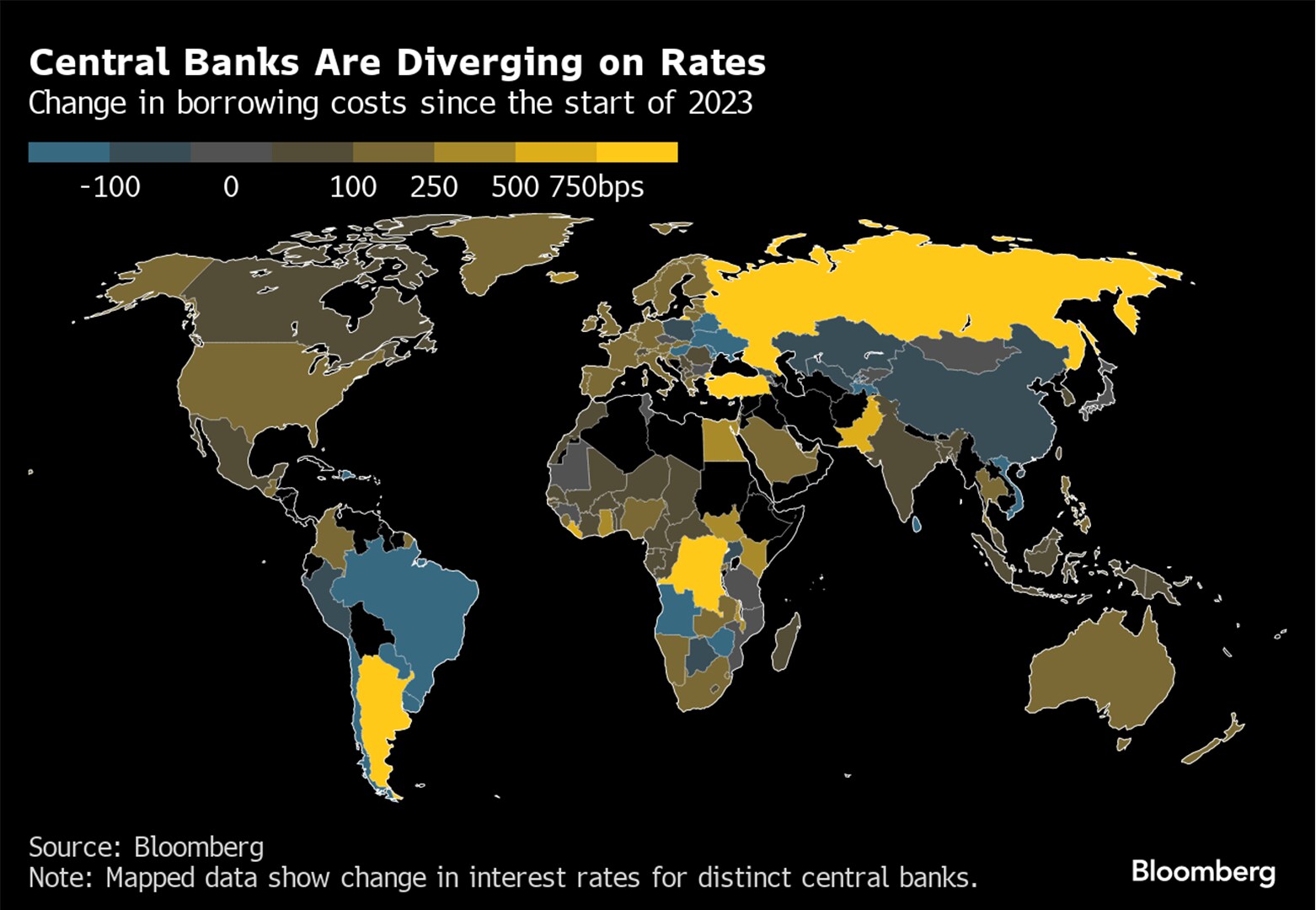

Outside of the major central banks, Norway's central bank pushed ahead with a final hike in borrowing costs. Russia also raised borrowing costs. Mexico, Pakistan, the Philippines, Switzerland, Taiwan held rates. Brazil, Peru, Ukraine, cut.

--With assistance from Andrew Atkinson, Krystal Chia, Tom Hancock, Zhu Lin, Yujing Liu, Jana Randow, Tom Rees, Andrew Rosati, Augusta Saraiva, Catarina Saraiva, Zoe Schneeweiss, Craig Stirling, Manuela Tobias, Craig Torres, Fran Wang, Alexander Weber and Lucy White.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.