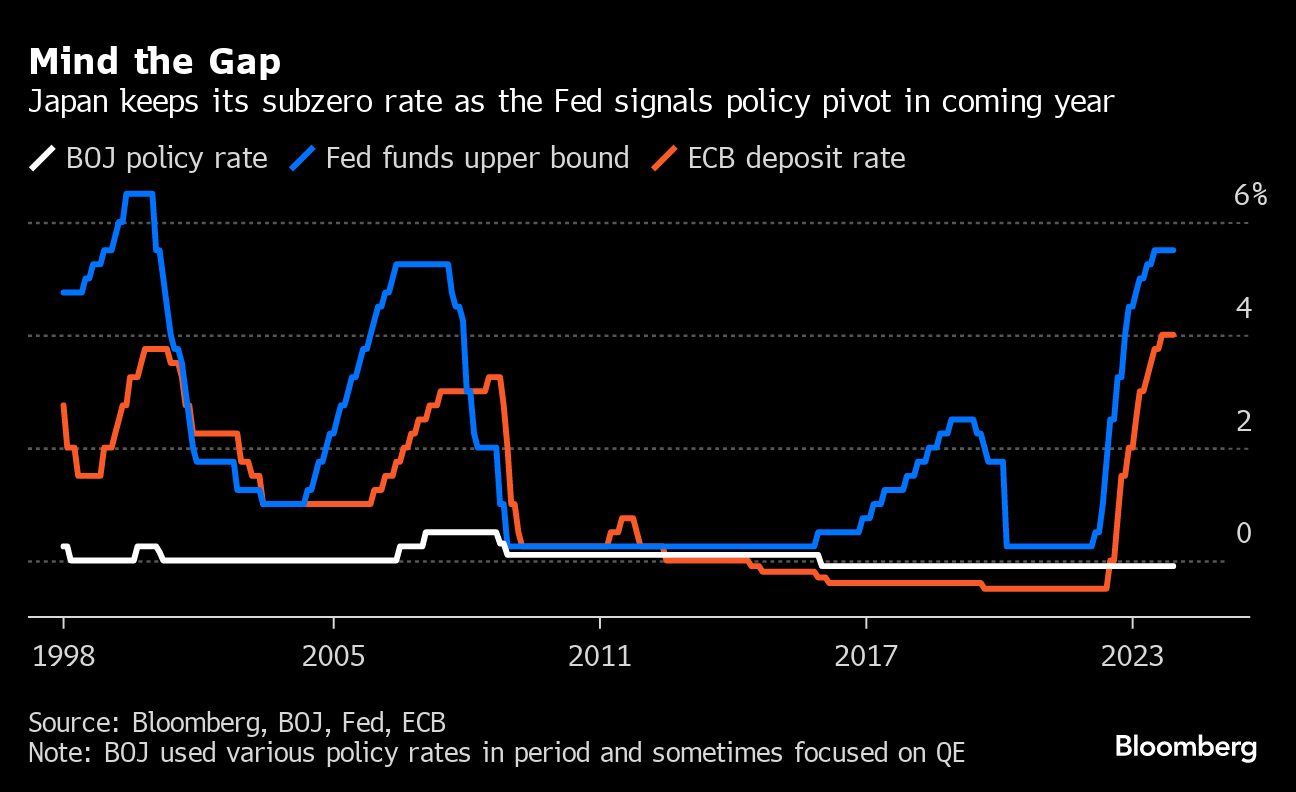

(Bloomberg) -- The Bank of Japan stuck with the world's last negative interest rate Tuesday and offered no guidance on if it might scrap the policy next year. The yen fell sharply after the decision.

The central bank kept its short-term rate at -0.1% and maintained its yield curve control parameters in a unanimous decision at the end of a two-day gathering, according to a statement. Forward guidance on policy was left unchanged with no specific references hinting at the prospects for a rate increase.

Governor Kazuo Ueda chose not to surprise the markets as he continues to seek more evidence to confirm that wage gains will feed into sustainable inflation. Still, the decision to stand pat in December won't quell speculation that a rate hike is coming sooner or later, with April seen as the most likely option.

Investors will parse Ueda's words closely when he addresses the press later Tuesday for any hints that build the case for that timing or for an earlier move.

The BOJ left its guidance unchanged, saying inflation expectations have risen moderately and it will continue to retain its monetary easing patiently. It made tweaks to its assessments of consumer spending and business investment in a slightly cautious sign. It said personal consumption has continued to increase moderately, removing the word “steadily” from the previous description.

The yen weakened to as much as 143.78 to the dollar from around 142.64 before the decision.

That move reflected disappointment from some who had bet the BOJ would surprise markets with a hike or a signal of an early move. Japan's currency touched a four-month high last week after the Federal Reserve signaled a policy pivot coming in 2024. The yen's earlier gains took some of the pressure off Ueda, who had faced the risk of sending the currency to a fresh three-decade low at recent meetings.

“There was some speculation the BOJ could alter its rhetoric today to prepare the market for a change in policy in the coming months,” said David Forrester, senior FX strategist, Credit Agricole CIB Singapore Branch. “The lack of any changes in the central bank's rhetoric makes the market's pricing for the end of NIRP by April 2024 look aggressive, which is weighing on the JPY.”

The Fed's dovish turn could put pressure on Ueda further out, as some BOJ watchers feel it narrows the window of opportunity for the BOJ to normalize policy. If an end to the BOJ's subzero rate were to trigger a much stronger yen, it would rekindle deflationary pressure in the economy. Pulling the plug on the negative rate when other central banks are starting to ease policy may also spark more volatility in markets.

On the other hand, if the Fed manages to engineer a soft landing for the US economy, it would put a floor under global growth, helping the BOJ.

What Bloomberg Economics Says...

“We don't expect Ueda to indicate the central bank is rushing to end yield-curve control and negative rates. But he may try to further lay the groundwork for a smooth transition next year.”

— Taro Kimura, economist

Click here to read the full report.

In recent weeks, BOJ officials have spurred speculation over a near-term end to the negative rate with their comments, although it's possible some of the verbal signals were more inadvertent than orchestrated.

Deputy Governor Ryozo Himino's upbeat discussion of the possible impact of a hike came in a speech on Dec. 6. Ueda further fueled the market chatter by telling lawmakers his job would become “more challenging” from the year-end. He said that before meeting with Prime Minister Fumio Kishida, who has highlighted the importance of policy alignment.

Kishida is embroiled in Japan's worst political turmoil in decades after a funding scandal enveloped the biggest faction of his ruling Liberal Democratic Party. Four cabinet ministers resigned last week, further destabilizing the premier's footing. In one poll, the Kishida administration's support was the weakest for a Japanese cabinet in 14 years. Prosecutors began raiding the offices of some LDP members in connection with the case earlier Tuesday.

That instability may add to the BOJ's rationale for holding policy steady for longer. If Ueda is going to conduct the nation's first rate hike since 2007, he probably would prefer to do so when the government is in a solid position to coordinate. In the past, exits from ultra-easy policy were criticized as premature. In one case, the central bank carried out a policy reversal in the face of government objections and ultimately proved to be a failure.

Japan's economy suffered the deepest contraction since the height of the pandemic last quarter due partly to weak consumer spending. With wage gains failing to keep up with inflation, consumer spending continues to languish below pre-Covid levels. A gauge of consumer price gains has stayed above BOJ's 2% target since April 2022.

Ueda has repeatedly stressed the importance of wage increases next year to spur a virtuous wage-price cycle. The initial results of spring wage negotiations come in March, a key reason why more than half of economists surveyed by Bloomberg forecast a rate hike in April.

The governor will host a press conference in the afternoon to elaborate on the thinking behind Tuesday's decisions. Investors will search for any subtle hints of change, as some 15% of economists expect a rate hike next month. The briefing usually begins at 3:30 p.m. Tokyo time.

--With assistance from David Finnerty.

(Adds economist's comments)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.