(Bloomberg) -- There is no doubt that the Bank of Japan is considering lifting negative interest rates in January, said Chotaro Morita, chief strategist at All Nippon Asset Management Co.

The BOJ focus on spring wage negotiations means that it will raise rates “around January to April no matter what anyone thinks,” said Morita, who was ranked No. 1 for bonds in the Nikkei Veritas analyst rankings for six consecutive years through 2022. “It is clear that the BOJ is considering lifting the policy in January” to ensure it has flexibility in the future, he said.

The BOJ is in the midst of its last monetary policy meeting of 2023, with its decision due Tuesday. A majority of forecasters expect the central bank will end the world's last negative rate regime by April, according to a Bloomberg survey. There has been increased speculation it could happen in January after Governor Kazuo Ueda said his job could become “more challenging” from year-end and following Deputy Governor Ryozo Himino's hypothesis for what might happen if indeed rates go positive.

Morita, who moved this year from SMBC Nikko Securities Inc. to All Nippon Asset, said lifting the negative rates this month is indeed unlikely,” but that the BOJ may “try to communicate in some way” about its intentions.

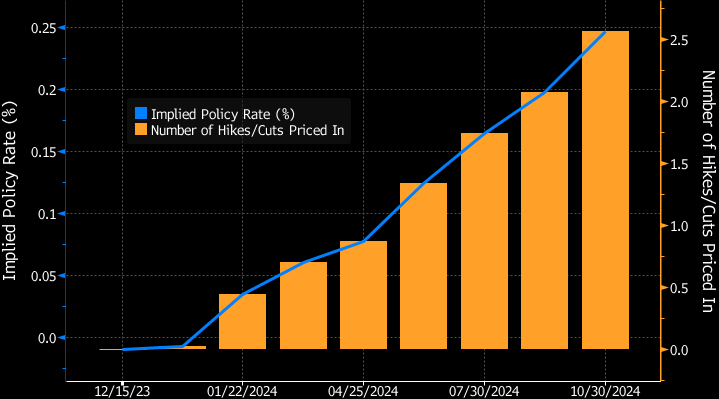

Overnight index swap are pricing in more than 40% of a rate hike in January.

If the yen appreciates rapidly against the dollar to the 120-130 range, a rate hike in January becomes unlikely, he said. Morita projects the central bank to raise rates to 0.25% in 2024, from the current level of -0.1%. The yen traded at 142.25 as of 11:25 a.m. in Tokyo.

There is a possibility that the BOJ may retain yield curve control after the lifting of negative interest rates, but its inflation overshoot commitment must be “modified in some way,” he said.

The weakening of the political faction of former prime minister Shinzo Abe, who championed the ultra-monetary stimulus of Ueda's predecessor, “may have eased the minds of BOJ policymakers” concerning making a change, Morita said.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.