(Bloomberg) -- The Bank of Japan raised its benchmark interest rate and unveiled plans to halve its bond purchases in actions that underscore its determination to normalize policy.

The BOJ raised its policy rate to around 0.25% from a range of 0 to 0.1%, according to its statement Wednesday. It also said it would reduce its monthly pace of bond buying to around ¥3 trillion ($19.6 billion) by the first quarter of 2026. The recent pace of purchases has been about double that amount.

Both the yen and stock prices gyrated immediately after the decision, leaving the Japanese currency weaker at 153.14 against the dollar at 1:15 pm local time and the Nikkei 225 up for the day at around 38574.

In taking these steps, Governor Kazuo Ueda showcased his will to proceed with normalization after years in which the bank pursued an ultra-easy policy that included the world's last negative interest rate until March. Wednesday's actions will likely fuel speculation that one more hike may be coming this year.

Coming hours before the Federal Reserve is set to meet, Ueda's hawkish tilt may spell a turning point for the beleaguered yen, as traders position for a narrowing of the US-Japan interest rate gap. Any comments by the Fed hinting at the possibility of a rate cut in September would support that narrative.

While the bank's interest rate remains low by global standards, it is now at its highest since December 2008.

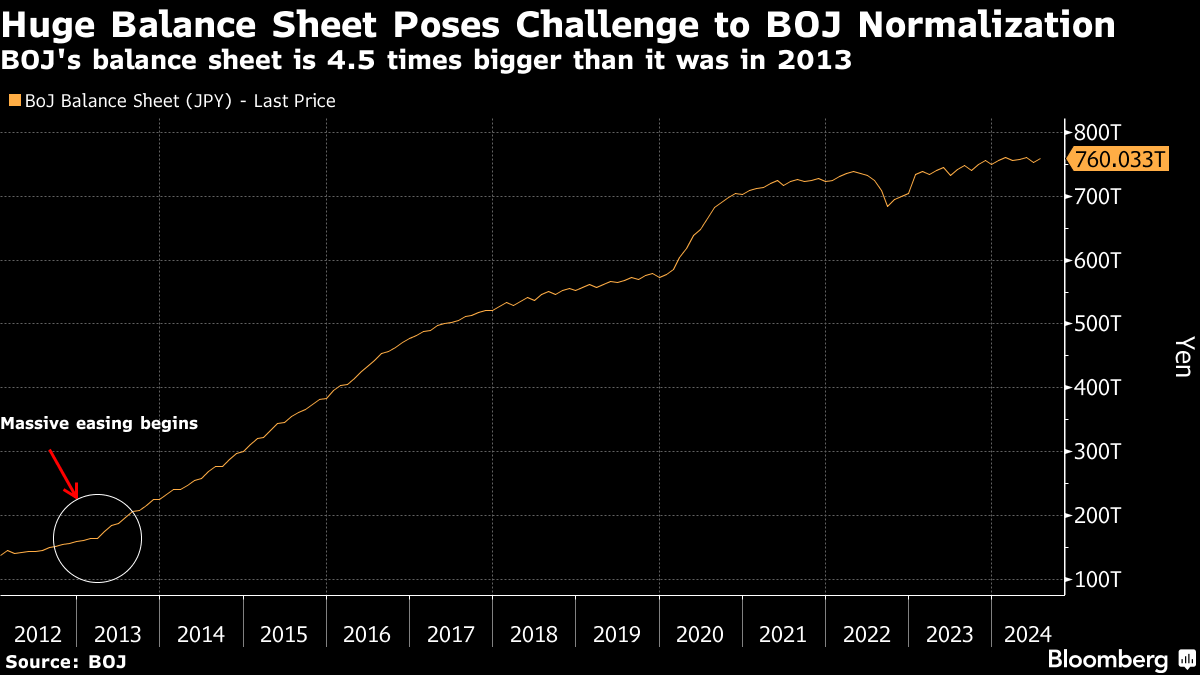

With its plans to cut bond buying, the BOJ is embarking on the path to quantitative tightening after a prolonged period of asset purchases left it holding more than half of the nation's outstanding bonds, with an even bigger proportion of the market for tenors of 10 years and shorter.

The cuts to bond buying were a touch more aggressive than the market consensus of a halving of purchases over a two-year period.

While only about 30% of BOJ watchers predicted a hike as their base-case scenarios, almost everyone saw the risk of a July move, according to a Bloomberg survey. The high degree of uncertainty leading up to the meeting kept the yen and Japanese stocks on a roller coaster ride in recent days.

In an updated quarterly inflation outlook, the BOJ kept its forecast for a gauge of core inflation roughly unchanged, predicting price growth will stay around 2% for the entire projection period through March 2027.

The forecast for the current fiscal year ending in March 2025 was nudged down to 2.5% from 2.8% to reflect the resumption of government energy subsidies. That fed into a bumping up of the following year's projection to 2.1% from 1.9%, while the fiscal 2026 view remained unchanged at 1.9%

Ueda has said a rate increase would be warranted as long as the likelihood of meeting the BOJ's price outlook rises.

What Bloomberg Economics Says...

“The Bank of Japan's surprise rate hike – which matched our out-of-consensus call – suggests Governor Kazuo Ueda is prioritizing solid inflation numbers over signs of slack demand in the economy, and pressing ahead with policy normalization.”

— Taro Kimura, economist

To read the full report, click here

By raising the rate soon after ruling Liberal Democratic Party heavyweights called for a policy shift, Ueda risks the appearance of having caved in to political pressure.

Toshimitsu Motegi, secretary general of the LDP, and Taro Kono, digital minister, recently urged the BOJ to tighten policy to support the yen and temper inflation, in a sign of their growing frustration over the yen's role in driving up costs of living.

Approval rates for Prime Minister Fumio Kishida's cabinet have suffered with inflation being a primary complaint. The cost of living has risen at a clip matching or exceeding the BOJ's 2% target for more than two years, prompting households to tighten their budgets. Consumer spending dropped every quarter in the 12 months through March.

In the runup to this week's meeting, some BOJ officials were of the view that standing pat was an option while they await more data in hopes of seeing signs of resurgent consumer spending, people familiar with the matter told Bloomberg earlier this month. The vote in favor of Wednesday's rate hike was a 7-2 majority.

It's unclear how Japanese households shouldering housing loans will react to the prospect of potentially higher payments. About 70% of the loans are tied to a floating rate, according to a government report. Savers may also see a higher return on their bank deposits.

Ueda will hold a press briefing in the afternoon that typically starts at 3:30 p.m. to elaborate on the thinking behind today's policy decision as well as the outlook for inflation.

--With assistance from Yoshiaki Nohara and Yuko Takeo.

(Adds more details from decision)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.