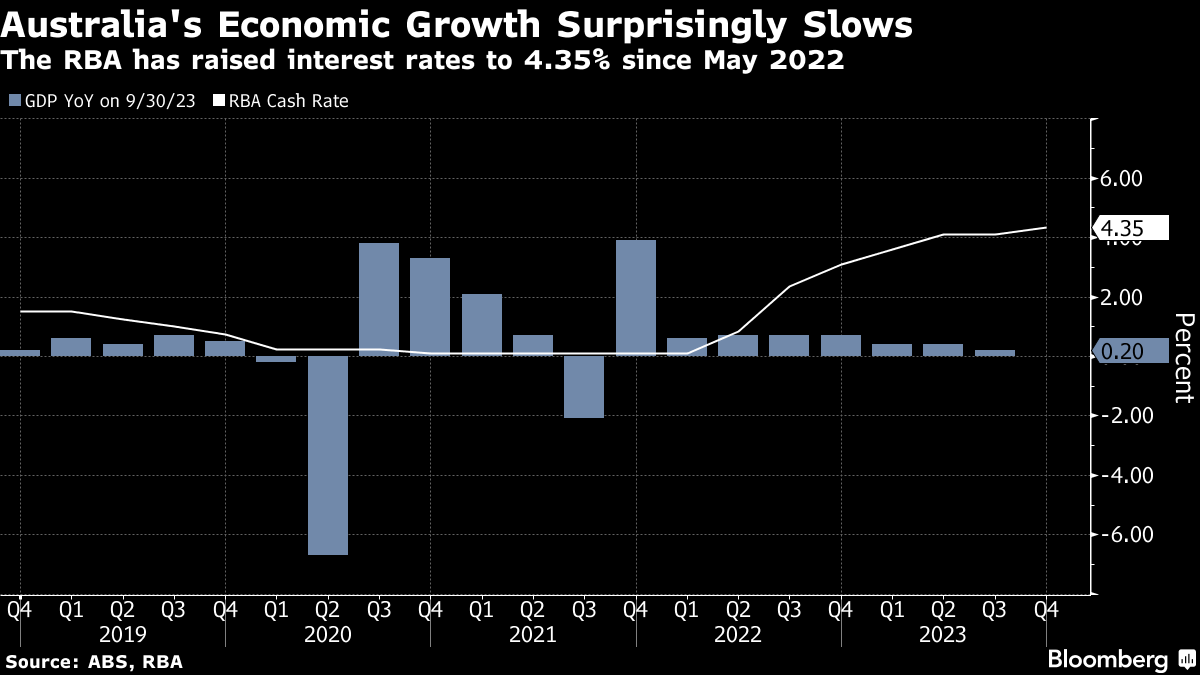

(Bloomberg) -- Australia's economy surprisingly slowed sharply in the three months through September as consumers hunkered down in the face of rising borrowing costs while trade detracted from growth.

Gross domestic product advanced 0.2% from the prior quarter, slower than economists' estimate of a 0.5% gain, Australian Bureau of Statistics data showed Wednesday. From a year earlier, the economy grew 2.1% from a downwardly revised 2%.

“Government spending and capital investment were the main drivers of GDP growth this quarter,” Katherine Keenan, ABS head of National Accounts, said in a statement. “Household spending was flat in the September quarter.”

The Australian dollar and government bond yields were little changed.

With annual growth slowing from a decade average of 2.4%, the data are likely to ease concerns about demand-driven inflation pressures. That suggests the RBA can remain in a holding pattern for a little while in order to assess the economy.

The RBA forecasts a further slowdown in response to its 4.25 percentage points of rate hikes since May 2022. The latest staff forecasts predict the economic expansion will ease to 1.5% by year's end before picking up to 2% in late 2024.

Bloomberg Economics expects growth to remain subdued, as the cumulative impact of higher rates damps household demand and housing-related activity.

Australian households are already facing a squeeze with Wednesday's data showing the savings ratio declined to the lowest level since 2007. It slumped to 1.1%, the eighth straight quarterly decline, from a downwardly revised 2.8%.

“Increased interest paid on home loans and inflationary pressure on households” were likely factors behind the fall in the household savings ratio, the ABS's Keenan said.

Household spending was flat in the third quarter, while government expenditure jumped 1.1%, adding 0.2 percentage point to GDP.

The figures follow the RBA's decision to leave rates unchanged at a 12-year high of 4.35% at its last meeting of the year on Tuesday. The cautious approach underscores a desire to hang on to some of the employment gains made during the pandemic.

Even so, economists ascribe about a 40% probability of a recession over the next 12 months.

“Our concern remains that the RBA has tightened more than necessary with a high risk of recession next year,” Shane Oliver, chief economist AMP Ltd., said ahead of today's data. “The key risk remains consumer spending where various indicators continue to point down.”

Most economists say the RBA has concluded its tightening campaign, though they acknowledge the risk of another hike early next year. By comparison, financial markets expect the Federal Reserve to begin easing next year while bets of rate cuts in Europe, New Zealand and the UK have also gained momentum.

“We expect to see some further moderation to annual growth over the year ahead,” Treasurer Jim Chalmers said in a statement. “In these difficult times, households are under acute pressure from the cost of living and the burden of higher interest rates.”

Today's GDP report also showed:

- Non-dwelling construction rose 3.3%, adding 0.2 point to GDP

- Compensation of employees rose 2.6%

- Trade was the biggest drag, subtracting a total 0.6 point

- Per capita GDP slipped 0.5% and real net disposable income declined 0.6%

--With assistance from Tomoko Sato.

(Adds further details, comment from economist.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.