(Bloomberg) -- Manufacturing in Asia ended the year on a weak note as sluggish economic activity in China and other developed markets dampened demand for the region's goods.

Most of Asia saw a slowdown in new orders and production volumes in December amid tepid customer appetite, according to the manufacturing purchasing managers' index published Tuesday by S&P Global. Input costs also rose and supply chain performance worsened.

The readings came as China reported mixed results, with a private measure of factory activity showing a small improvement last month in contrast with a broader official gauge falling to a six-month low. Chinese President Xi Jinping pledged to strengthen economic momentum and job creation in his new year address on Sunday.

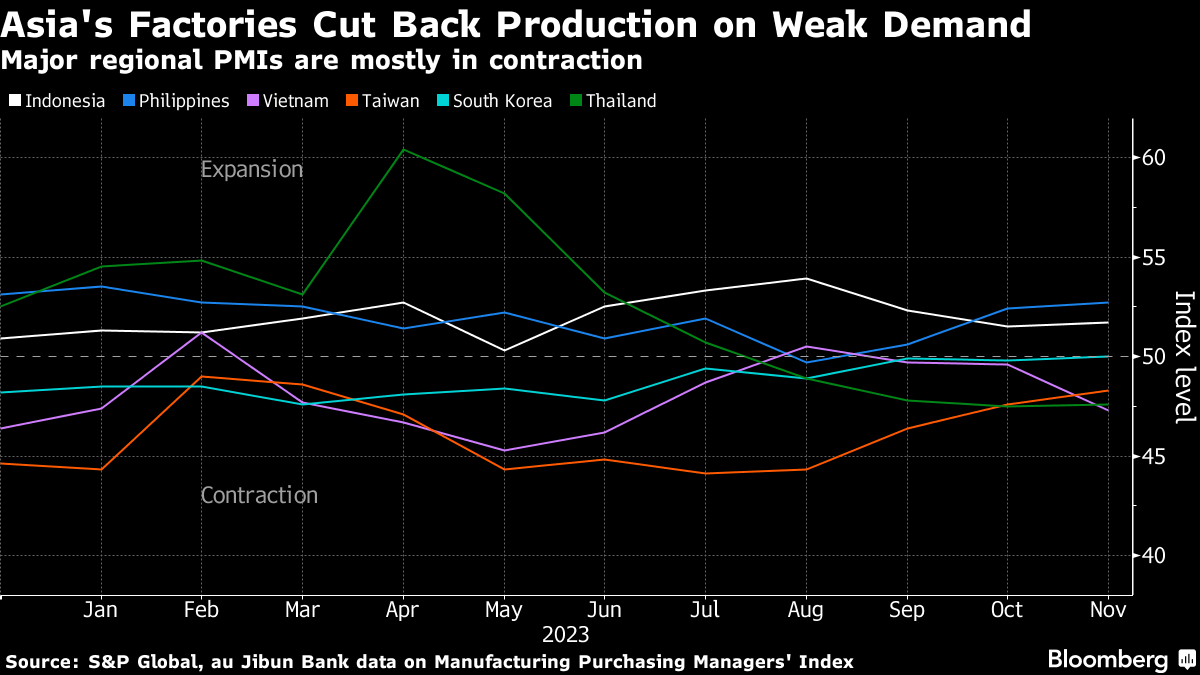

Trade bellwether Taiwan's factory conditions deteriorated sharply to 47.1 in December, after notching an eight-month high of 48.3 the month prior. South Korea's PMI fell slightly to 49.9, below the 50 waterline that separates expansion and contraction. Despite the nation's improving exports performance, S&P Global noted a further monthly decline in new orders due to a weak domestic economy and slower Chinese demand.

Southeast Asia's manufacturing activity likewise shrank in December, with Thailand, Malaysia, Myanmar and Vietnam still in the red. Indonesia posted the region's best PMI reading of 52.2, while the Philippines stood at 51.5, both largely powered by their domestic consumers.

“While the recent downturn across ASEAN's manufacturing sector is only mild overall, growing signs of demand weakness could result in fresh cuts to production as we move into 2024,” S&P Global economist Maryam Baluch said, referring to the 10-nation Southeast Asian bloc. “Manufacturers across the region will be hoping for expansions in new orders to help support growth over the coming year.”

The latest PMI data out of Asia show that recovery may yet be far off for the world's manufacturing hub. It also signals a bumpier road ahead for global trade that's seen the El Nino dry spell bring about the return of food inflation, while attacks in the Red Sea choke supply chains for crucial commodities like oil. The continued weakness in the region will add further headwinds to global growth that's expected to slow anew this year.

(Updates throughout with more details, China data)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.