India’s Economy Is Picking Up as It Moves Past Cash-Crunch Bump

India is showing signs of overcoming tight money conditions.

(Bloomberg) -- India is showing signs of overcoming tight money conditions, with lending and business activity picking up in Asia’s third-largest economy.

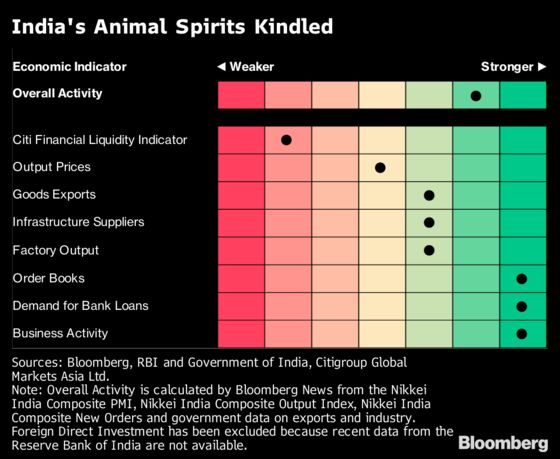

An overall activity indicator measuring "animal spirits" moved two notches up in November from a month ago. The gauge, compiled by Bloomberg News, reflects strength in new orders boosting business activity, but more importantly a rebound in a liquidity indicator.

Consumer sentiment and demand remained subdued, but the government’s decision in December to slash taxes on some goods and services may help stoke an economy that saw expansion slow in the three months through September. Here are the full details of the dashboard:

Business Activity

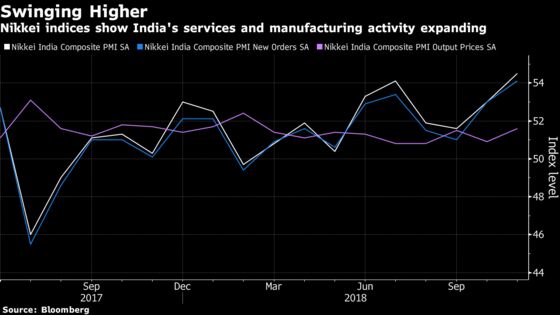

November saw activity in manufacturing and services’ sectors pick up. Inflows of new work expanded at the fastest pace in over two years, supporting further job creation and an uptick in business confidence. The picture for prices was mixed as input-cost inflation hit a seven-month low, but firmer demand enabled firms to hike their charges to a larger extent.

The Nikkei India Composite PMI Output Index rose to 54.5 in November from 53.0 in October, the fastest expansion in private-sector activity since October 2016. The Nikkei India services gauge rose to the strongest since July, with firms highlighting greater client numbers, favorable market conditions and sales growth.

Exports

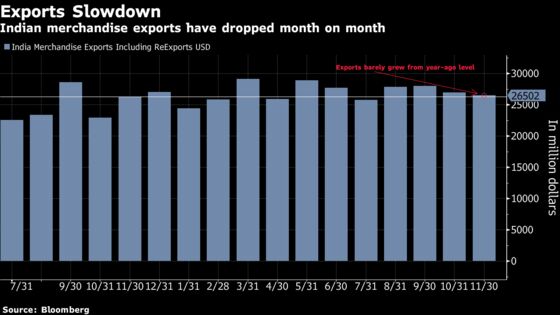

Exports in November barely grew from a year ago, and posted a decline from October as a global slowdown started to bite. According to Aditi Nayar, an economist at ICRA Ltd, a double-digit contraction in exports of gems and jewelry and engineering goods weighed down non-oil shipments.

Still, the trade gap narrowed slightly as softer crude-oil prices capped the import bill. A smaller deficit should help stabilize the rupee, and together with inflation that slowed sharply in November, it opens room for India’s new central bank governor to shift to an easing bias and possibly cut interest rates next year.

Consumer Activity

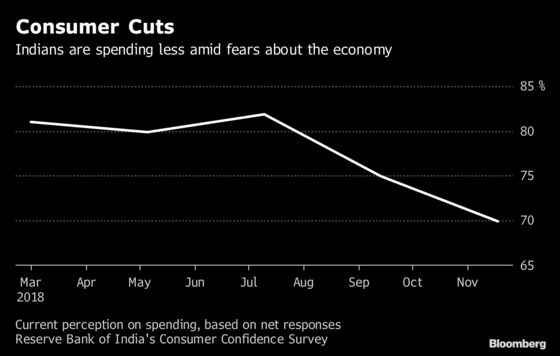

Data from the Society of Indian Automobile Manufacturers showed passenger vehicles sales declined 3.4 percent in November from a year ago. The robust pace of growth in commercial vehicles and two-wheeler was also hit.

A survey from the Reserve Bank of India this month showed consumer sentiment has taken a knock on the back of increasing worries about the economy and rising concerns about jobs. The Consumer Confidence Index dropped to 93.9 in the latest gauge from 94.8 in September, the RBI said.

But there are signs that the worst might be over. Demand for bank loans strengthened -- up 15 percent in November from a year ago.

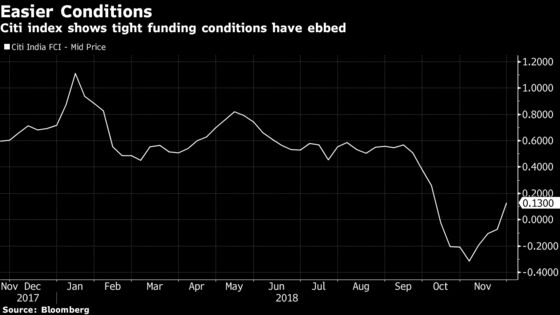

The Citi India Financial Conditions Index shows some easing in the considerable tightening of liquidity. The index includes indicators such as short-term money market rates, government bond yields, the yield curve, credit and credit default spreads.

Industrial Activity

Growth in infrastructure industries -- which contribute 40 percent to factory output -- picked up in October, due partly to an improvement in the output of crude oil, coal and cement. Overall, growth in the index for industrial production gathered pace, expanding 8.1 percent in October from a year ago. Data for both indicators are available with a month’s lag.

--With assistance from Shaina Patel and Hannah Dormido.

To contact the reporter on this story: Anirban Nag in Mumbai at anag8@bloomberg.net

To contact the editors responsible for this story: Nasreen Seria at nseria@bloomberg.net, Karthikeyan Sundaram, Henry Hoenig

©2018 Bloomberg L.P.