.jpg?downsize=773:435)

Market continues to behave as expected and that is certainly a relief! The whole idea of making forecasts is that we can draw a map along which we look for the trends to move so that we can take appropriate actions. In an arena filled with noise, we need all the help we can get.

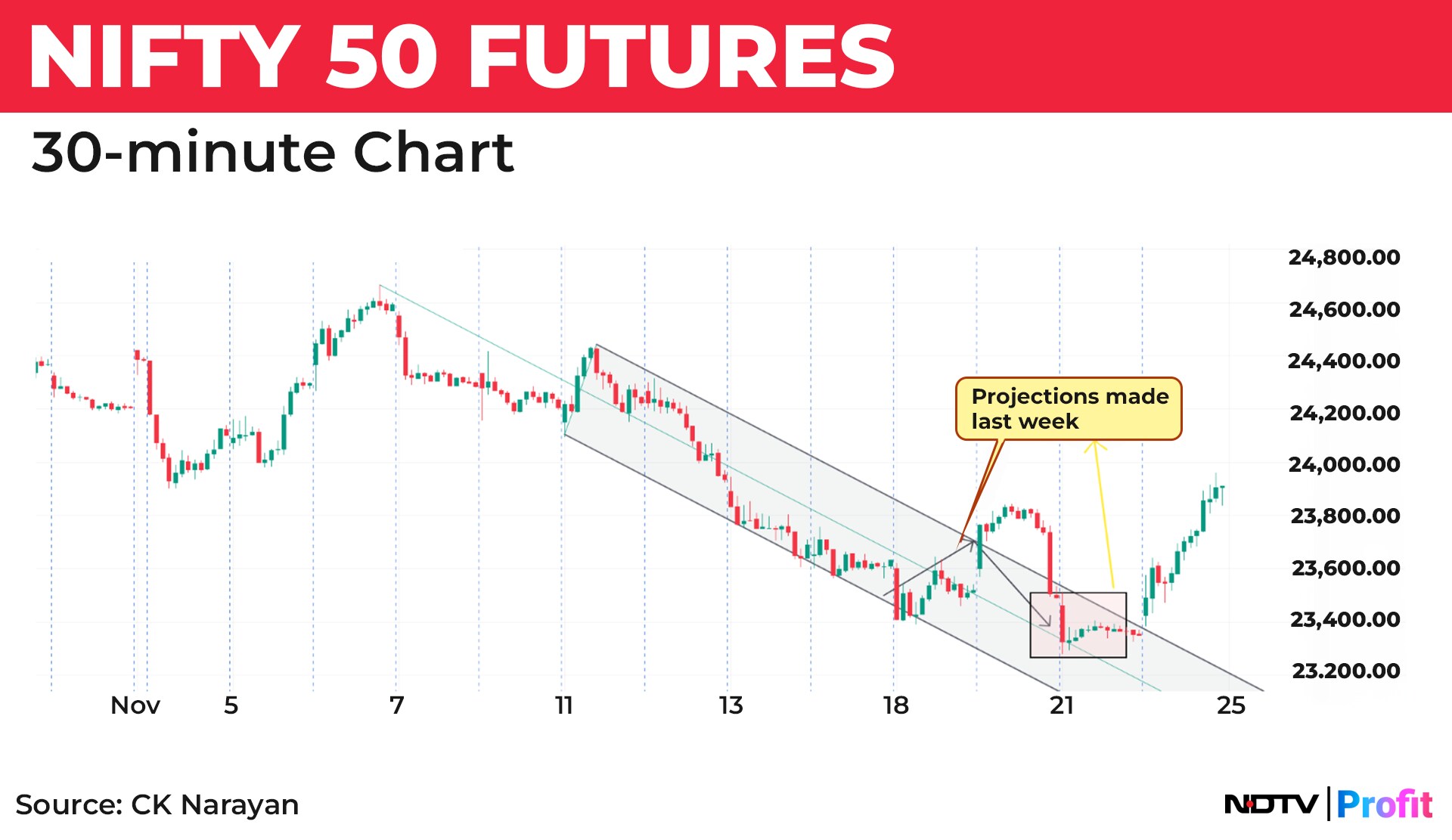

And so it was during the last week. In the earlier letter I had stated “…the next support zone to look for would be the 23215 area, being 61.8% retracement of the rise from June 4 bottom. Next immediate turn date is in the 19/21 Nov window (20 being a holiday). So, if we get a price and time match there, it would be a good point to look and plan for an oversold pop. The move may be something along these lines in Chart 3. The pathway anticipates a mild upside pop and a slide into the price and time window”.

(That same chart is reproduced below, with updates, as Chart 1)

As can be seen, the market pathway pretty much followed expectations. The small rise expected from the 19th was a bit better but that got hit down to reach the projected box exactly on the 21st.

Writing in my column on my website (see https:// cknarayan.com/insights) I tracked these moves down right into the low and updated my followers in there about the coming turn. What I mentioned therein, and also what is necessary every time we reach a turn point, was the need for a thrust. Such a move is necessary because it confirms that the expected turn is indeed happening.

We got the hint of that on the 21st as the indices-both Nifty and Bank Nifty futures- managed to get off the lows and finish better for that day. This, despite the mess created by the Adani news. Then, on Friday, we got this thrust and it was indeed a forceful one, as the range for the day topped over 600 points, much bigger than the average of large move days (average around 550) and close was near the top. Since the move developed gradually thru the day (rather than thru a big gap), it was tradable. Now that is important too. When a set up occurs and you get a nice confirmation, the market should not rob you off the opportunity by gapping away from you. Note here that one could have bought into the better open only if you had been prepared for it by earlier analysis. We got the rewards by the end of the day, banking a nice fat gain!

Now, this brings us to the next event that could also prove to be important in deciding the course of activity in the coming week. The poll results this time is not sullied much by the exit polls (all of whom seem to have been shunned by the channels!) but by the end of Saturday we would all know the outcomes in two states. This time, it should be a binary. A gap up in case BJP wins Maharashtra and an even bigger if Jharkand is thrown into the bag too, or, a gap down in case they flop. It really doesn't look like market is prepared for a neutral type of result. Friday's trade is suggestive of a BJP victory getting built in.

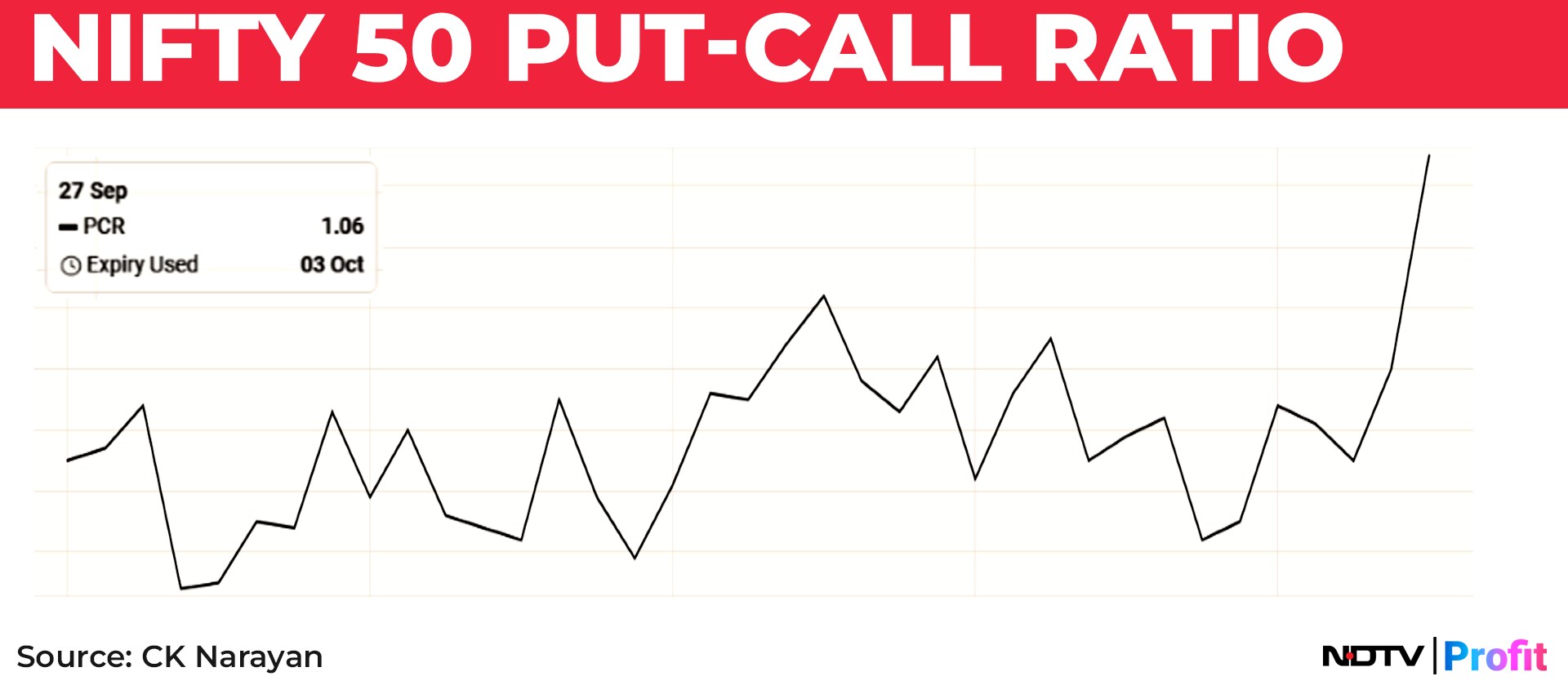

Important here is the data point of the Put Call Ratio. As can be seen (in chart 2), the PCR reading stayed under 1-implying tending to growing sold positions- all through October and into November until Friday! This was a bit unusual and implied that the market tended towards the sold-oversold situation all thru this period.

It pushed higher to reach 1.15 on Friday. This indicated that a lot of short covering may have happened. The futures OI too had been falling over the last three sessions of the week, as the prices traded down into support zones. What is also interesting in the positioning is that thru October the Retail held long index futures while FIIs shorted, taking their net position from long 82% in Sept end to short 24% in mid-November. On Friday, the two seemed to have exchanged positions- retail sold 43k contracts while FIIs bought 46k contracts! Although, the FIIs were seen active in the F&O area, the data showed that the Pro traders were a lot more active on Friday. Usually, these two are the smart money of the market and they seem to have been active on the long side.

This is important in the context of what may happen from Monday. If the market moves higher on positive news flow, then it will be continued short covering as well as fresh longs that will get built and this will have a positive impact in a longer lasting rally. However, if the opposite happens, then the market may fall swiftly, as cushion of shorts would be gone to a good extent. So Monday action is certainly something to watch, as it can set the stage for multi day trends to occur. Only a hung result would lead to continued uncertainty and in that case, we would have to see how fresh moves occur in terms of open interest, Pcr etc.

If the market moves higher then we may see it head towards 24490 and if beyond, then all the way to 25100. Gaps may be involved in this attempt. On the downside, life is simpler. If gap down, then the recent low will be tested and even broken. So be ready for that as well.

On this Adani business, I feel the whole matter has wheels within wheels. Conspiracy theories abound. The timing of all these make me want to believe them. Order is issued on Oct 24th but news released only on 20th Nov. But market gets smacked on 19th late sessions and with a gap on 21st. RG starts his usual tirade immediately thereafter. Fake news of arrests etc start appearing. But against all these, stock doesn't recover. Ultimately that is what matters- what the stock does. Our money is made and lost basis that. Stocks surrounding Adani were all hit down and most of them recovered rather well. Seems like this matter will go into some settlement mode (as others before them have done) and will recede into memory. Some people would have made money and a lot of retail traders would have lost money. Noises will happen at Institution levels (Bank, Rating agencies, Funds etc. etc.) but nothing more than that. Been there, seen that before.

Best to leave the group stocks alone for now until the dust settles. That tactic was the approach last time too. Stocks recovered almost completely although it took time. Perhaps same shall happen here too. However, the collateral damaged stocks will all recover faster. Best to concentrate on those to see if something has been dragged down to value areas. Don't bother passing judgements on who is right or wrong. Just see what we can do with the situation and move on. Market is much bigger than Adani group or any other stock or group.

Not much of analysis details this time as a binary outcome may render any view wrong. I never like to hedge my views, saying if-that-then-this stuff. I have stated that mildly as that is the heated discussion in the market right now. My leaning is to the long side as evidence points that way. I have waited for this pullback, timed it to the day and now wish to play the new side. I traded long into the bottom and booked out on Friday as prices hit the highs. All our goals in the market should be to make profits and not worry about being right. With money, one ought to be prudent. I wrote earlier that the tailwind in the market is gone. It still stays that way. Just because we hit a bottom is no reason to rejoice and expect bulls to rule again.

So, happy to see what the morrow brings and what the market does with that new input when Monday is here. We can create positions on long side if that plays out. If not, I will review the situation once again to see if failed bull signals turn into new bear signals and what can be the extent of those in both price and time. After that only I may consider taking bearish stances. In the interest of teji may the ruling party win!

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.