Indian banks should be recapitalised at the earliest and a centralised bad bank needs to be established to take over large bad loans, said the Economic Survey 2016-17 presented by the government on Tuesday.

The Survey pointed to the “twin balance sheet” problem of the country which is composed of over-leveraged companies and banks troubled by the weight of bad loans. Terming it a “legacy of the boom years” around the global financial crisis, the Survey said that since other approaches have failed, a centralised Public Sector Asset Rehabilitation Agency (PARA) could be established.

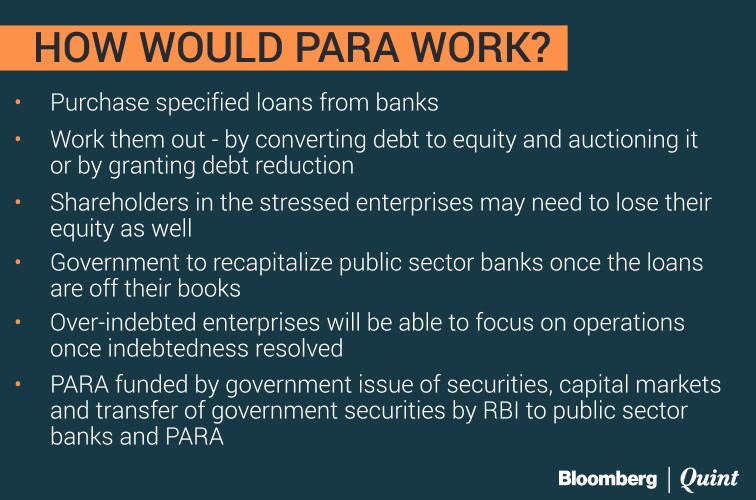

The PARA would essentially take charge of the largest, most difficult cases, and make politically tough decisions to reduce debt.

A bad bank is essentially a government-driven asset reconstruction company where banks can park their stressed assets. While this helps relieve individual banks from the pressure of stressed debt, the system as a whole still needs to provide enough capital provision against the bad loans.

Also Read: Does India Need A Bad Bank To Clean Up The Bad Loan Mess?

The idea of a bad bank is not new. The concept has been tried a number of times across different economies. In the aftermath of the global financial crisis, a number of countries set up bad bank-like structures. The U.S. set up the Troubled Asset Relief Program (TARP), Ireland put in place the National Asset Management Agency and Spain established an entity called ‘Sareb' to which troubled and illiquid assets were transferred.

In a January 16 interview, Neelkanth Mishra, head of equity strategy for India at Credit Suisse told BloombergQuint that the government hasn't acted on the bad bank perhaps “deliberately” since the systematic risk isn't “that high”.

However, RBI's Deputy Governor Viral Acharya had told BloombergQuint in October before being appointed to the Reserve Bank of India that he supported a bad bank model.

“I am absolutely proposing, either explicitly or implicitly, that we separate the unhealthy parts of the troubled banks from the healthy parts,” Acharya had said.

The Pile Of Bad Loans

Reported bad loans on the books of Indian banks have surged after the Reserve Bank of India (RBI) conducted an asset quality review in the second half of 2015 and asked banks to classify stressed assets appropriately. Raghuram Rajan, the then RBI governor, had given banks a deadline of March 2017 to finish cleaning up their balance sheets. This meant classifying stressed loans as non-performing assets (NPAs) and providing for them.

According to the Survey, gross NPAs climbed to almost 12 percent of gross advances for public sector banks at end-September 2016. It noted that India's NPA ratio is higher than any other emerging market with the sole exception of Russia. The resulting fund crunch has led to slow credit offtake, especially to the industry and medium and small enterprises, the Survey noted.

Even the RBI's Financial Stability Review (FSR) released in December said that gross NPAs for the banking system are expected to rise to 9.8 percent by March 2017 from 9.1 percent in September. This ratio, under the baseline scenario of economic growth, could rise to 10.1 percent by March 2018.

Banks, however, have found it difficult to provision for these bad loans due to low levels of capitalisation. The government has committed to infusing Rs 70,000 crore into public sector banks over a four-year period till fiscal 2019. Rating agencies, however, say the amount of capital needed is far higher than that.

ICRA estimates that Rs 1.5-1.8 lakh crore in capital will be needed during the FY17-FY19 period.

.jpg)

Also Read: Bad Bank: An Idea From The Good Ol' Banking Book

Moving Towards PARA

While mooting the idea for setting up PARA, the Survey claimed that strong steps are needed because growth in private and overall investment has turned negative. Thus, a serious resolution is required before the “twin balance sheet” (TBS) problem becomes a drag on growth, the Survey added.

It said that the public discourse on the bad loan problem has focused on bank capital, but far more problematic is the way to resolve existing bad loans. Noting that large cases are difficult to resolve but also present an opportunity to tackle fewer cases to resolve the TBS problem, the Survey said that restoring financial health for them will require large write-downs.

This increases the costs for the government as bad debts of public sector banks continue to climb, hindering credit, investment, and growth, the survey observed.

The survey said that PARA will "come at a price" since loans have been made and lossess incurred, making a bulk of the burden fall on the shoulders of the government.

In other words, the issue for any resolution strategy – PARA or decentralised – is not whether the government should assume any new liability. Rather, it is how to minimise the existing liability by resolving the bad loan problem as quickly and effectively as possible.Economic Survey

Adding that the capital requirements will be large, the survey conceptualised that PARA could be funded in various ways. For instance, through government issue of securities, through equity share provided to the private sector and through RBI, which can transfer some of the government securities it holds to public banks and PARA.

This, experts believe, could result in fiscal pressure on the government and the banks which hasn't proven to be the best of ideas.

I don't personally think that the bad bank idea is a great one because what will happen is it will need a lot of funding. So either the government will have to give the funding or the banks themselves will have to give the funding. Historically, this has not been the most efficient model. The problem is the skill in restructuring and reviving which should stay as central as possible. Once you put it in a parking place, then that onus will go away.Rashesh Shah, Chairman and Chief Executive Officer, Edelweiss Financial Services On January 9

Conceding that the experience with government-run agencies like PARA is not uniformly positive, the Survey said that the agency must be ready to confront losses, take tough political decisions as well as price loans realistically.

All three problems are formidable ones, which is precisely why other schemes have been tried first. But these other schemes have not worked, years have flown by, and meanwhile the costs are continuing to mount.Economic Survey

It also concluded that private Asset Reconstruction Companies have “not been successful” in resolving bad debts either, while there's international evidence of a professionally run central agency with government backing bearing fruit by overcoming political issues.

Also Read: Economic Survey Moots Universal Basic Income To Replace Existing Subsidies

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.