Higher trade barriers in the wake of the US elections could pose additional challenges for issuers across multiple credit sectors in Asia-Pacific, particularly if Chinese exports via third-party nations attract more attention, according to Fitch Ratings.

Heightened trade barriers could pose significant challenges, especially for countries reliant on exports to the US, with Vietnam identified as the most vulnerable, as per the latest Fitch Ratings report on the US presidential elections' impact on APAC. Other countries like Taiwan, Thailand, Hong Kong, Singapore, Malaysia, and South Korea also face considerable exposure, it said.

The report highlighted that sharp increases in US tariffs could adversely affect global economic growth, with particular pressure on APAC economies. If trade protectionism escalates, geopolitical tensions may rise, further straining credit profiles for some APAC sovereigns, it warned.

Weaker global growth prospects could lead to a downturn in macroeconomic conditions in the region, especially if China is disproportionately affected, the report stated.

While Trump's platform suggests support for baseline tariffs and reciprocal trade measures, specifics remain ambiguous. "A scenario featuring a 60% tariff on Chinese imports and a 10% across-the-board tariff could severely impact APAC exporters. Moreover, any retaliatory measures from US trading partners could exacerbate these challenges, particularly for technology hardware manufacturers," the report said.

The anticipated consequences of these tariff policies include increased inflationary pressures in the US and potential repercussions on global commodity markets. China, being a dominant player in energy metals and other critical materials, could see its exports disrupted, impacting global supply chains and prices in sectors like technology and automotive, it said.

India Will Be Relatively Unaffected

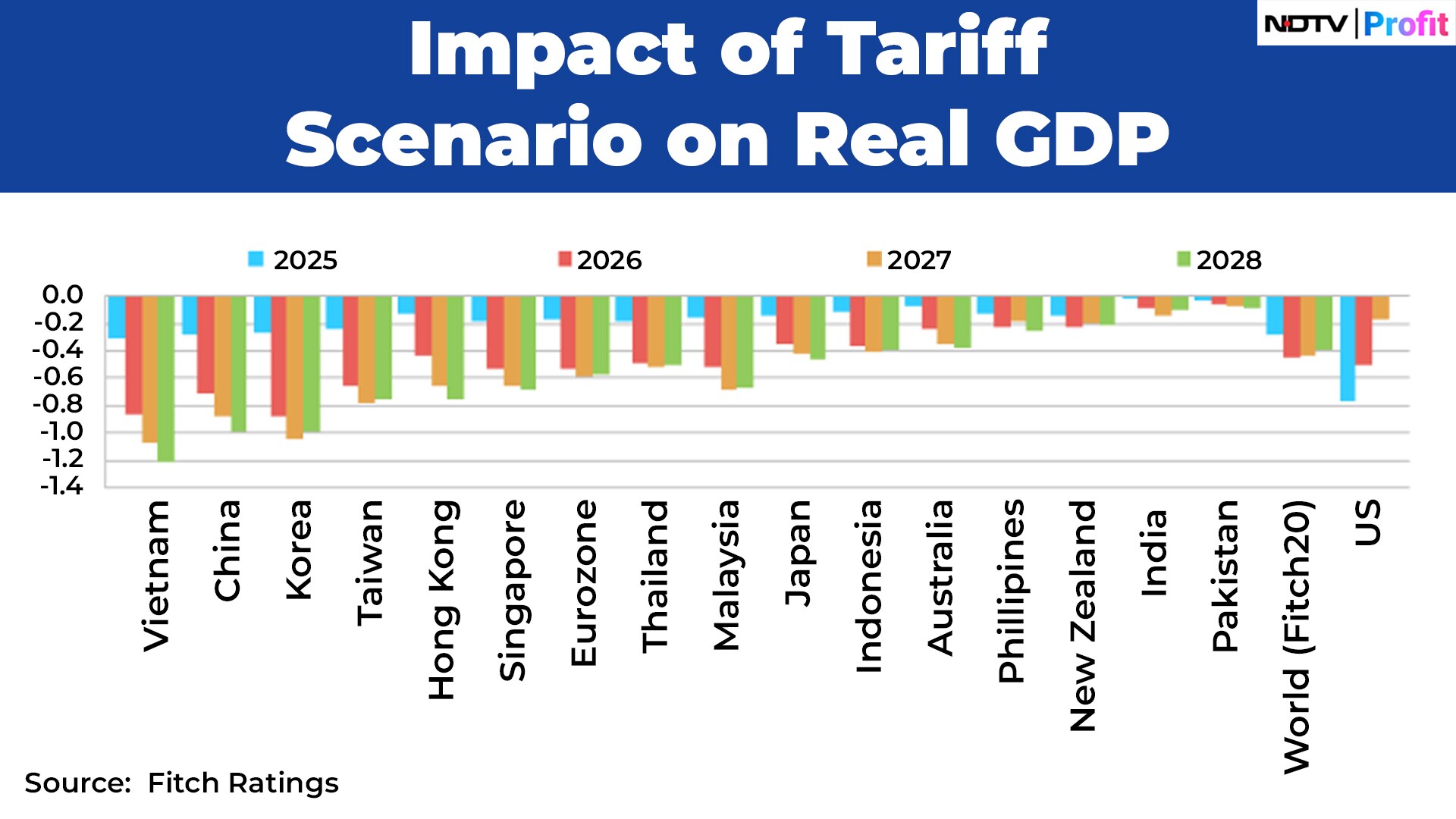

Fitch's analysis indicates that a significant uptick in tariffs could lead to lower real GDP growth in China, Korea, and Vietnam by at least 1% by 2028, compared to current forecasts. Hong Kong, Taiwan, Singapore and Malaysia also stand out as economies that would be significantly hit, it said.

"India, which is less export-oriented than many other Asian economies, would be relatively unaffected," the Fitch Ratings report said.

A stronger US dollar following tariff increases could burden Asian issuers with US dollar-denominated debt, complicating refinancing efforts and increasing financial strain. Additionally, supply chain disruptions may lead to higher production costs, delayed manufacturing, and investment uncertainties, further squeezing profit margins for firms operating in the region.

The outcome of the US elections could herald significant policy shifts, introducing new risks for APAC issuers amid an already volatile global economic landscape, the report said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.