(Bloomberg) -- India's central bank will likely keep interest rates unchanged for a sixth straight policy meeting Thursday, with traders focused on whether it will signal any easing ahead.

The Reserve Bank of India's six-member monetary policy committee is expected to keep the repurchase rate unchanged at 6.5%, according to all 42 economists surveyed by Bloomberg. Many expect the RBI to stick to its stance of “withdrawal of accommodation” as well, although they expect the tone of the statement to be less hawkish.

While Governor Shaktikanta Das has downplayed expectations of a rate cut unless inflation settles firmly around the RBI's 4% target, economists are optimistic of a move in coming months. Inflation pressures are likely to ease and the US Federal Reserve is preparing to cut rates too, although not as soon as March.

“The RBI MPC will keep the policy rate unchanged at the February 8 policy meeting at 6.5%, sound optimistic on growth, recognize the sharp fiscal consolidation in the interim budget, and reiterate the commitment to the 4% headline inflation target,” Santanu Sengupta, a senior economist at Goldman Sachs Group Inc., wrote in a note.

In the absence of any policy action, the focus will be on the RBI's liquidity strategy, which is another way the central bank influences market interest rates. There'll also be heightened attention on any comments from officials around Paytm Payments Bank, which is at risk of losing its license amid compliance issues.

Here's a look at what's expected from the RBI governor when he announces the rate decision at 10 a.m. in Mumbai on Thursday:

Growth and Inflation

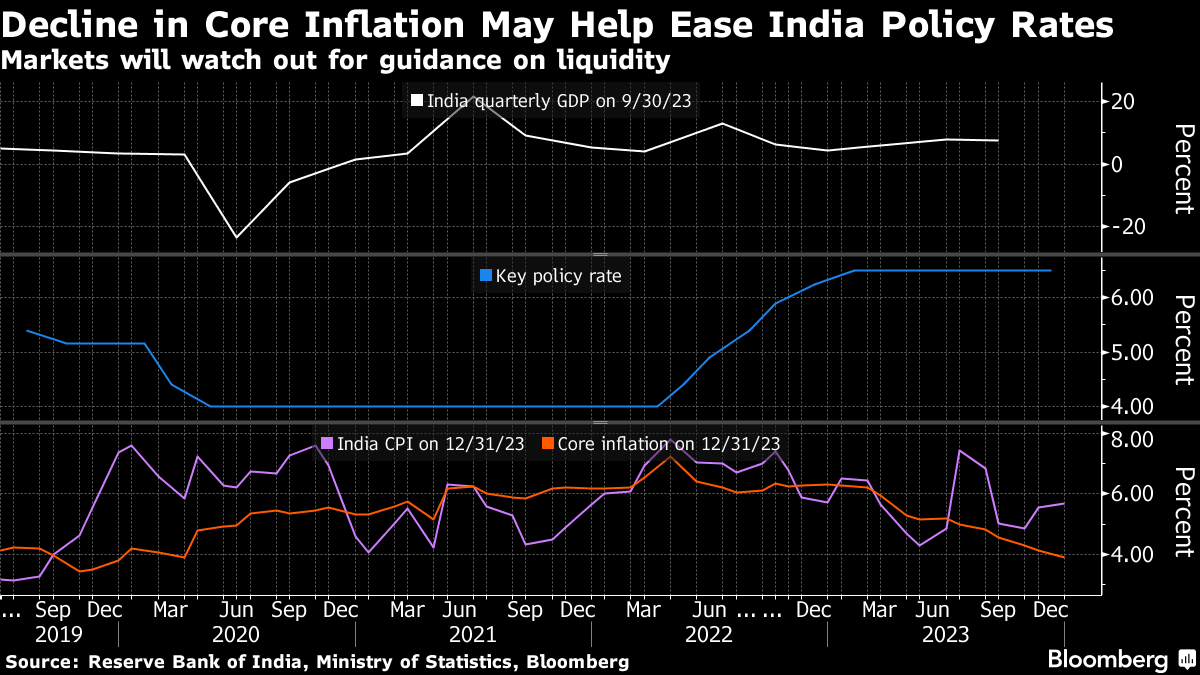

India's inflation accelerated to a four-month high in December due to surging food costs, remaining well above the 4% target. The core measure, though, which strips out food and fuel costs, eased below the 4% mark for the first time in four years. Analysts expect the RBI to maintain its vigil on prices, while reiterating its commitment to prevent food inflation pressures from spreading more broadly in the economy.

“The primary risk to the RBI's efforts to align headline inflation with the 4% target is likely to stem from potential volatility in food prices,” Rajani Sinha, an economist at Care Ratings Ltd., wrote in a note. Nevertheless, the benign nature of core inflation will provide some reassurance to the rate setters, she said.

The central bank may also publish new growth and inflation forecasts for the fiscal year starting April. Das has already hinted that growth will be about 7% in the coming year, while inflation will average around 4.5%.

Policy Stance

The easing in core inflation and a fiscally prudent budget may create some space for the central bank to signal that rates may have peaked.

“In our base case, we still expect MPC stance change to neutral in April, but February is now becoming a ‘live' policy for its consideration,” Samiran Chakraborty, an economist at Citigroup Inc., wrote in a note.

What Bloomberg Economics Says

There have been four key developments since its December review that suggest it's time to start getting ready to cut rates — cooling core inflation, a disinflationary budget, the Federal Reserve's pivot to neutral, and a rise in the liquidity deficit.

Abhishek Gupta, India economist

For the full report, click here

Liquidity Pressure

Traders are looking for a clearer roadmap from the central bank on how banking liquidity will pan out. In a surprise to markets, the RBI has done a spate of liquidity removal auctions recently, draining 921 billion rupees since Friday, after injecting cash into the system.

“We believe that RBI will assure markets of adequate liquidity to tide over the year-end tightness,” said Churchil Bhatt, executive vice president for debt investments at Kotak Mahindra Life Insurance Co. “Beyond that, no new policy actions are expected.”

Bond yields slid to a seven-month low last week after authorities unveiled a lower-than-estimated borrowing plan in the annual budget.

Paytm's Banking Woes

India's fintech giant Paytm is in the RBI's crosshairs after persistent non-compliance and supervisory concerns, with the company at risk of losing its license. While the MPC statement is unlikely to address the issue directly, Das will likely face questions during his press briefing.

The RBI has prohibited the bank from onboarding new customers, take fresh deposits, or allow top up in its wallet after Feb. 29. Paytm's shares fell more than 40% in the three days after the RBI's action, cutting its market value by over $2 billion.

--With assistance from Tomoko Sato.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.