(Bloomberg) -- India's booming liquefied natural gas imports are likely to slow as cooler weather due to monsoon rains crimps electricity demand and increases in hydropower crowd out expensive gas-fired generators.

“Electricity demand won't be as high as it was in May and June, which is the prime driver of higher LNG imports,” said Ayush Agarwal, LNG analyst at S&P Global Commodity Insights.

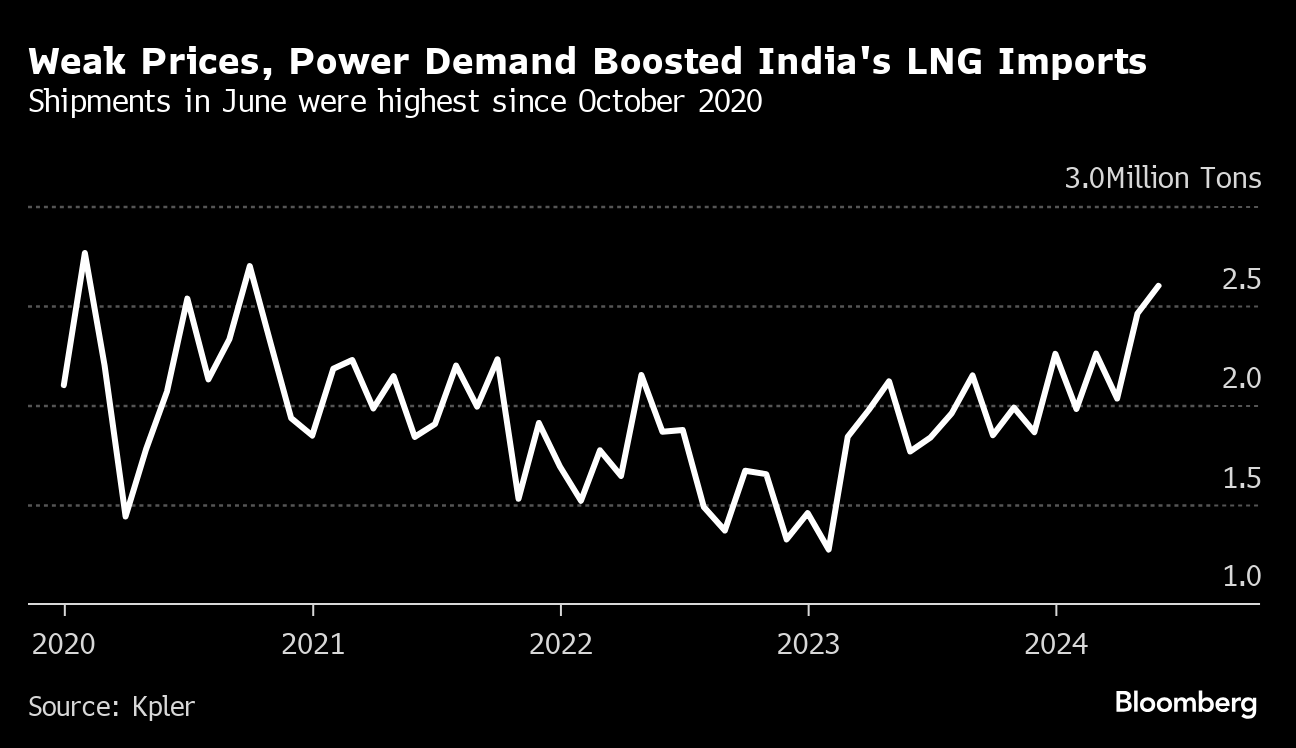

The South Asian nation bought some 2.6 million tons of the fuel last month, its highest since October 2020, according to Kpler data. That came on the back of affordable spot prices in the range of $11-$12 per million British thermal units, and as gas-based power plants cranked up generation to meet high demand.

The shipments were driven by an emergency order to operate gas-fired plants, most of which typically remain under-utilized due to their high generation costs. That resulted in a 63% increase in output from the units during the three months through June.

However, as the interim ruling came to an end on June 30, LNG imports are likely to see a decline for the remainder of the year, Agarwal said.

India's peak electricity demand during evenings averaged 207 gigawatts in the first three days of July, leaving ample buffer for the country's 445 gigawatt generation fleet. A 10% increase in hydropower output in the quarter ended June, caused by melting snow and monsoon rains, is also expected to reduce the need for expensive gas-fired power.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.