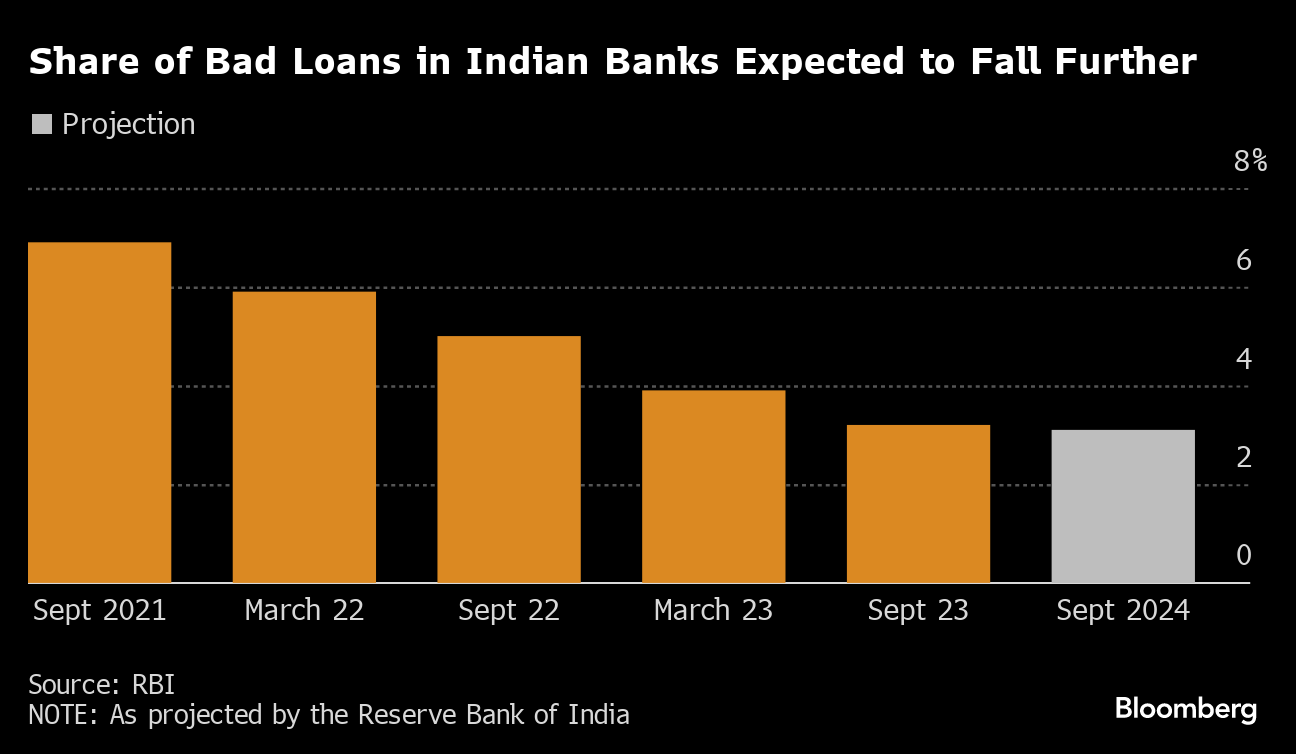

(Bloomberg) -- Soured-debt ratios at Indian banks will ease further and the central bank will curb excessive exuberance by lenders if financial stability risks emerge, according to the Reserve Bank of India.

Bad-debt ratio is expected to fall further to 3.1% of total loans by September next year from the current level of 3.2%, the central bank said in its half yearly Financial Stability Report released Thursday.

While the health of India's financial sector is improving, “we remain alert and committed to act early and decisively to prevent any build-up of risks,” Governor Shaktikanta Das said.

Earlier this month, the central bank moved to close a loophole that had allowed lenders to shift their bad loan exposure to external funds with lighter oversight. Lenders plunged on concerns they will face potential mark-to-market losses if they liquidate the investments, or their balance sheets take a one-time hit in case of provisions. The move had followed the regulators' clampdown on consumer loans.

The recent macroprudential measures, “underline our commitment to preserve financial stability without compromising availability of funds for productive requirements of the economy,” Das added.

The nation's top regulator is zeroing in on the risks of a lending boom in the world's fastest growing major economy that's driven record profits for local lenders and drawn the interest of investors ranging from Apollo Global Management to Goldman Sachs Group Inc.

But the recent regulatory measures will impact the capital positions of the bank. The “stability enhancing and credit positive” move by the RBI will bring down the aggregate capital adequacy ratio of 46 major banks to 14.8% by September next year from 16.6% during the same period this year, it said.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.