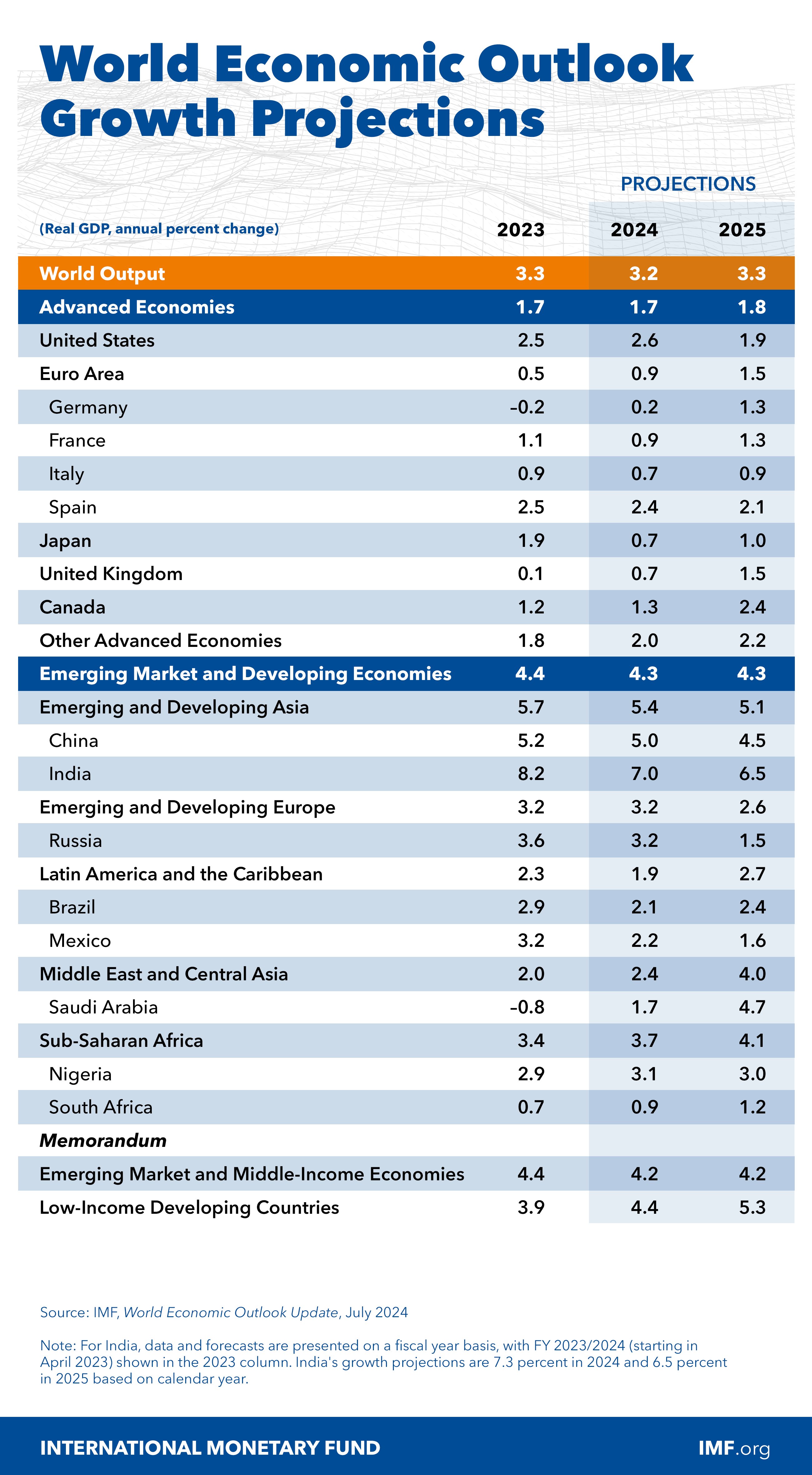

The International Monetary Fund has lifted India's GDP growth projection to 7% for fiscal 2025 in its latest outlook, citing improved prospects for private consumption, particularly in rural areas. In its April review, the agency had projected 6.8% growth for the year.

The multinational lender also retained the country's fiscal 2026 growth outlook at 6.5%.

India's improved growth prospects come as the IMF kept its global GDP growth forecast for 2024 unchanged at 3.2%. While it has lowered the growth projection for the US and Japan, the Euro area, China and the UK have seen an upward revision.

The forecast for growth in emerging markets and developing economies has been lifted, powered by stronger activity in Asia, particularly China and India.

Last month, the World Bank said India will remain the fastest-growing of the world's largest economies, although its pace of expansion is expected to moderate, projecting a 6.6% rate in FY25.

(Source: IMF)

Outlook On Energy, Inflation, Interest Rates

Energy prices are expected to fall by about 4.6% in 2024, reflecting elevated oil prices from deep cuts by OPEC+ and reduced, but still present, price pressure from the Middle East conflict, the IMF said.

Global inflation will continue to decline, even as it remains higher in developing countries than in advanced economies. Falling energy prices have contributed to inflation returning close to pre-pandemic levels for the median developing country, the IMF said.

Moreover, the agency said the monetary policy rates of major central banks are expected to decline in the second half of 2024, with divergence in the pace of normalisation reflecting varied inflation circumstances.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.