(Bloomberg) --

India's economic growth may exceed 6% for the rest of the decade, driving more investments from China into the South Asian country, Goldman Sachs Group Inc.'s India economist said.

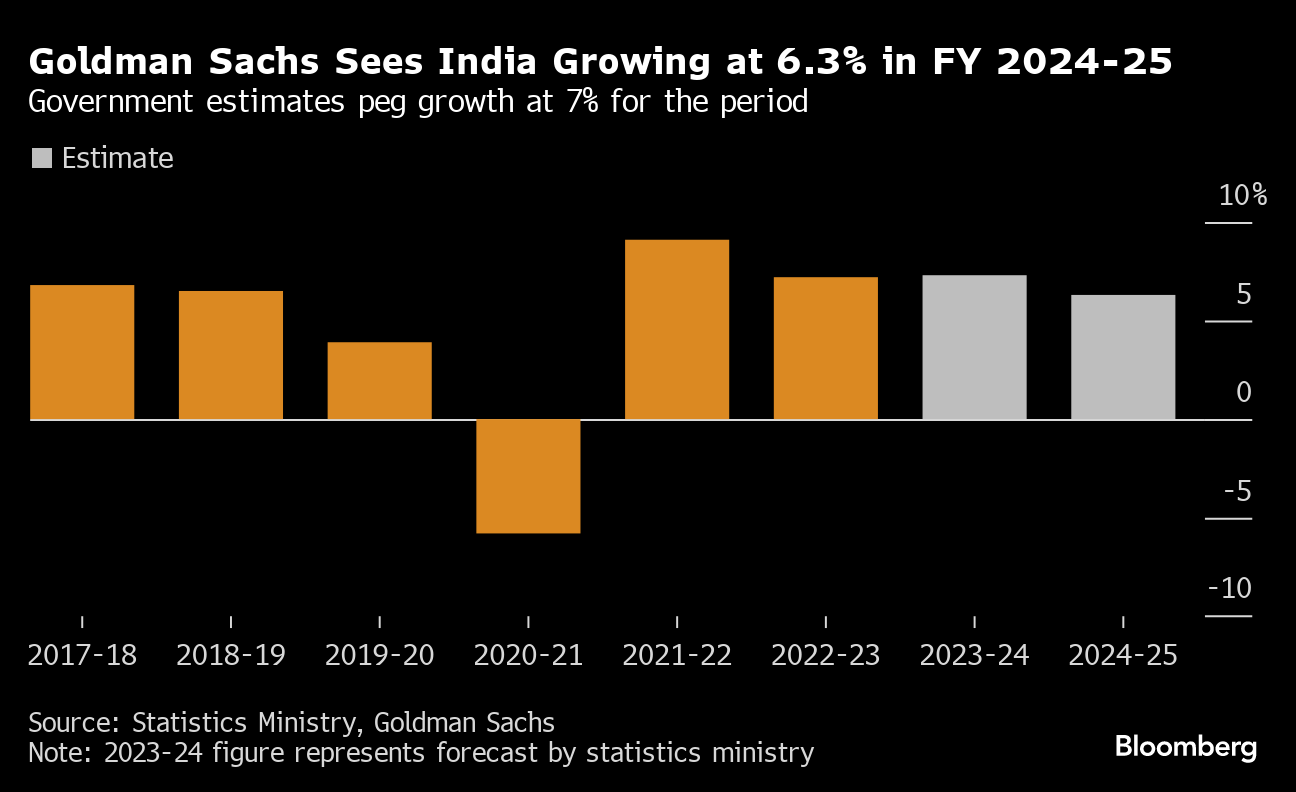

The long term growth potential is likely “inching higher toward 6.5%, or slightly higher,” Santanu Sengupta said in an interview with Bloomberg Television's Haslinda Amin Friday. He forecast growth at 6.3% for the next fiscal year that starts in April, lower than Reserve Bank of India's projection of 7%.

India's demographics, strong government-led spending and healthy domestic demand makes it a “favorable destination for investments going forward,” he said.

Potential growth is an estimate of the pace an economy can grow at without causing excess inflation. India's central bank governor last month estimated the nation's potential growth rate was around 7%.

Goldman Sachs expects the private sector in India to accelerate investments after nationwide elections. Businesses have deleveraged aggressively and their balance sheets are among the “cleanest that we have seen India in the last 20 years or so,” he said.

Here's more from Sengupta:

- The Reserve Bank of India is expected to wait for the Federal Reserve to move before adjusting monetary policy, he said, adding that the RBI's actions will come in three phases, including easing liquidity, a change in the policy stance followed by interest rate cuts

- Goldman expects two rate cuts in India in the second half of the year

- If the economy performs weaker than expected, the RBI may be forced to cut interest rates faster and deeper

--With assistance from Anand Menon.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.