India currency, money, rupee.jpeg?downsize=773:435)

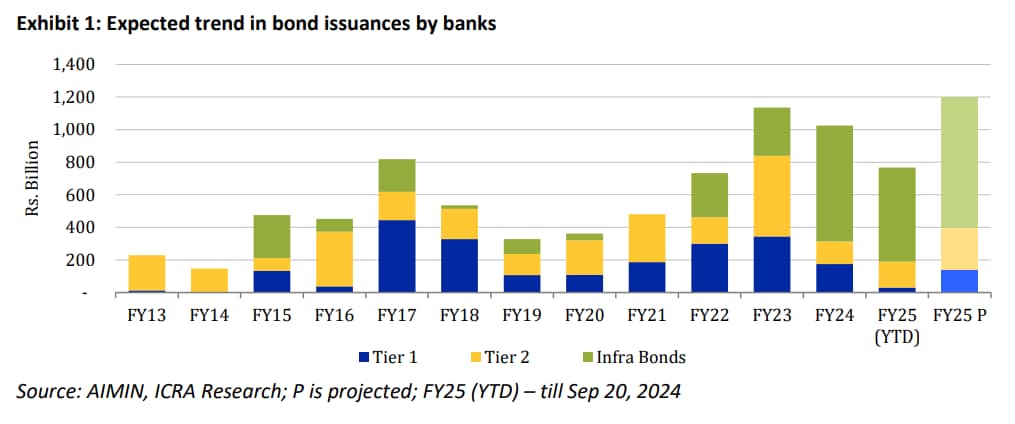

Bond issuances by banks will peak to an all-time high of Rs 1.2–1.3 lakh crore in the financial year 2024–25, according to a report released by ICRA Ltd. on Tuesday.

It added that the surge would be driven through the issuance of infrastructure bonds, majorly by public sector banks.

The last all-time high in bond issuances was recorded in fiscal 2023, when it peaked to Rs 1.1 lakh crore. In the subsequent year, the amount declined to Rs 1 lakh crore.

"Tight liquidity conditions and credit growth continuously surpassing deposit growth have necessitated fund raising by banks from alternate sources," ICRA said.

So far, in the current fiscal, banks' total bond issuances have climbed to Rs 76,700 crore, which is 225% higher year-on-year and amounts to 75% of the total issuances in fiscal 2024, it added.

PSBs Lead

With private banks focussing on reducing their credit-to-deposit ratio, the fundraising through bonds is largely being dominated by public sector banks this year, the rating agency said.

The PSBs are expected to command a share of 82–85% of bond issuances, with "infrastructure bonds dominating the same," it added.

Additionally, the government's continued focus on infrastructural spending and the availability of sizeable infrastructure loan books support these bond issuances, ICRA added.

Infrastructure bonds are required to have a minimum tenure of seven years, according to the regulations. However, given the investor preference, they have been issued for relatively longer tenures of even 10 and 15 years, the report said.

"With improved capital position, tight funding position and a sizeable infrastructure loan book, the PSBs became dominant in the issuance of infrastructure bonds and accounted for 77% of banks' infrastructure bond issuances in FY2023–FY2025 (YTD)," said Sachin Sachdeva, vice president and sector head of financial sector ratings at ICRA.

In the past, banks' bond issuances were dominated by tier 1 and tier 2 instruments to help boost capitalisation metrics, especially when they were facing low profitability amid asset quality challenges, ICRA pointed out.

However, from fiscal 2023 onwards, issuances of infrastructure bonds have gained traction as profitability improved, it said.

"With the availability of a more stable and granular depositors' base, the PSBs have more wherewithal to provide long-term funding and usually have a larger share in the infrastructure sector than private banks," the rating agency added.

ICRA, in a release, said that it analysed a sample of 13 large banks—public and private—with infrastructure bonds outstanding at around Rs 2.2 lakh crore as on Aug. 31, against which they have an infrastructure loan book of around Rs 11 lakh crore as on June 30.

"Of these, 11 banks have their infrastructure bonds outstanding as a proportion of their infrastructure book at less than 40%, leaving a sizeable headroom for them to raise funds through these instruments," Sachdeva said.

In addition, affordable housing assets are also eligible for funding through infrastructure bonds and hence the overall eligible book is likely to be higher, he added.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.