“Most Indians are just one hospitalisation away from bankruptcy,” was Zerodha's Nithin Kamath's warning on medical inflation in India.

The recent study, 'Health Report of Corporate India 2023', conducted by Insurtech company Plum suggests that his concerns are valid.

According to the report, 71% of employees cover most of their healthcare expenses out of their own pockets.

On an average, consulting a general physician costs Rs 300, a specialist Rs 1,000, and mental health services Rs 25,000 in urban India. The average cost for health check-ups is Rs 1,500, and lab test costs begin from Rs 1,500 to Rs 25,000, according to the report.

Health Comes With A ‘Cost'

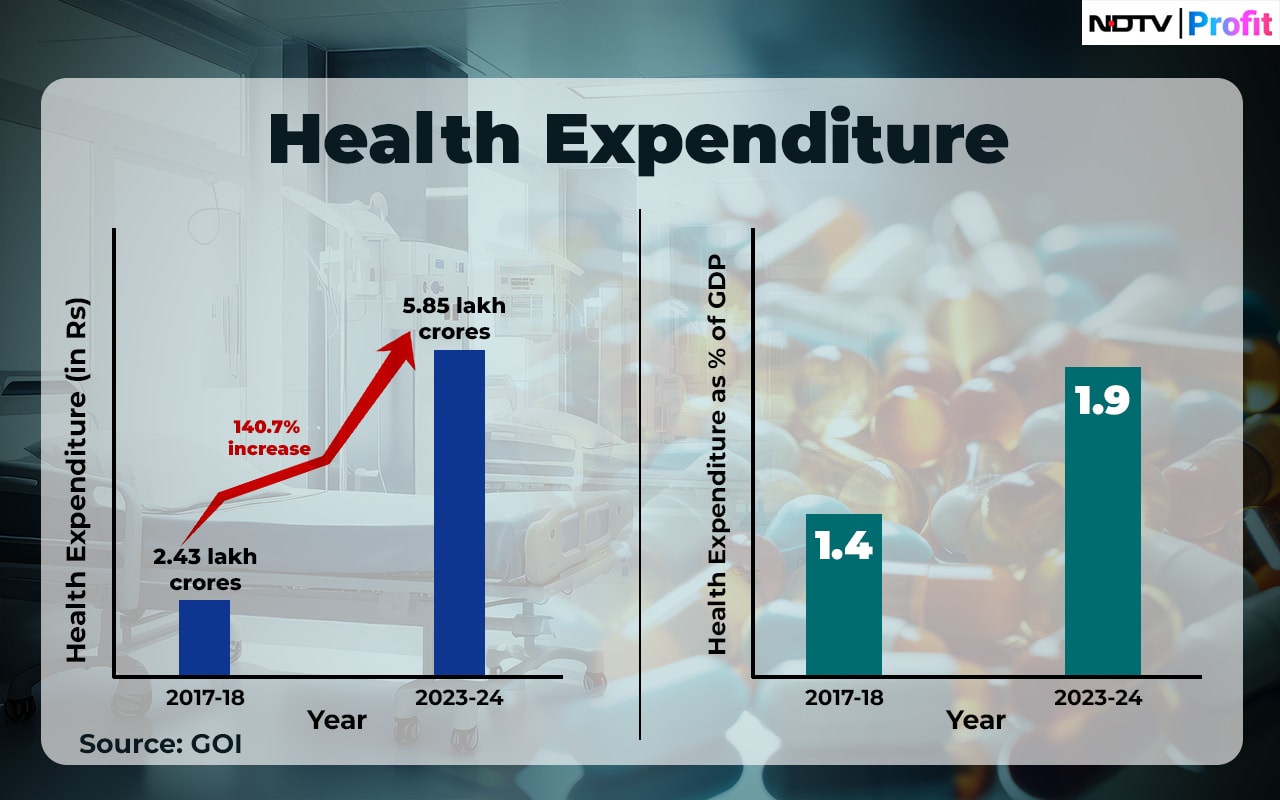

Between FY18 and FY24, the expenditure on health has grown at a CAGR of 15.8%, according to the Ministry of Finance's press release.

India's expenditure on healthcare has grown to 1.9% of GDP in FY24 from 1.4% in FY18. Healthcare expenditure in FY24 was Rs 5.85 lakh crore, a 140.7% increase from Rs 2.43 lakh crore in FY18.

Moreover, the Economic Survey 2023-2024 noted that the social security expenditure on health grew to 9.3% in FY20 from 5.7% in FY15.

Among Asian countries, India had seen the highest medical inflation rate of 14% in 2021, followed by China (12%), Indonesia (10%), Vietnam (10%), and the Philippines (9%).

The Health Insurance Conundrum

Employer-sponsored insurance coverage is inadequate in India, according to the report by Plum.

NITI Aayog's report, 'Health Insurance for India's Missing Middle', highlights the coverage gap in India's health insurance system, focusing on the "missing middle." The missing middle segment, comprising around 30% of the population (400 million individuals), lack financial protection for healthcare expenses.

However, those who already own medical insurance in India sometimes struggle to claim and maintain it.

According to a survey by LocalCircles, 52% insurance owners surveyed said that their premium has increased by over 25% in the last 12 months.

And 43% of those who filed an insurance claim in the last three years struggled to get it processed.

“It is time IRDAI steps in to rationalize the increase in premiums along with processing of claims, so health insurance becomes citizen centric,” the survey mentioned.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.