After a period of consolidation, debt levels across Indian states are once again on the rise and could pose a medium-term challenge, the Reserve Bank of India has cautioned in its annual study of state finances. Apart from factors such as lower growth due to expenditure cuts, which could impact the sustainability of state debt, risks emerging from the Ujwal DISCOM Assurance Yojana (UDAY) continue to loom large over states, the central bank cautioned.

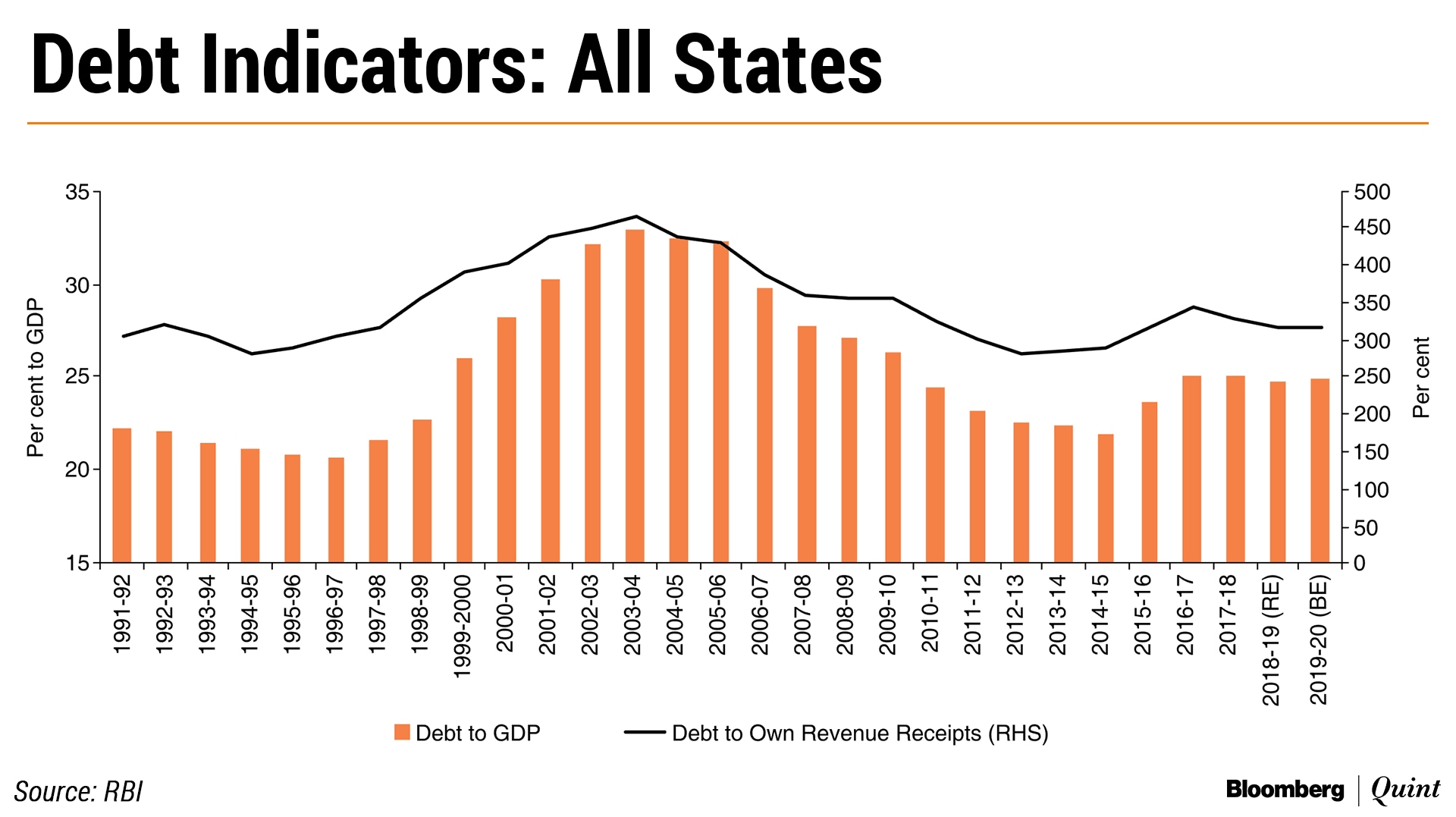

The debt-to-GDP ratio across all states and union territories is estimated at 24.9 percent for FY20, close to the levels seen over the last few years. However, the performance across individual states varies sharply and at least 20 states have breached the threshold of a debt-to-GDP ratio of 25 percent, the report, released on Monday, said.

Total debt of Indian states is expected to rise to Rs 52.58 lakh crore in FY20, an increase of 11.5 percent over last year. The expected rise in debt is steeper than the 9.8 percent increase seen in FY19.

India has the highest sub-national debt as compared to other BRICS countries, the RBI said. “The debt position of state governments has started showing incipient signs of unsustainability, particularly post UDAY,” it added.

Under the UDAY scheme, implemented in 2015, state governments took over 75 percent of the outstanding liabilities of power distribution companies in the form of grants or equity. The scheme also led to an increase in the ratio of interest payments to revenue receipts of states, the RBI said.

Variance Across States: Best And Worst Performers

Data included in the RBI report shows that the debt performance across large states varies widely. Despite repeated attempts, investors in state government securities do not differentiate much between states based on their individual performance.

With no incentives for prudence or better performance, a number of large states are now running higher debt-to-GDP ratios.

Among larger states, Punjab has the worst debt-to-GDP ratio of 39.9 percent, followed by Uttar Pradesh, where debt levels have hit 38.1 percent of GDP. Himachal Pradesh, Rajasthan and West Bengal also have debt-to-GDP ratios far higher than the threshold.

In contrast, Assam, Gujarat, Karnataka, Maharashtra and Telangana have the lowest debt-to-GDP ratios among larger states.

In addition to the debt-to-GDP across states, the RBI also flagged off the increase in guarantees given by the state. Data obtained from the Comptroller and Auditor General and from state finance departments shows that the quantum of guarantees given jumped sharply by 37.7 percent in 2017-18 to 2.5 percent of GDP.

“In terms of the sectoral distribution of exposure, the power sector remains dominant – accounting for over 60 per cent of total outstanding guarantees, on average. For a few states, it accounted for over 80 per cent – followed by the transport sector,” the RBI said.

The Ghost Of UDAY

The lingering impact of the 2015 UDAY scheme continues to play out on state finances and could even worsen over the next two years if the performance of distribution companies does not improve, the RBI cautioned.

The scheme is continuing to impact state finances in a number of ways.

First, states which were part of the programme have seen an increase in interest payouts since the coupon rates on UDAY securities were higher than state government bonds.

Second, states had signed an agreement to take on a larger share of DISCOM losses with each passing year. As per the agreement, states would take on:

- 10 percent of DISCOM losses of the previous year in 2018-19

- 25 percent of DISCOM losses of the previous year in 2019-20

- 50 percent of DISCOM losses of the previous year in 2020-21

As such, the health of DISCOMs will remain critical to state debt in the coming years, said the RBI.

“Another potential impact from UDAY could materialise from takeover of incremental losses of DISCOMs as mandated in UDAY agreements, particularly as the benefit of grants to supplement revenues will not be available for some states,” the RBI said.

Fiscal Deficit In Check But At A Cost

While medium-term concerns about the sustainability of debt have re-emerged, states have managed to keep their fiscal deficits in check, often by cutting expenditure.

The gross fiscal deficit ratio across states is estimated at 2.6 per cent for FY20 as against the revised estimate of 2.9 percent in FY19.

This has, however, been achieved by sharp retrenchment in expenditure, mainly capital expenditure, with potentially adverse implications for the pace and quality of economic development, given the large welfare effects of a much wider interface with the lives of people at the federal level.RBI Report On State Finances

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.