(Bloomberg) -- Bitcoin advanced past $46,000 to a one-month high, supported by signs of steady inflows into a batch of US funds for the token as well as growing attention on the so-called halving due in April.

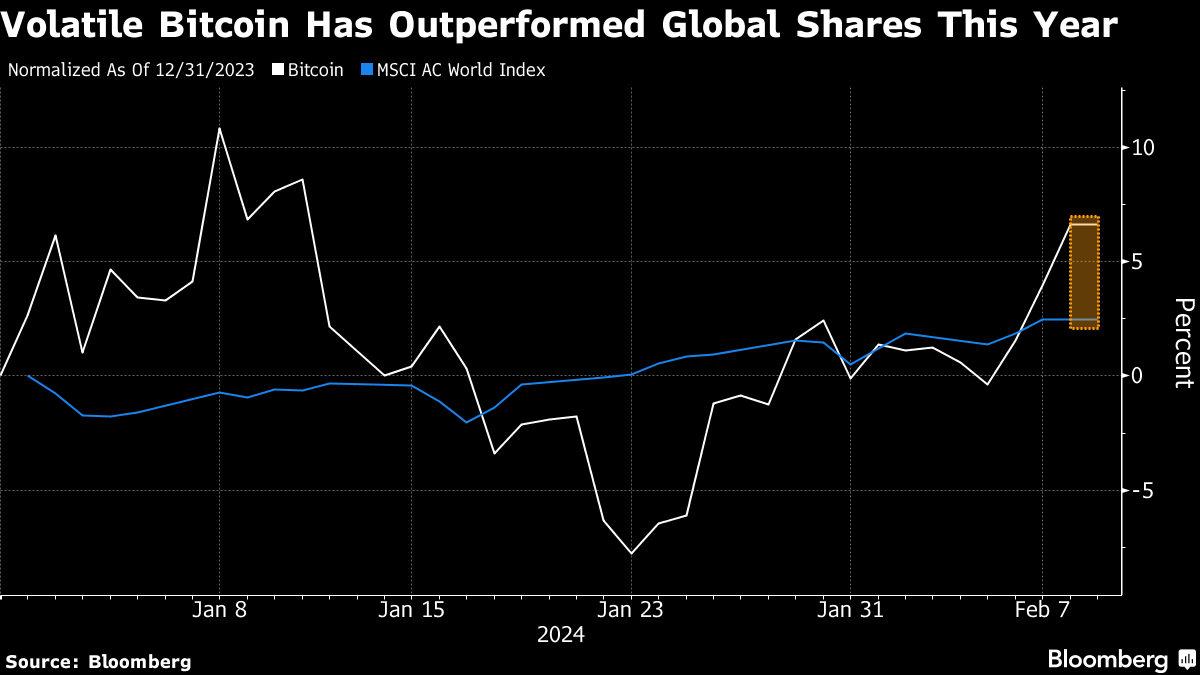

The largest digital asset rose about 2% to $46,166 as of 11:06 a.m. in Singapore on Friday, taking its 2024 rally to roughly 9%. Smaller tokens such as Ether, Solana and Cardano also pushed upward.

Nine US spot Bitcoin exchange-traded funds debuted on Jan. 11, while the more than decade-old Grayscale Bitcoin Trust converted into an ETF the same day. The accessibility of ETFs promises to widen the investor base for the token. The new funds have attracted a net $8 billion so far, while a $6 billion outflow from the Grayscale fund since its conversion is now losing steam.

“Bitcoin appears set to resume its march up after the Grayscale outflows finally tapered off,” said Caroline Mauron, co-founder of digital-asset derivatives liquidity provider Orbit Markets. The “halving narrative” will gather momentum, potentially taking Bitcoin past $50,000 in the next few weeks, she said.

The quadrennial halving cuts the quantity of Bitcoin that miners receive for operating power-hungry computers that secure the network by solving complex puzzles. Halving is key to capping the supply of Bitcoin at 21 million tokens. Rewards drop to 3.125 coins per block from 6.25 coins in the upcoming event.

Previous halving events “preceded strong bull runs,” a team including DBS Bank Ltd. Chief Economist Taimur Baig wrote in a note. “There is a simple economic reason why prices should rise. As the reward for mining decreases, the price for mining output (namely Bitcoin) must increase to compensate and not trigger a withdrawal of computational resources by miners,” the team said.

Bitcoin remains about $23,000 below the record high the token hit in 2021, during a pandemic-era bull run oiled by easy money.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.