(Bloomberg) -- Bitcoin options traders are already locking in profits even before the Wednesday deadline by which the US Securities and Exchange Commission must decide if it will allow an exchange-traded fund to directly hold the digital asset.

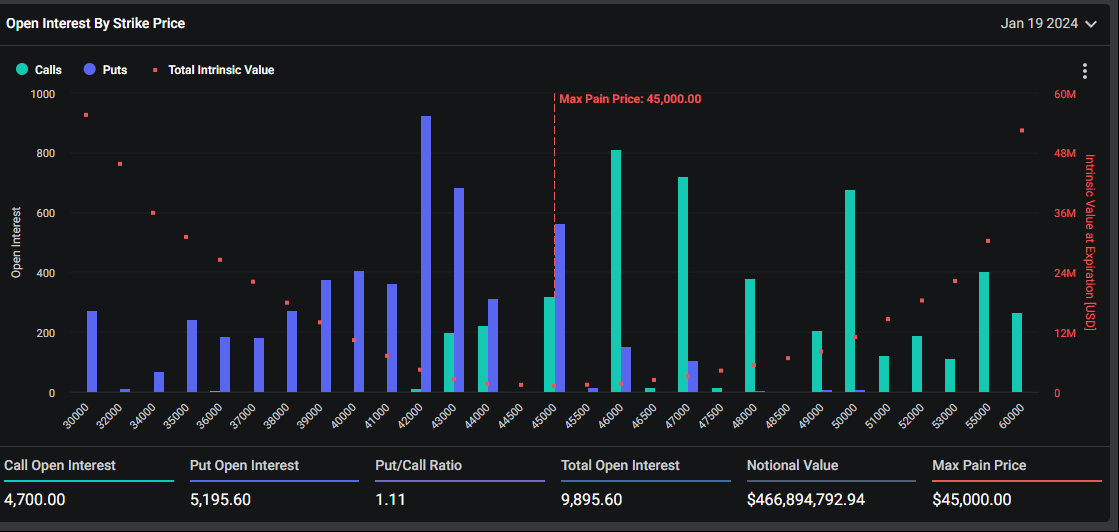

Market participants have seen a surge in the selling of short-term call option contracts over the last 24 hours. The put-to-call ratio for the contracts that will expire on Jan. 19 is now above 1 — much higher than two weeks ago, according to data compiled by Deribit, the largest crypto options exchange.

Bitcoin has jumped over 8% so far this year. It suddenly tumbled to around $45,000 from over $47,000 late Tuesday afternoon in New York as the SEC's official X, formerly Twitter, account was compromised and falsely stated the Bitcoin ETFs were approved.

Some traders are buying more puts to mitigate risks associated with a negative outcome for the spot Bitcoin ETF around the SEC's Jan. 10 deadline, which may have driven the ratio even higher. The put-to-call ratio is often seen as a measure of market sentiment; the higher the ratio, the more bearish traders are on the price.

“What we have seen, and public data supports, is that outsized amount of call selling over the last 24 hours has pushed short-dated skew negative (puts more expensive than calls) for the first time since September,” said Chris Bae, CEO at Enhanced Digital Group, a derivative trading firm. “This is at odds with the price action of spot making new highs overnight and thus suggests participants are looking to lock in gains ahead of ETF news.”

Options traders have been bullish on Bitcoin prices due to optimism around the possibility of the ETFs being approved, opening the asset class to a wider range of investors. The cryptocurrency has been on a tear since traditional asset managers such as BlackRock started preparing the ETFs last year. However, traders have become more cautious about their bullish bets as the deadline approaches.

Some traders anticipate the Bitcoin ETF approval could be a “sell-the-news” event, leading to a significant pull-back in the aftermath.

“In the past few months, there has been significant buying interest in calls due to people speculating on ETF approval,” said Ethan Ren, head of Options at Wintermute Asia. “Now with high market expectations of ETF approval, as seen with the rally to over 45k and six-month highs, people are hedging and reducing their positions with put buying and call selling, a reversal of the recent trend.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.