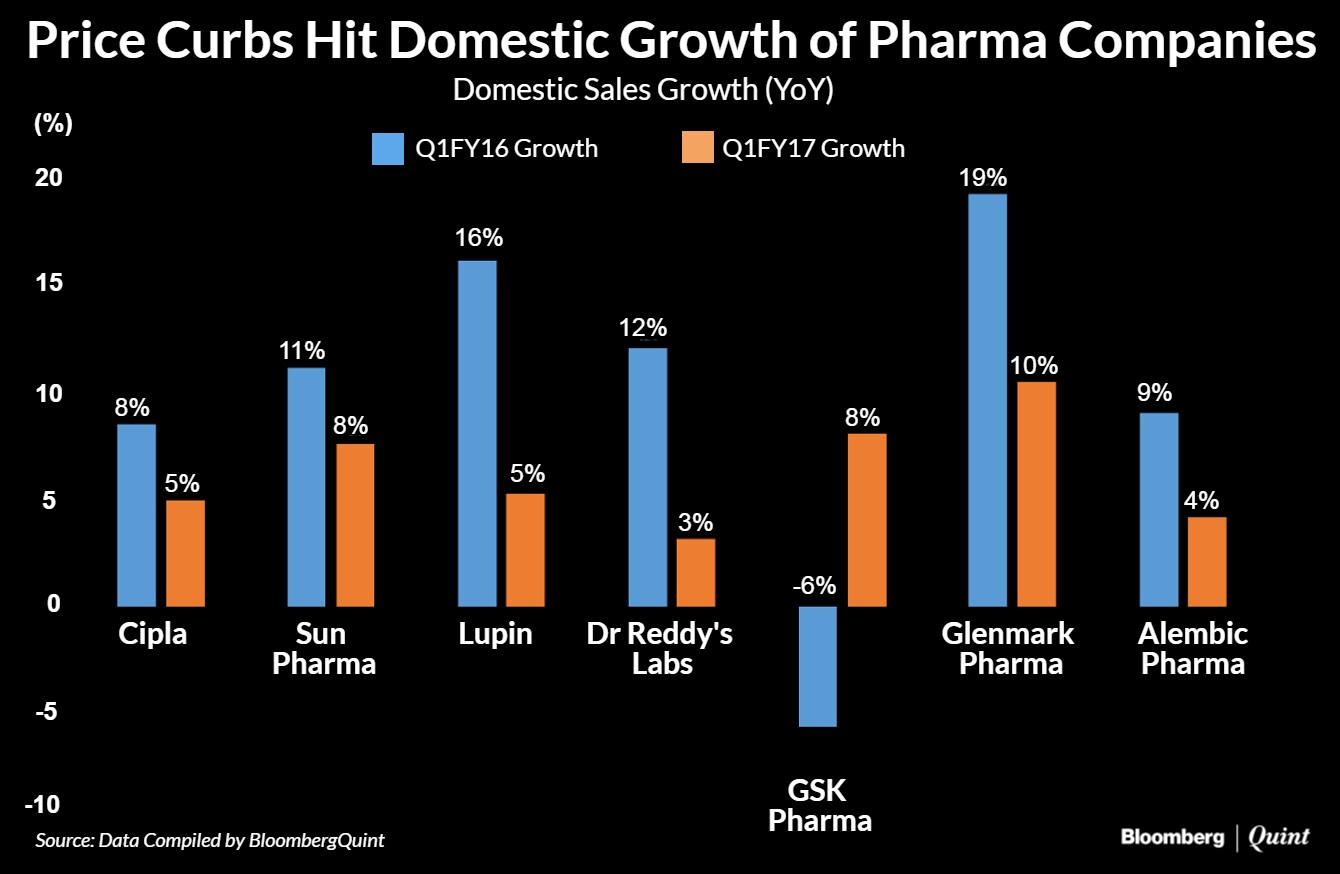

The government's drug price controls have hurt domestic sales growth of Indian pharmaceutical companies, some of whom are already facing the brunt of regulatory actions by the U.S. regulator (U.S. FDA). The April to June quarter earnings of these companies showed visible signs of the growth slowdown.

The revenue growth rate for seven pharmaceutical companies in India has fallen to single-digits, except Glenmark Pharma which managed to cross the 10 percent mark. Lupin has been the worst hit – its domestic market revenue saw a slower growth of 5.2 percent as compared to 16 percent in the same quarter last year. The management attributed the lower growth to the effect of price controls. Sun Pharmaceuticals attributed weaker domestic sales growth to the negative impact of price cuts and the proposed ban on Fixed Dosage Combinations (FDCs). In fact, the company warned of an adverse impact of this ban on the business going forward.

Dr Reddy's Labs saw the slowest growth this quarter – of 3 percent. Optically, Glaxo Pharma's growth is higher this quarter because of base effect. The negative impact of supply constraints in the same quarter last year had pulled growth lower. The company said the double digit growth profile seen over the last two quarters, slid to 8 percent for this current quarter due to the government-mandated price revisions.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.