Shares of Apollo Hospitals Enterprises Ltd. recorded their biggest fall since December 2021 after the stake sale of its unit, Apollo HealthCo Ltd., to Advent International LP was at a lower valuation, according to analysts. At the same time, brokerages are positive about the company's integration with its promoter group entity, Keimed Pvt.

Apollo HealthCo will raise Rs 2,475 crore from Advent International to integrate the company with wholesale pharma distributor Keimed over the next 24-30 months, according to an exchange filing on Friday. Advent International will hold a 12.1% stake in the merged entity, it said.

"While the headline valuation of the Advent deal for the existing AHL business is below our SoTP value, we think that the margin upside of the integrated business does provide meaningful upside in the medium term," BofA Securities Ltd. said in a note. The brokerage maintains a 'buy' rating for the stock, with a price target of Rs 7,200 per share.

"While stake sale of AHL to Advent was done below our estimates by $0.8–0.9 billion, the likely merger of Keimed with AHL is a positive step and removes the overhang of any leakage," said Prabhudas Lilladher Pvt.

"The transaction is at a 25% discount to the closest listed peer," according to Krishnan Akhileswaran, group chief financial officer of Apollo Hospitals Enterprise. Loss is expected to come to zero in 6-8 quarters, he said.

"Respecting the immediate reaction from markets regarding the Advent deal, the combined entity will be significantly value-accretive to our shareholders," he said. "Keimed valuation implies an 18 times forward Ebitda."

Motilal Oswal Financial Services Ltd. has a 'buy' rating on the stock and a target price of Rs 7,280 per share. This transaction would enable Apollo HealthCo to establish an integrated pharmacy distribution business, complemented by a fast-growing omnichannel digital health segment, it said.

The merged entity targets to achieve Ebitda breakeven for the digital business in 6-8 quarters, higher margin realisation through supply chain efficiencies, and accelerated growth in private label business, which would drive margin expansion, it said.

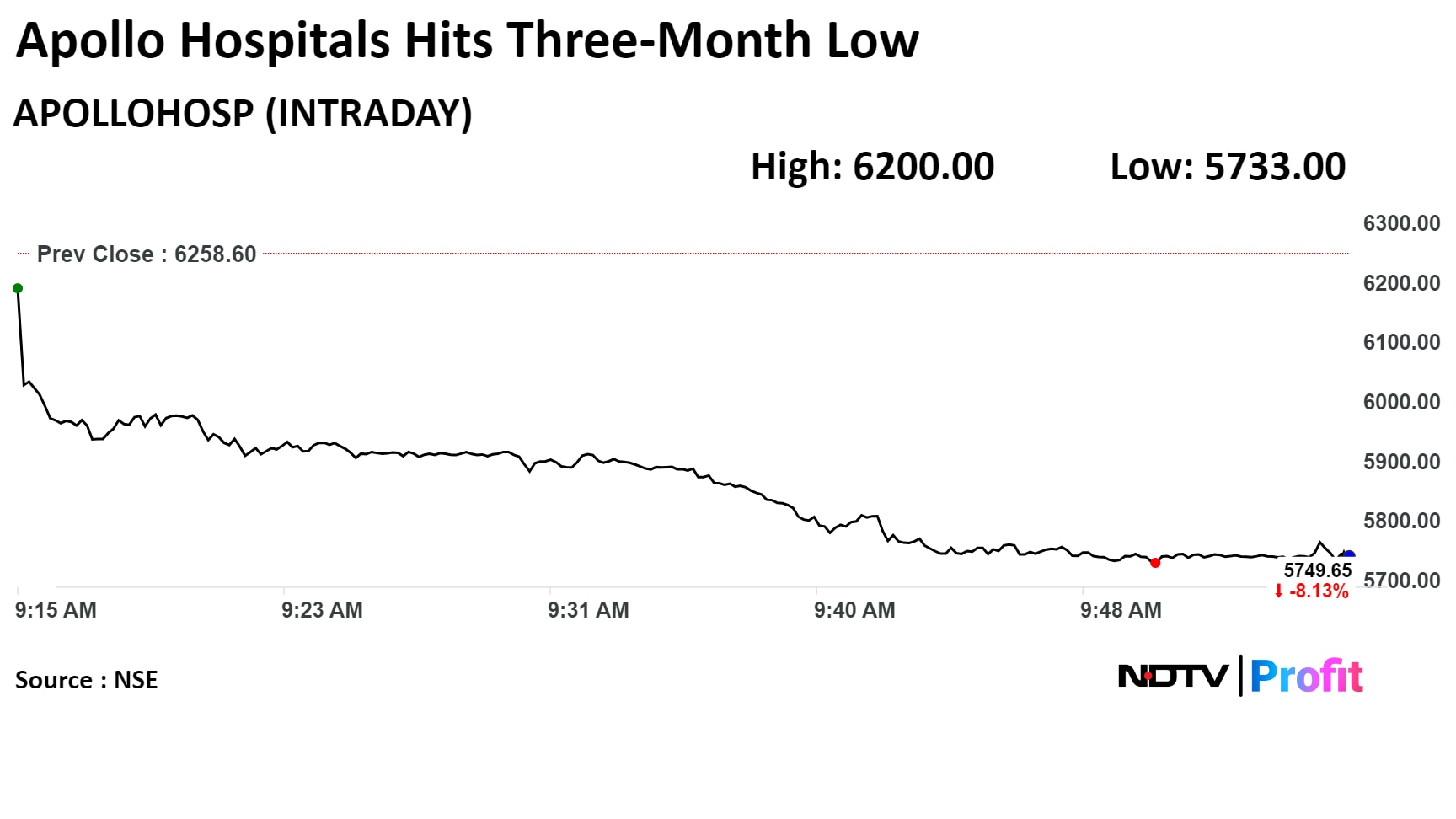

Shares of the company fell as much as 8.40%, the lowest level since Jan. 10, before paring loss to trade 6% lower as of 10:57 a.m. This compares to a 0.47% advance in the NSE Nifty 50.

The stock has risen 3.6% year-to-date and 24.68% in the last 12 months. The total traded volume on NSE so far in the day was 3.61 times its 30-day average. The relative strength index was at 36.65.

Of the 27 analysts tracking the company, 24 maintain a 'buy' rating, one recommends a 'hold', and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' target prices implies an upside of 18.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.