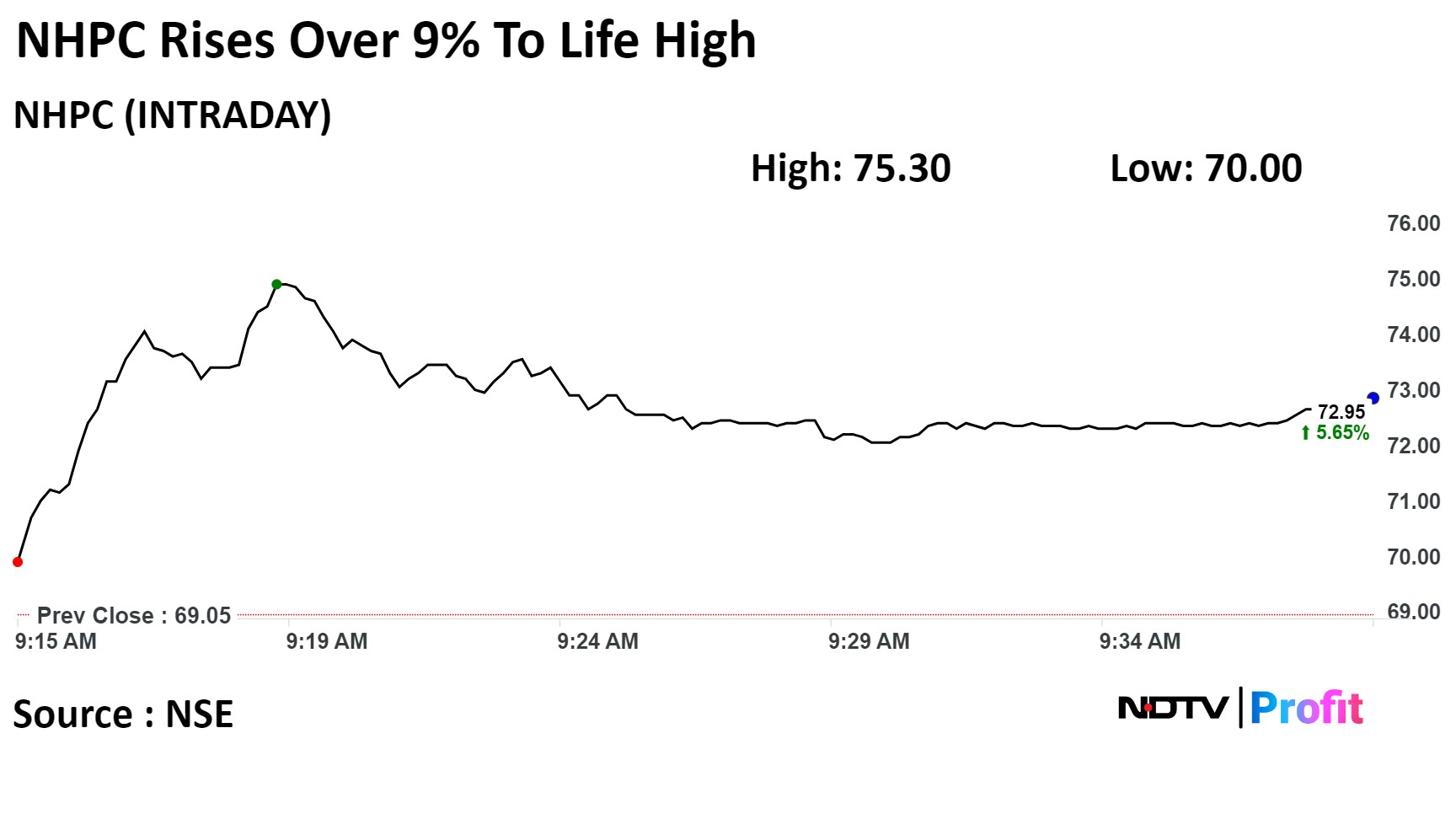

Shares of NHPC Ltd. surged 9% to hit a life-time high on Thursday after the key electricity regulatory body proposed to raise the return on equities for new storage-based hydro projects from April 1.

The Central Electricity Regulatory Commission, in its draft tariff norms for FY25–FY29, has raised the return on equity for new storage-based hydro projects—including pumped hydro—to 17% from 16.5%. It has kept the majority of norms for thermal and other power projects unchanged.

Adding to this, the company also signed a pact with Gujarat Power Corp. to invest Rs 4,000 crore in the 750 MW Kuppa Pumped Hydro Storage Project at Chhota Udaipur in Gujarat.

BofA has maintained an 'underperform' rating on NHPC with a target price 20% below the current market price at Rs 58.00 as the brokerage expects its medium-term growth to remain muted.

The brokerage expects it to sustain its current RoE of 15.5% on delayed project execution.

Shares of NHPC surged 9.05% to Rs 75.30 apiece, the highest level since listing on Sept. 1, 2009. It pared gains to trade 5.0% higher at Rs 72.50 apiece as of 09:52 a.m. This compares to a 0.33% advance in the NSE Nifty 50 Index.

In 12 months, NHPC Ltd has risen 84.95% Total traded volume so far in the day stood at 12 times its 30-day average. The relative strength index was at 75.88, which implied the stock is overbought.

Out of nine analysts tracking the company, eight maintain a 'buy' rating, and one suggests a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 16.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.