Shares of Jio Financial Services Ltd. rose nearly 5% on Tuesday after it announced the formation of a 50:50 joint venture with BlackRock and BlackRock Advisors Singapore Pte to form a wealth management business in India.

The JV will include the incorporation of a wealth management company and a brokerage company for solely undertaking wealth management business in India.

The announcement comes in response to the NBFC's plans to launch new business ventures. In its Q2 FY24 results, the company proposed an asset management joint venture with BlackRock. However, back then, it did not disclose all the details.

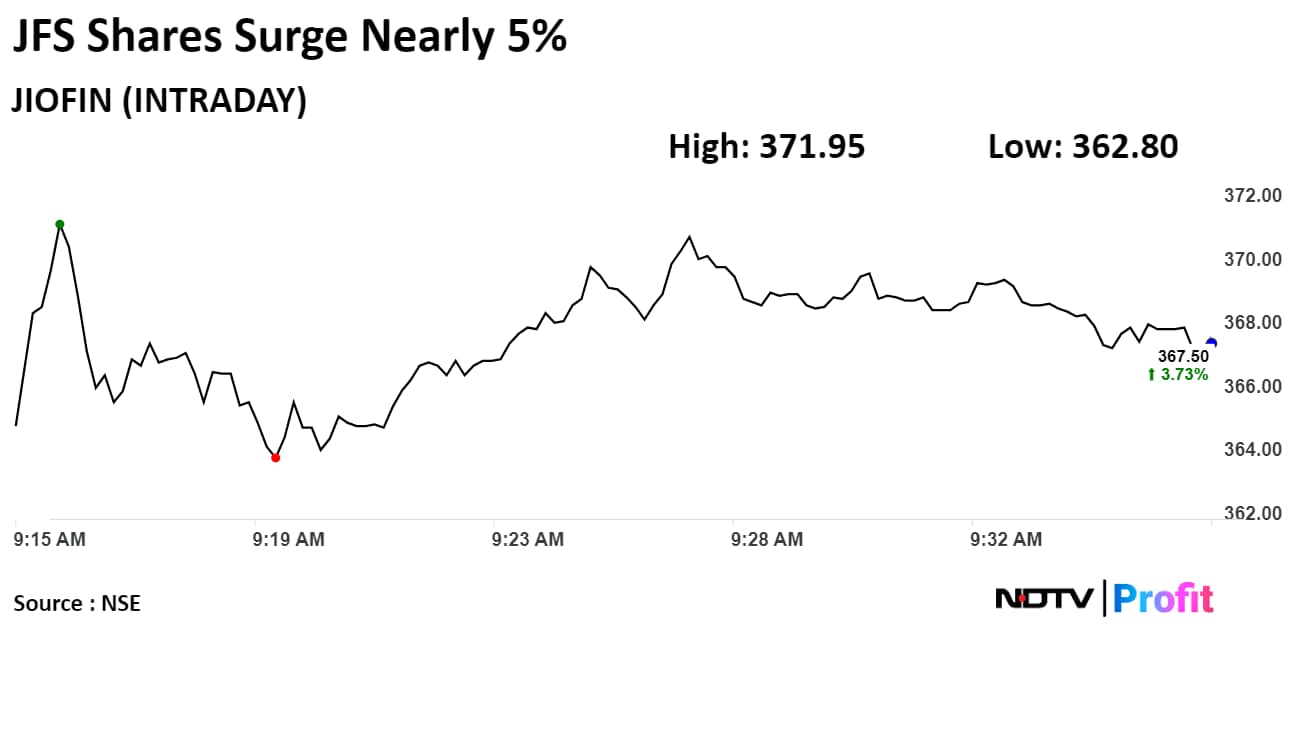

JFS stock rose as much as 4.98% during the day to Rs 371.95 apiece on the NSE. It was trading 4.11% higher at Rs 368.85 apiece, compared to a 0.33% decline in the benchmark Nifty 50 as of 9:35 a.m.

It has risen 119% in the last 12 months. The total traded volume so far in the day stood at 3.1 times its 30-day average. The relative strength index was at 61.

An analyst tracking JFS has a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 20.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.