Marico Ltd.'s performance in recent quarters has been underwhelming, and demand improvement in the core business continues to be delayed, according to brokerages.

The consumer products company's third-quarter net profit rose in line with estimates, but revenue fell for the third straight quarter due to weak rural demand, lower pricing of edible oil, and currency depreciation in select overseas markets.

The revenue decline was driven by price deflation in the India business. Volume growth was lower quarter-on-quarter, which management attributed to a planned inventory reduction with distributors, according to Goldman Sachs.

"The general trade situation (is) hurting business growth trends," Morgan Stanley said.

Marico Q3 FY24 Earnings Highlights (Consolidated, YoY)

Net profit up 16% to Rs 386 crore. (Bloomberg estimate: Rs 367.8 crore).

Revenue dipped 2% to Rs 2,422 crore. (Bloomberg estimate: Rs 2,473 crore).

Operating profit rose 12.5% to Rs 513 crore. (Bloomberg estimate: Rs 514 crore).

Margin widened to 21.2% versus 18.5%. (Bloomberg estimate: 20.8%).

India business revenue fell 3.13% to Rs 1,793 crore.

International business posted 6% constant currency growth, dragged by transient macroeconomic headwinds in Bangladesh.

Here What Analysts Say About Q3 Results

Macquarie Equity Research

The research firm maintains an 'outperform' rating on the stock with a target price of Rs 625, implying an upside return potential of 20.1%.

Marico's Q3 Ebitda was broadly in line with Macquarie's estimate, with the gross margin beat offset by higher ad spend. Better growth in Parachute was offset by declines in Saffola edible oils.

With Parachute price cuts largely behind and transient nature of hit in Bangladesh in Q3, Marico expects sales growth to turn positive in the fourth quarter.

It also raised its gross margin guidance to 450–500 basis points expansion in the current fiscal vs 350–400 basis points shared in Q2, and its Ebitda margin guidance to 250 basis points expansion, the research firm said.

Marico targets double-digit sales growth and low-teen profit growth in FY25, led by 5–7% volume growth, no hit from edible oil deflation from first quarter, steady portfolio mix improvement, cost controls, and price increases in Parachute as the typical 18–24-month inflation cycle seen historically in copra prices starts in the second half.

It largely maintains its earnings per share estimates for the current and the next two fiscals, given the in-line Ebitda in the third quarter.

Key risks to investment thesis include continued weakness in rural demand and the sharp volatility of copra prices that may weigh on Marico's profitability in the Parachute coconut oil business or hurt its competitive position vs unorganised peers.

Morgan Stanley

Morgan Stanley has an 'equal weight' rating on the stock, with a target price of Rs 533, implying a 3% upside potential.

It updates its model to factor in the third-quarter earnings — lowers the FY24 revenue growth forecast but raises the margin estimates. Overall, the FY24 earnings estimate is unchanged.

The research firm lowers the FY25 revenue growth outlook from 12.7% to 8.5% to factor in the delayed demand recovery in the core business.

"We reduce our FY25 and FY26 earnings estimates by 5% and 1%, respectively," the research firm said.

Management said there is a profitability and liquidity challenge in the general trade channel due to lack of sales growth in the channel over the past few quarters.

Goldman Sachs

The research firm maintains a 'buy' rating and decreased the target price to Rs 590 from Rs 600 earlier.

Goldman Sachs marginally raises the FY24 EPS estimates by 1.2% due to higher-than-expected margin expansion, but lower FY26 estimates by 1.3% to build in lower revenue growth.

Food organic growth slowdown a concern, digital brands did well. Marico's foods business grew 18% year-on-year, which included the revenues of the acquired brand Plix.

The organic foods business grew in the mid-single digits year-on-year, which is a cause of concern. This is likely due to management's focus on improving profitability in the business.

The foods business gross margins are now higher than the edible oil business and are likely to improve further. However, achieving 20% revenue growth in the foods business in FY25 will need an acceleration in organic segment growth.

A lot will depend on the-scale up of Plix in FY25. Marico's digital brand portfolio is scaling up well and had an annualised run rate of Rs 4 billion in the third quarter.

"We expect Marico's coconut oil business to see steady growth through market share gains from small brands and unbranded players, while Saffola edible oil should grow through premiumisation towards healthy edible oils."

JP Morgan

Marico's performance in the recent quarters has been underwhelming, posting slow domestic revenue growth.

Even as new portfolio initiatives are broadly tracking expectations, upside from these is not able to offset the drag from relatively soft offtake for core portfolio of hair oils and edible oils.

Even as revenue growth momentum should improve in the coming quarters with modest uptick in volume and improving pricing, its revenue growth should lag peers.

The main downside risks to the rating and price target are significant deceleration in revenue growth, especially in Saffola and value-added hair oils, sharp inflation in raw-material costs, a significant increase in competitive intensity leading to higher-than-expected advertising & promotion investment and a slower-than-expected pick-up in new product launches.

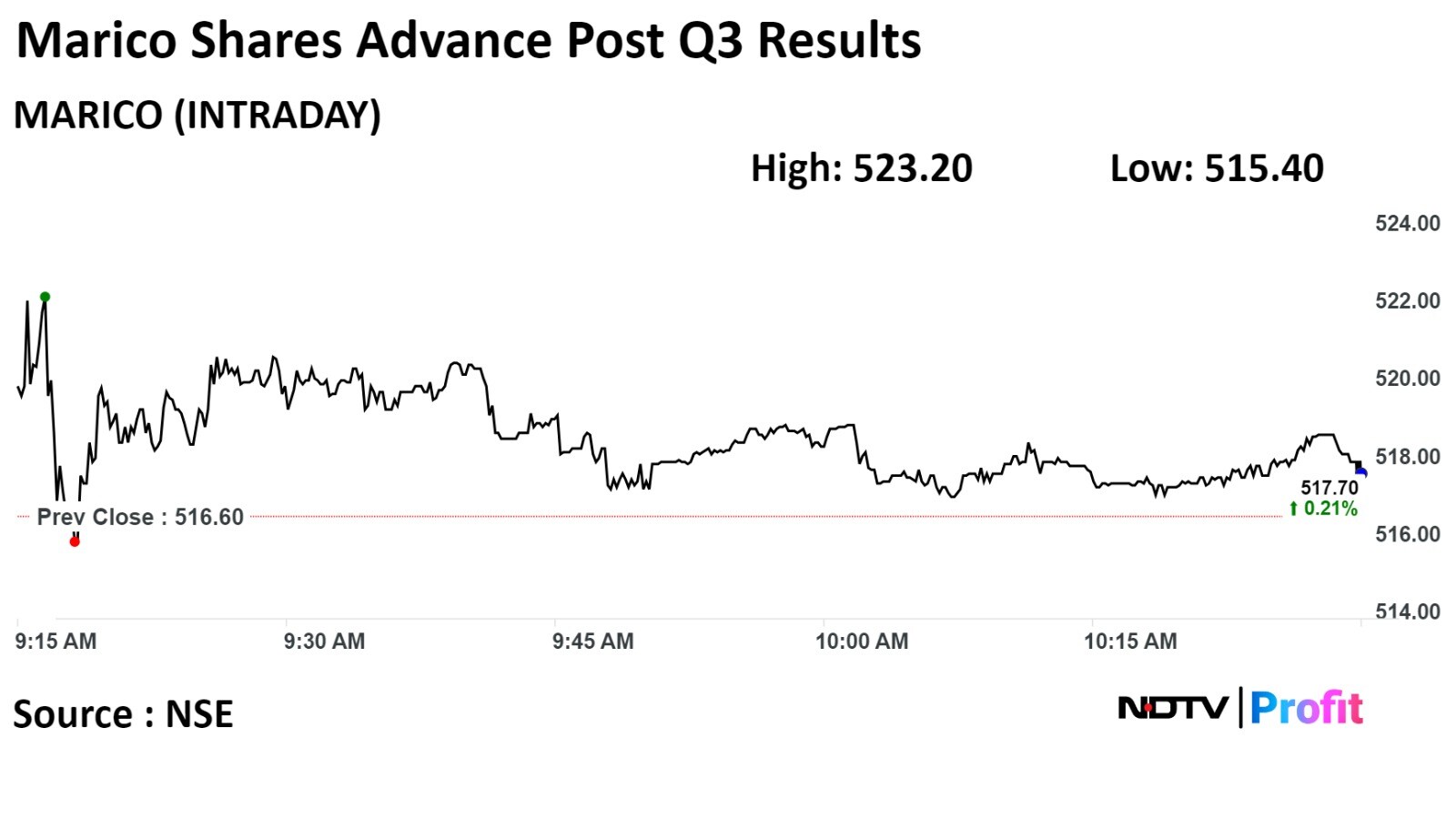

Marico stock rose as much as 1.18% during the day to Rs 523.20 apiece on the NSE. It was trading 0.26% higher at Rs 517.95 per share compared to a 0.04% advance in the benchmark Nifty 50 at 10:29 a.m.

The total traded volume so far in the day stood at 2.1 times its 30-day average. The relative strength index was at 41.

Of the 52 analysts tracking the company, 32 have a 'buy' rating on the stock, 14 recommend a 'hold' and six suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 12.6%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.