Shares of Lupin Ltd. gained over 5% on Thursday after it got a double upgrade from Kotak Institutional Equities on the expectation of a robust earnings outlook backed by a slew of new launches.

The brokerage, in its note titled "the party will continue", also attributed the ratings to the pharma company projecting a strong US trajectory aided by Tolvaptan's launch set for April 2025. The company anticipates that the hyponatremia-treating drug will generate sales of $106 million in fiscal 2026, significantly surpassing the street's estimates.

The brokerage upgraded the stock to 'add' from 'sell' while raising the target price to Rs 1,805 apiece from Rs 1,400 apiece earlier, implying a potential upside of 10.7% from the previous close.

"While we stay cognizant of not ascribing a high multiple to one-off earnings, we highlight that LPC has a bunch of products lined up, which will ensure that the earnings per share decline in fiscal 2027 is limited," the note said.

The brokerage also stated that there is still a possibility of additional positive surprises if Lupin continues to gain share in the drug gSpiriva and if the impact of Albuterol competition is less than projected.

Overall, it is going to be a remarkable year of sales in the US for the pharma manufacturer, and the brokerage expects US sales to grow by 12% to $914 million in the current fiscal and by 11% to $1013 million in fiscal 2026.

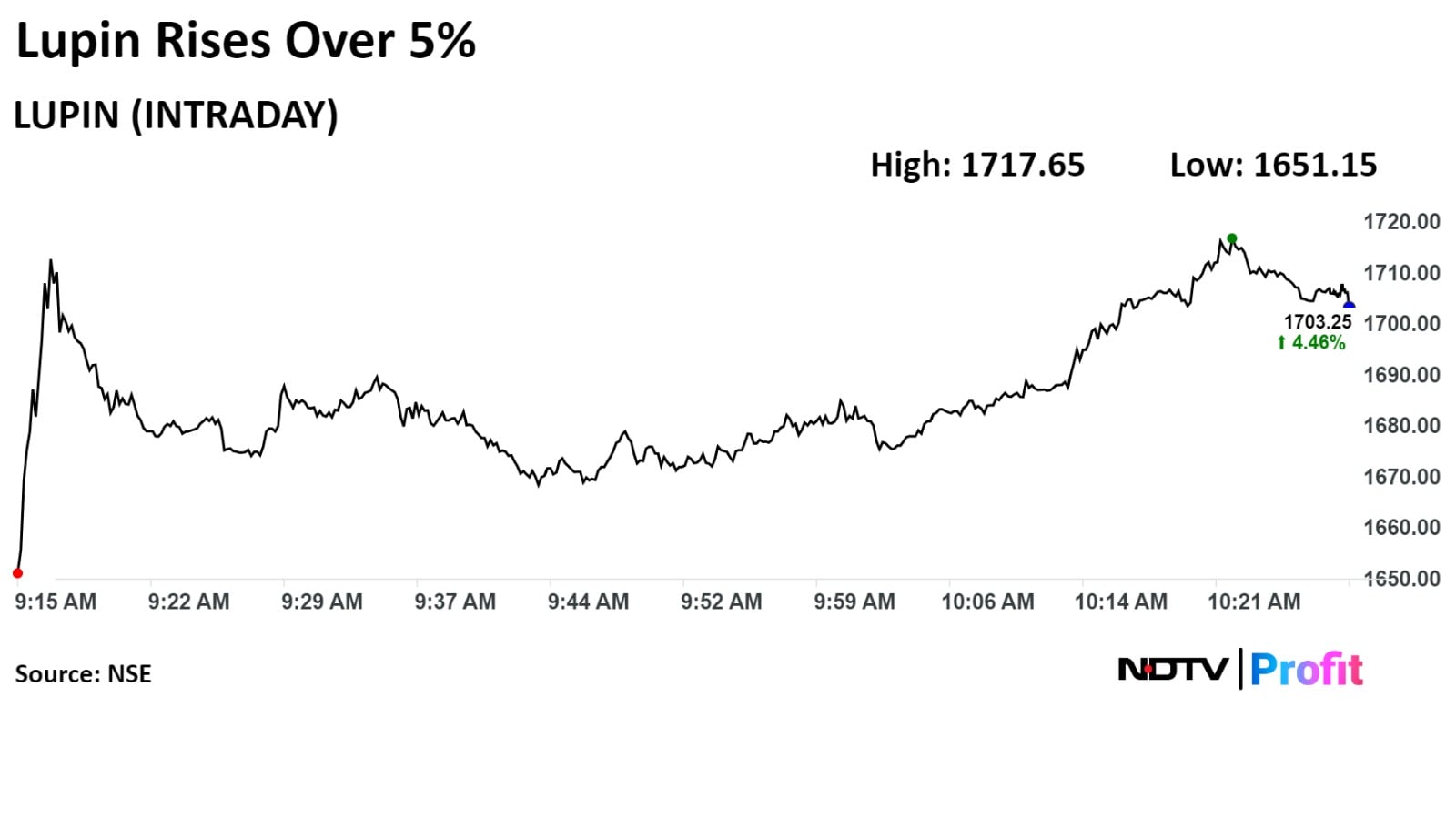

Shares of Lupin rose as much as 5.34% during the day to Rs 1,717.65 apiece on the NSE. It was trading 4.58% higher at Rs 1,705.30 apiece, compared to a 0.19% advance in the benchmark NSE Nifty 50 as of 10:27 a.m.

The stock has risen 91.78% in the last 12 months and 29.15% on a year-to-date basis. The total traded volume so far in the day stood at 4.1 times its 30-day average. The relative strength index was at 69.56.

Thirteen out of the 36 analysts tracking Lupin have a 'buy' rating on the stock, 11 recommend a 'hold' and 12 suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 4.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.