Shares of J. Kumar Infraprojects Ltd., among the companies building Mumbai's metro rail network, jumped 15% to a record high after CLSA raised its target and earnings-per-share estimates., citing an increase in its new orders.

It is "raining" urbanisation orders for the company, which won orders worth with Rs 8,800 crore so far in the current financial year as the government brings forward orders ahead of a likely election-led lull, according to the research firm.

CLSA maintains the rating on the stock with 'buy', and raised target price from Rs 385 to Rs 720, a potential upside of 46% from Friday's closing price.

The 57% of orders in the second half of FY24 came from a large tunnel in Mumbai, Mumbai Metro Line 2 stations and the elevated corridor in Chennai.

J. Kumar Infraprojects, in a joint venture with NCC Ltd., has emerged as the lowest bidder for the package B Versova–Dahisar coastal road costing $2 billion, the research firm said.

CLSA sees the company as an inexpensive play on high-growth urbanisation capex with a foothold in metro rail contracting and diversification to water and building domain.

The government is focusing on building decarbonisation and climate resistant infrastructure as a part of city decongestion capex, the research firm said in a Dec. 24 note. "We also roll-forward our valuation and see a rerating as the government delivers on urban capital expenditure."

The company is set for large order wins as India builds new-age climate resistant infrastructure.

The order inflow grew 16 times year-on-year in second-quarter of FY24 on receiving multiple large orders while its backlog grew 44% year-on-year, the research firm noted.

Company Targets To Double Top Line

The company has also benefitted from urbanisation capex to decongest cities and reduce vehicular pollution, according to CLSA. "We believe J. Kumar Infraprojects will be a key beneficiary of high-growth decarbonisation and urbanisation capex, given its expertise in metro rail and complex projects and its bidding discipline."

The management expects its top line to jump over twofold to $1 billion by FY27.

Growth Outlook

For FY25, the management has revised its revenue growth to 16-17% from 15% earlier on an expected top line of Rs 4,800 crore in FY24. The engineering firm also targets to widen its margin by 1 percentage point in the coming eight quarters, according to the earnings transcript of the company.

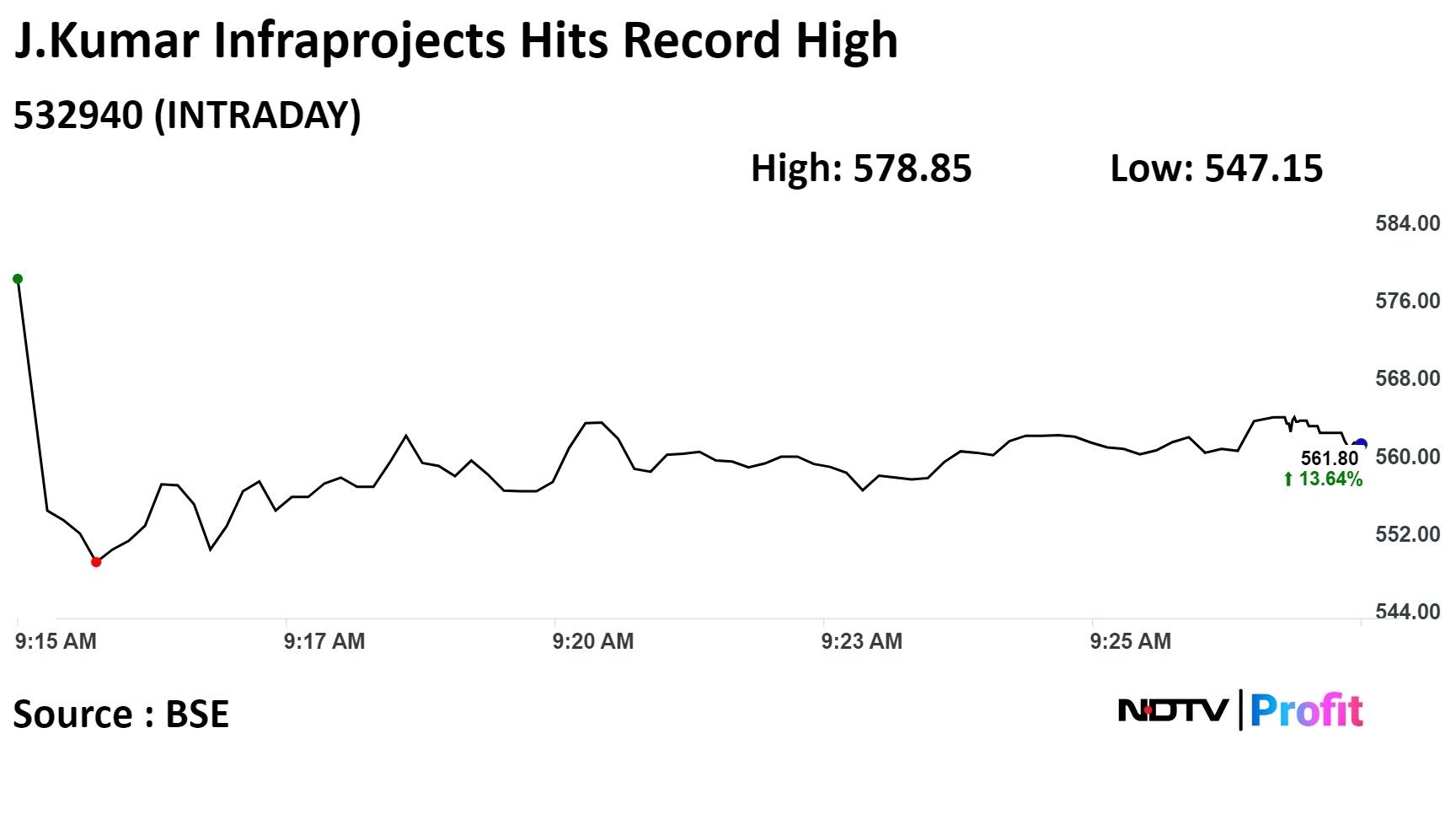

J. Kumar's stock rose as much as 15% during the day to Rs 568.80 apiece on the NSE. It was trading 13.02% higher at Rs 559 apiece compared to a 0.11% advance in the benchmark Nifty 50 as of 9:26 a.m.

The stock has risen 104.7% year-to-date. The total traded volume so far in the day stood at 25 times its 30-day average. The relative strength index stands at 78, indicating that stock may be overbought.

Five out of the six analysts tracking the company have a 'buy' rating on the stock and one recommends a 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a downside of 3.3%.

Risks include a delay in the pickup of the investment cycle, execution logjams, increasing receivable days and geographic concentration of the company, CLSA said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.