Jefferies has moved Paytm-operator One97 Communications Ltd. to 'not rated' from 'underperform', until the “news flow settles down”.

As the company is hit by regulatory action by the Reserve Bank of India, the brokerage decided not to rate the stock, it said in a Feb. 19 note.

"Factoring in the direct and indirect impact, we now see a 28% year-on-year decline in FY25 revenues that pushes the company into cash burns," the brokerage said.

Paytm's focus will now move to ensuring customer and merchant retention, and it will dip into its Rs 8,500 crore cash reserves for spends on retaining users, the note said.

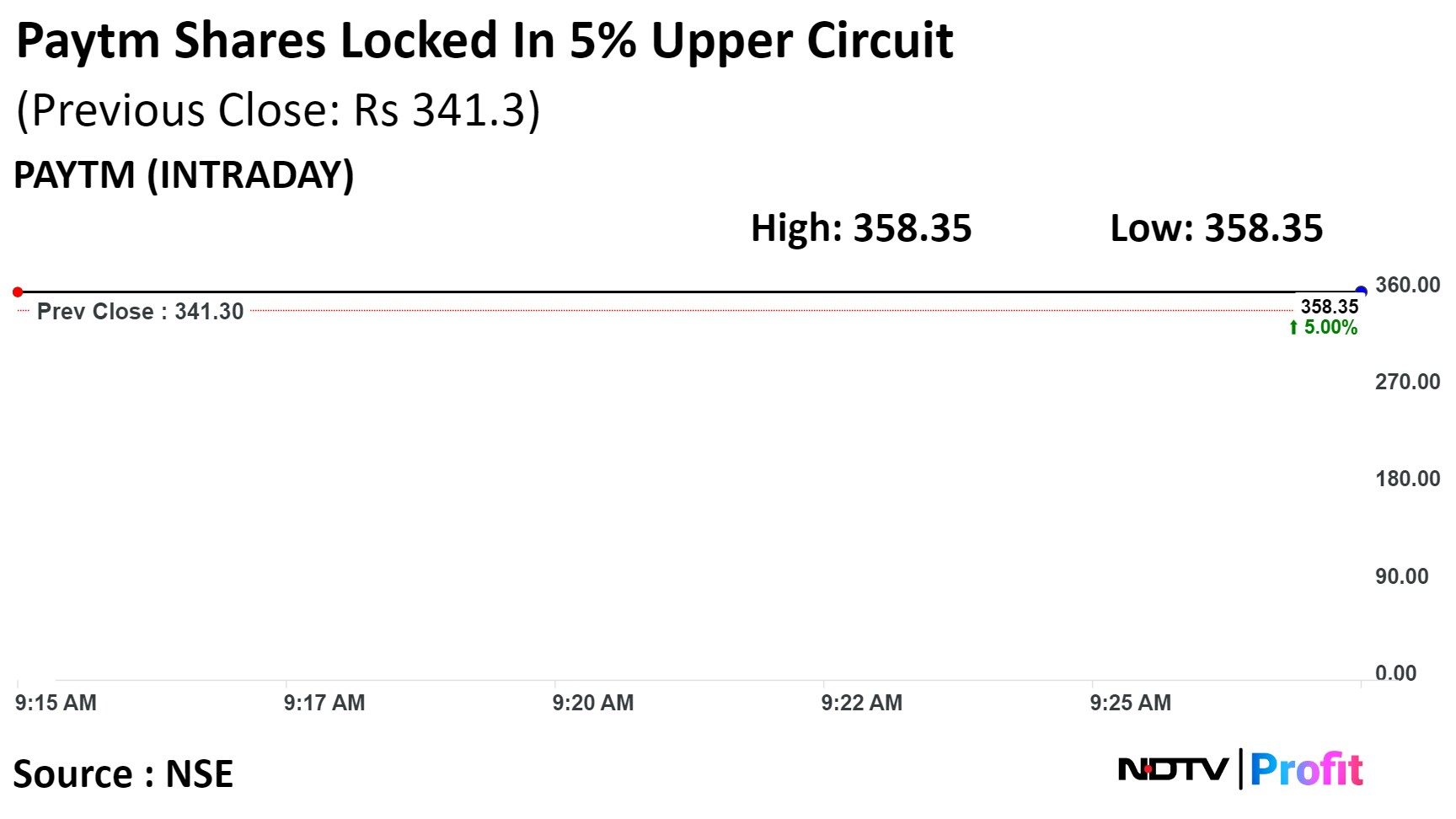

Shares of One 97 Communication Ltd. were locked in the upper circuit of 5% after the Reserve Bank of India extended the restriction deadline on Paytm Payments Bank.

Paytm has also shifted its nodal account to Axis Bank Ltd. With this, the Paytm QR, soundbox, and card machines will continue to work even beyond March 15, 2024. This should be positive, given an environment in which merchant/customer leakage is the largest concern for the parent entity.

There could be multiple scenarios for the business, depending on user and merchant retention, in the absence of an incremental regulatory clampdown, according to Jefferies.

On Friday, the central bank released the Frequently Asked Questions regarding bank accounts with Paytm Payments Bank.

Here is what brokerages have to say about the company.

Jefferies

Moved to 'not rated' from 'underpeform' until news flow settles.

RBI FAQ effectively winds down wallet business.

Clarity on non-Paytm Payments Bank Ltd (approximately 70-80%) is a positive.

Business model moving to a pure payments company.

Paytm likely to use its $1 billion of cash reserves for merchant and customer retention.

Bernstein

Has an 'outperform' rating with a target price of Rs 600 apiece.

It suggests the RBI's actions be limited to Payment Payments Bank.

RBI actions are not intended to disrupt the UPI and other functions of Paytm, it said.

Sees RBI's hint at merchants being able to use a Paytm QR code/soundbox or POS terminal as positive.

The extension of the cut-off date gives Paytm a longer window.

Citi

Citi maintained 'sell' on Paytm, with a target price of Rs 550 apiece.

Expects Paytm to announce more banking relationships.

Paytm to see an impact on app traffic and elevated user churn.

Sales fleet to be deployed for customer awareness.

The growth outlook on products will require a revisit, after which the impact will be assessed.

The company has made progress, and if approvals are received, the regulatory overhang could be lower than before.

Paytm stock rose as much as 5% during the day to hit the upper circuit of Rs 358.35 apiece on the NSE. This compares to a 0.19% advance in the benchmark Nifty 50 as of 9:25 a.m.

It has fallen 45.87% in the past 12 months. The relative strength index was at 26.

Six of the 14 analysts tracking the company have a 'buy' rating on the stock, five recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential downside of 45.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.