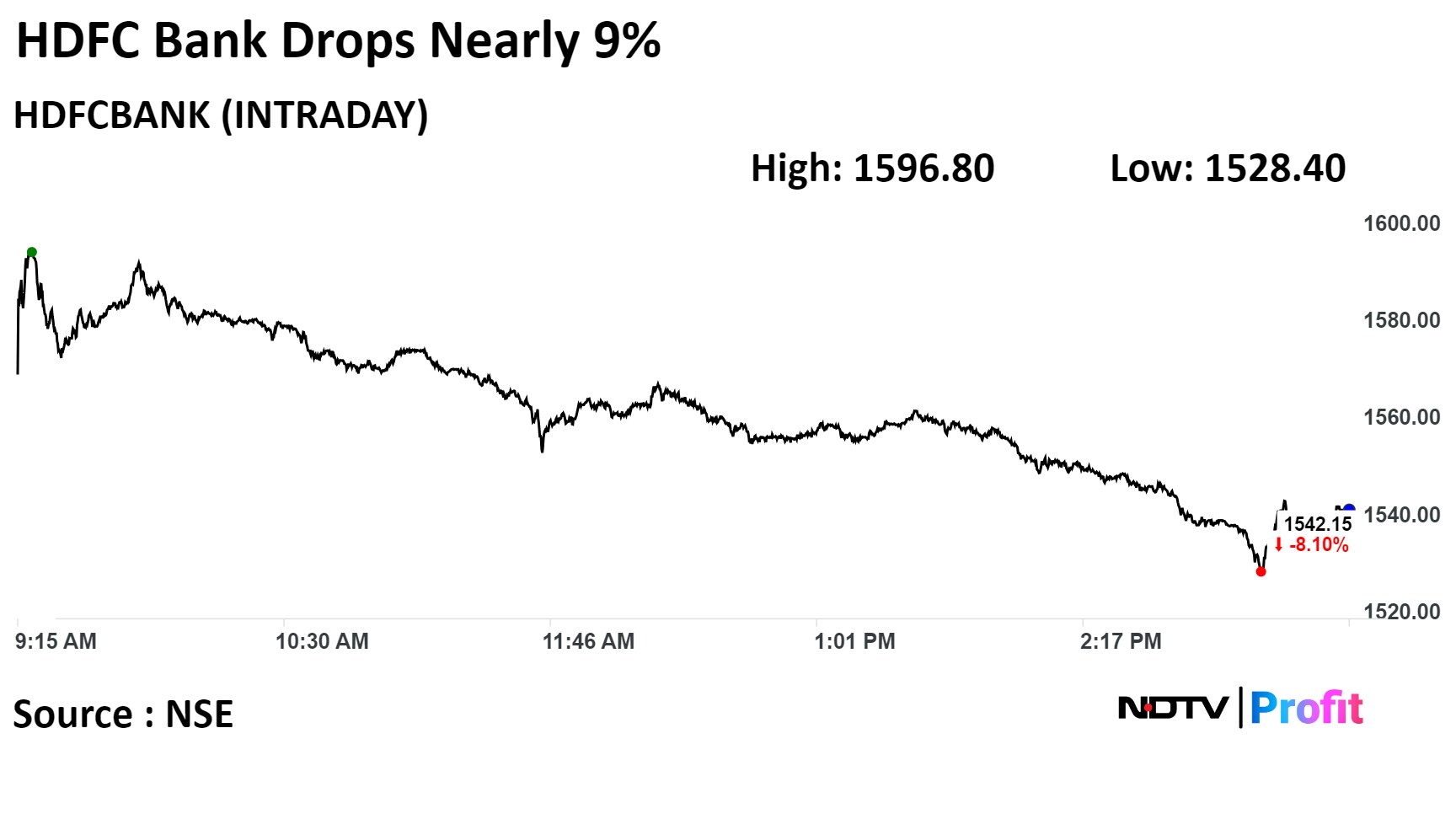

Shares of HDFC Bank Ltd. slumped nearly 9% on Wednesday, the most since March 23, 2020, after its third-quarter net interest margin missed analysts' estimates.

The plunge wiped off Rs 92,984 crore from investor wealth represented by the lender's market capitalisation. It also triggered a slide in financial services stocks, dragging down benchmark indices. The impending derivates expiry also added to the market-wide selloff.

The Sensex dropped 2.25%, the most since Aug. 30, 2022. Similarly, the Nifty sank 2.15%, the biggest drop Jan. 27, 2023. HDFC Bank has the highest weight of 13.52% on Nifty 50 and financial services stocks account for 35.26% of the index.

The Nifty Bank fell as much as 4.46%, the most since March 7, 2022, with HDFC Bank, Kotak Mahindra Bank Ltd. and IDFC First Bank Ltd. dragging the index the most.

HDFC bank's net profit rose 2.5% sequentially to Rs 16,373 crore in the quarter ended December, according to an exchange filing. Analysts polled by Bloomberg estimated a net profit of Rs 15,763 crore for the quarter.

The private lender had to sell government securities to maintain its margin in the third quarter, lowering its liquidity coverage ratio, brokerages said.

Citigroup cut the target price on the lender to Rs 2,050 apiece from Rs 2,100 per share, saying that having maxed out liquidity coverage ratio, “visibility fades on growth” as well as on net interest margin.

HDFC Bank Q3 Highlights (QoQ)

Net profit: Rs 16,373 crore vs Rs 15,976 crore.

Net interest income: Rs 28,471 crore vs Rs 27,385 crore.

Gross NPA: 1.26% vs 1.34%.

Net NPA: 0.31% vs 0.35%.

Capital adequacy ratio: 18.39% vs 19.54%.

The bank disappointed on both the metrics that mattered--loan-to-deposit ratio and net interest margin change, Bernstein Research said in a note.

Core net interest margin for the bank stood at 3.4% as of Dec. 31, and at 3.6% on an interest earning assets basis. Macquarie capital said HDFC Bank's profit beat was helped by lower taxes.

Adding to this, the net profit of the private lender was weighed by higher provisions, which rose sharply due to the one-off impact of provisions on investments in alternative investment funds.

Provisions rose 50% year-on-year to Rs 4,216.6 crore in the reporting quarter. The provision number for the quarter is inclusive of contingent provisions worth Rs 1,212 crore.

Shares of the bank fell as much as 8.89% and closed 8.2% lower at Rs 1,542 apiece. It has fallen 4.28% in the last 12 months.

Out of 50 analysts tracking the company, 44 maintain a 'buy' rating and six recommend a 'hold', according to Bloomberg data. The average of 12-month analyst price target implies a downside 3.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.