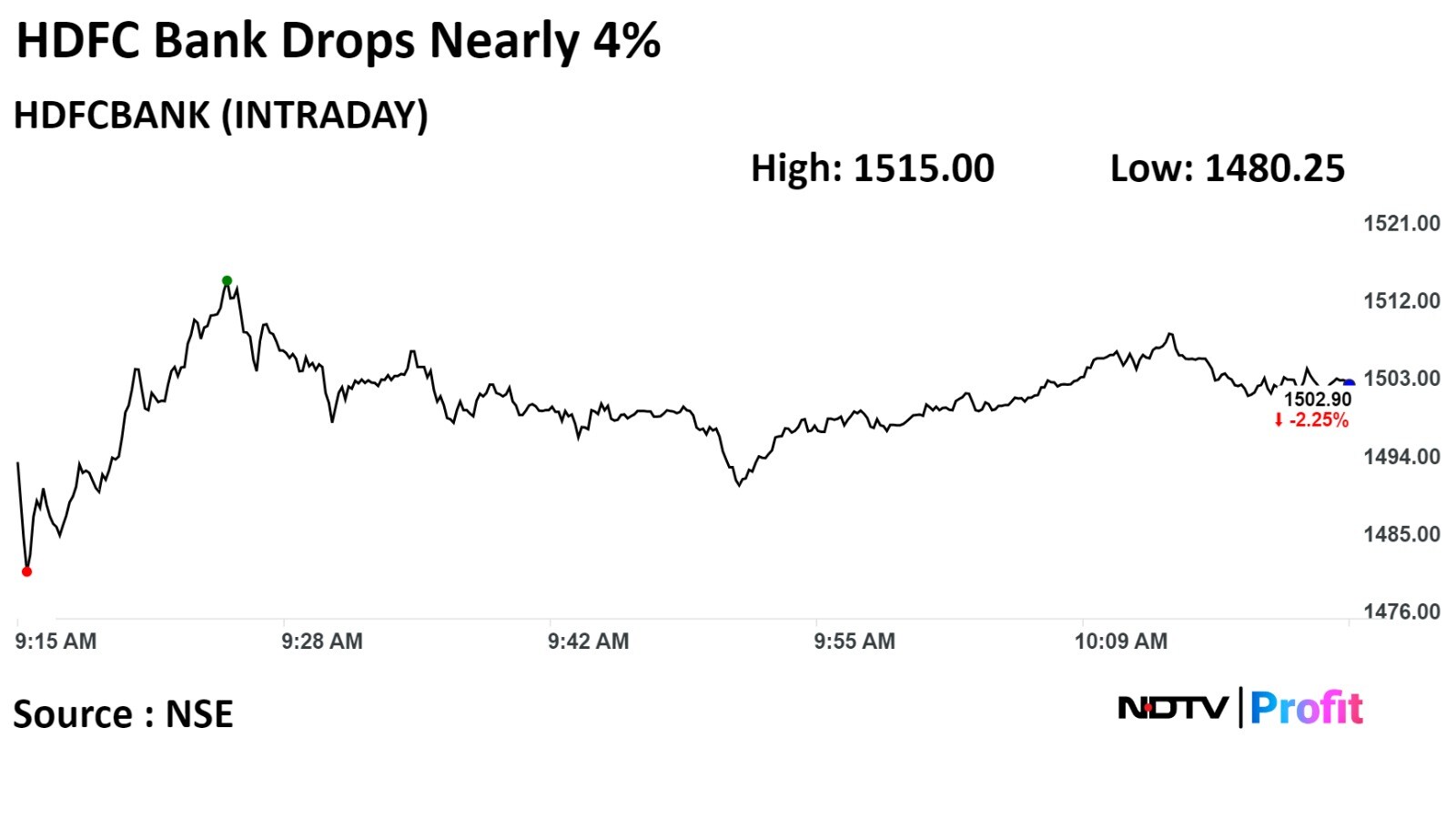

Shares of HDFC Bank Ltd. extended losses to fall nearly 4% on Thursday after its third-quarter net interest margin missed analysts' estimates.

The plunge wiped off Rs 38,987 crore of investor wealth, as represented by the lender's market capitalisation. It also triggered a slide in financial services stocks, dragging down the benchmark indices.

During the day, the Nifty Bank fell as much as 1.38%, with HDFC Bank, Punjab National Bank and the Federal Bank Ltd. dragging the index the most.

Here's What Brokerages Say

Bernstein Research

The biggest concern is on the drivers for the NIM surprise and the weaker deposit growth. and the lack of a clear pathway to normalisation, it said in a Jan. 17 note. It is unclear if the NIM surprise was a result of a system-wide increase in cost of funds or a consequence of choosing expensive liability sources that were required to optimise other parameters.

Earnings Growth Risk: A continued weak deposit growth can limit loan growth and/or eat into margins, leading to a potential decline in earnings growth in FY25 and FY26.

Less of a self-help story: Overall, the improvement in operating metrics of the bank now appears to be more dependent on the operating environment rather than an automatic even if a gradual improvement story.

Investment Implications: Bernstein remains confident of the bank's ability to eventually see an improvement in its operating metrics. However, the latest quarterly numbers increase the uncertainty on the time needed for this improvement. The research firm maintains 'outperform' rating with a target price of Rs 2,200, implying an upside of 43%.

Jefferies

The research firm maintains a 'buy' call with a target price of Rs 2,000 and $79 on ADR.

After the disappointing third-quarter results, Jefferies had trimmed earnings estimates for loan growth and the NIMs for the bank for FY25–26.

"Still, we factor a decent 16% YoY growth in loans for FY25 (implying 3.8% quarterly rise), 17% rise in deposits and 10 bps YoY expansion in NIMs (starting Q1 FY25)," it said in a Jan. 17 note.

The tailwinds are from uptick in retail/personal loan growth & rise in share of deposits over high-cost bonds (refinancing of old and incremental shift). Ramp-up of deposits from new branches can aid deposit growth.

The headwinds can arise from continued slower mobilisation of deposits, need to lower LDR and early impact of rate cuts.

Compounding of stock price & valuation re-rating will depend on improving growth in core EPS (reported EPS was down 2% YoY in Q3 and core EPS was down 12% YoY).

"We see EPS picking up from Q1 FY25."

The bank's stock fell as much as 3.74% during the day to Rs 1,480.05 apiece on the NSE. It was closed at 3.34 % lower at Rs 1,486.15 apiece, compared to a 0.51% decline in the benchmark Nifty 50.

Forty-four out of 50 analysts tracking the company have a 'buy' rating on the stock and six recommend 'hold', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 30.5%.

The U.S.-listed shares of HDFC Bank extended losses by plunging another 9% on Wednesday. The American Depository Receipts of the bank fell as much as 9.38% to $55.44—the most since April 3, 2020.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.