HCL Technologies Ltd. will gain access to the top 20 global telecom service providers, along with IP assets, engineering, and research and development talent through acquisition of certain businesses of Communication Technology Group, a unit of Hewlett Packard Enterprise.

The acquisition for a cash consideration of Rs 22.5 crore is large and strategic, considering HCLTech's focus on organic growth, according to Morgan Stanley. But the financial impact of the acquisition is not significant.

HPE will retain part of the former Communication Technology Group business, focused on operations support systems. The transaction will complete in six to nine months. HCLTech will take over the services portfolio around business support systems of the Communication Technology Group, the brokerage said.

The acquisition will increase HCLTech's access to Japan—the largest revenue pool—and Europe, Nomura said. It will also complement the company's managed network services offering in the existing telecom verticals.

Revenue from the acquisition is likely to contribute 2% to the total revenue, Morgan Stanley estimates. While, Nomura refrained from giving any estimates, as HCLTech is yet to give exact revenue contribution.

Brokerages' Views

Morgan Stanley

Morgan Stanley maintained an 'overweight' rating on HCLTech with a price target Rs 1,650 per share.

The overall impact of acquisition is less on the company's financials.

Through this acquisition, HCLTech will get certain IP assets, engineering, and R&D talent across multiple geographies.

The acquisition will also give client relationships with top global communication service providers.

The acquisition will complement its existing portfolio of engineering services around internet of things in the telecom verticals.

Morgan Stanley estimates annual revenue from this asset could be ranging between Rs 27.5 crore and Rs 35 crore. This will add 2% revenue growth, while diluting margins 30–40 bps and EPS by 1% for FY26.

Risks to upside:

Sharp rupee depreciation.

Better-than-expected macro environment and acceleration in deal win momentum.

Better-than-expected margins.

Risks to downside

Escalations in geopolitical environment and inflation risks hampering global macro environment.

Lower-than-expected outcome on revenue guidance.

Weakish commentary on deal wins in the coming quarters.

Nomura

Nomura also retained its 'neutral' rating on HCLTech with a price target Rs 1,400 apiece.

HPE's acquisition does not form a part of HCLTech's guidance for FY25. The company is yet to reveal the exact contribution to the revenue from acquisition.

Acquisition will provide HCLTech access to top 20 out of 30 largest telecom service providers across the globe.

The company will take over 1,500 employees, 700 contracts of Communications Technology Group, with telecom industry experience in Spain, Italy, India, Japan, and China.

HPE will increase HCLTech's access to Japan, the largest revenue pool, and Europe.

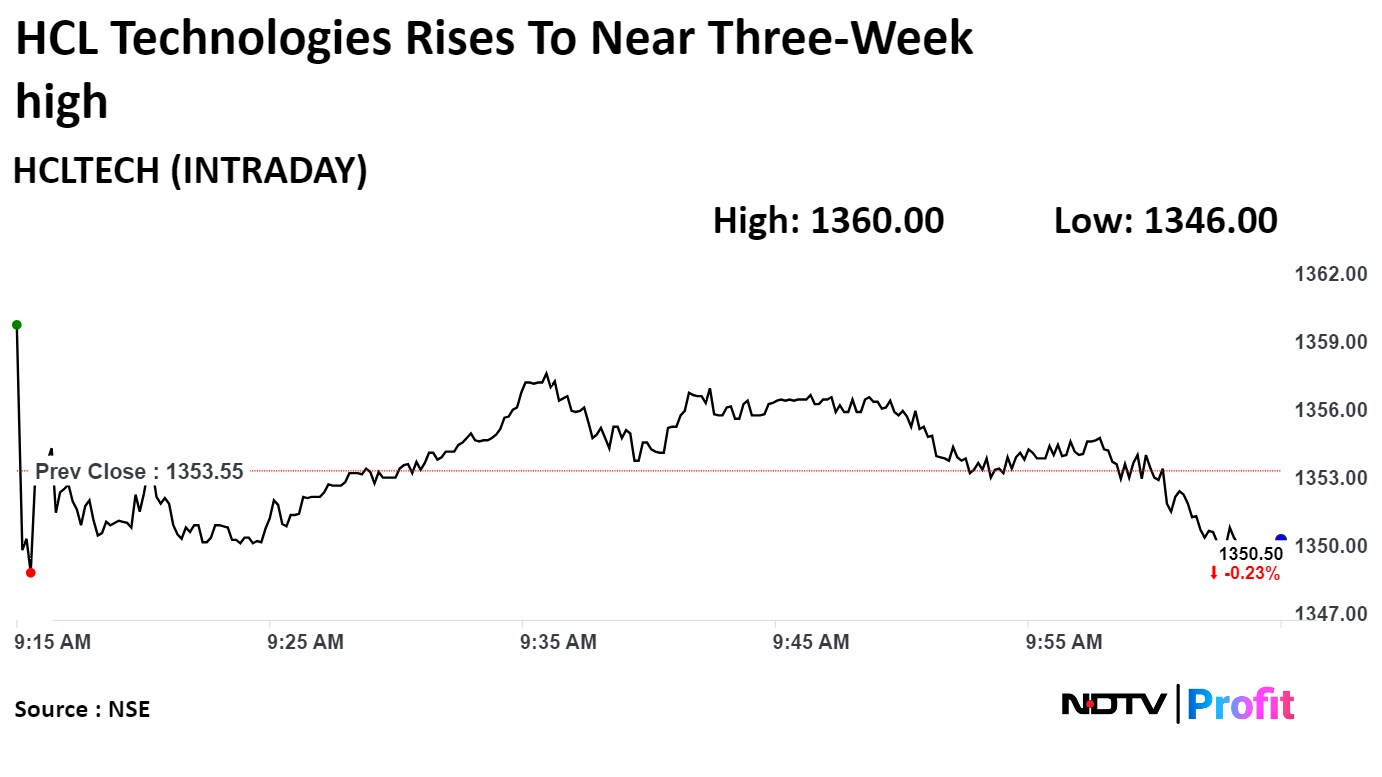

Shares of HCLTech rose 0.48 to the highest level since May 6, before erasing gains to trade 0.11% lower at 10:01 a.m. This compares to a 0.10% decline in the NSE Nifty 50.

The stock has fallen 7.85% on a year-to-date basis but risen 17.9% in the last 12 months. Total traded volume so far in the day stood at 0.09 times its 30-day average. The relative strength index was at 38.89.

Of the 43 analysts tracking the company, 21 have a 'buy' rating, 15 recommend a 'hold' and seven suggest 'sell', according to Bloomberg data. The average 12-month analysts' price target implies an upside of 12.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.