UBS raised Hindustan Aeronautics Ltd.'s target price, anticipating that the company's order book will quadruple by fiscal 2028, leading to a 50% increase in manufacturing revenue amid a government push for domestic manufacturing to reduce imports.

The brokerage maintained a 'buy' rating on the stock and raised the target price to Rs 5,200 apiece from Rs 3,600 apiece, implying an upside of 25% from Monday's closing price.

UBS projects that HAL will benefit significantly from order wins worth Rs 5.3 lakh crore between FY24 and FY28 as the government aims to expand internal production. UBS expects order wins of Rs 6.5 lakh crore in the upside scenario and Rs 3.8 lakh crore in the downside scenario.

India's defence ecosystem is structurally expanding with defence corridors, increased private sector participation, and technology transfer instead of foreign-based contract manufacturing, according to UBS.

The brokerage highlights HAL as having the highest order book accretion due to its 40% share of current defence programs, driven by strong pipelines of combat aircraft, light combat helicopters, and utility helicopters.

"Almost 25% of HAL's long-term order pipeline is on a fast track with high visibility," UBS noted.

Improvements in the domestic supply chain are expected to enhance HAL's execution capability and profitability, supported by the defence equipment manufacturer's timely capital expenditure, as per UBS's note on Monday.

HAL's share in domestic defence capital expenditure is set to increase over the next three to five years as the Ministry of Defence implements a strategic plan to expand the fleets of fighter planes and combat helicopters.

Over the past five years, the company has achieved 8.5% topline growth in defence manufacturing. Now, UBS estimates that HAL will add more than Rs 0.7 lakh crore to the topline over FY24–28, representing 8.8% of defence manufacturing in the country.

Key Takeaways From UBS's Note On HAL

UBS maintained a 'buy' on HAL and raised the price target to Rs 5,300 apiece from Rs 3,600 apiece earlier, implying a 25% upside from Monday's closing price.

Orders and delivery run rates are expected to increase with stable profitability, UBS said.

The brokerage expects order wins of Rs 5.3 lakh crore over FY24–28, which indicates a quadrupling of the order book by FY28.

The government's push should improve HAL's execution capability and profitability.

Street's concern about the production ramp-up looks misplaced.

The target price increase was led by earnings upgrades, roll forward and an increased target PE from 32x to 40x.

Threats:

Private sector collaboration with international OEMs may represent a competition risk to HAL.

Any shift in business from nominations to competitive bids could pose challenges to HAL.

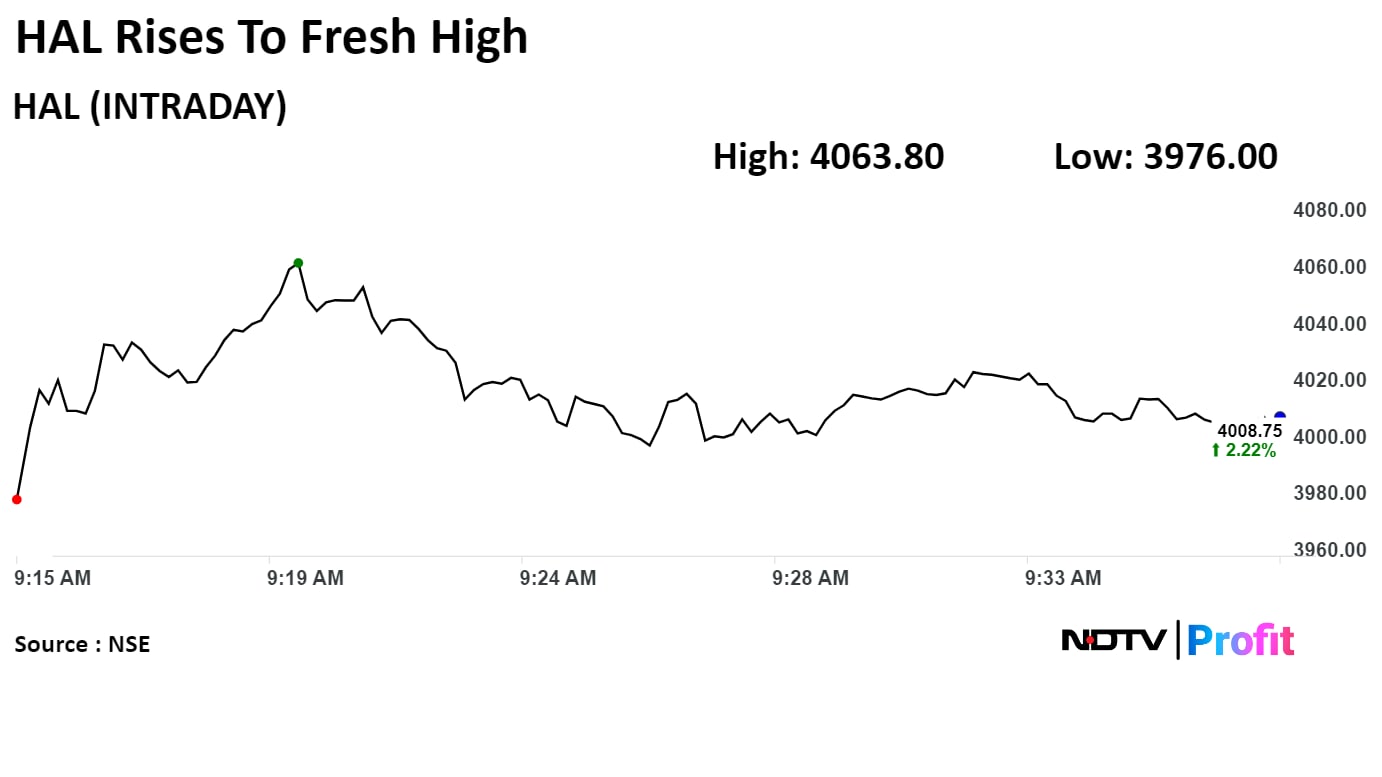

Shares of the company rose as much as 3.62% to Rs 4,063.80, the highest level since March 28, 2018. It was trading 2.28% higher at Rs 4,011.5 as of 9:36 a.m., compared to 0.11% advance in the NSE Nifty 50 index.

The stock gained 165.98% in 12 months and 42.94% on year-to-date basis. Total traded volume so far in the day stood at 3.6 times its 30-day average. The relative strength index was at 66.51.

Out of 16 analysts tracking the company, 14 maintain a 'buy' rating, one recommends a 'hold,' and one suggests a 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 4.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.