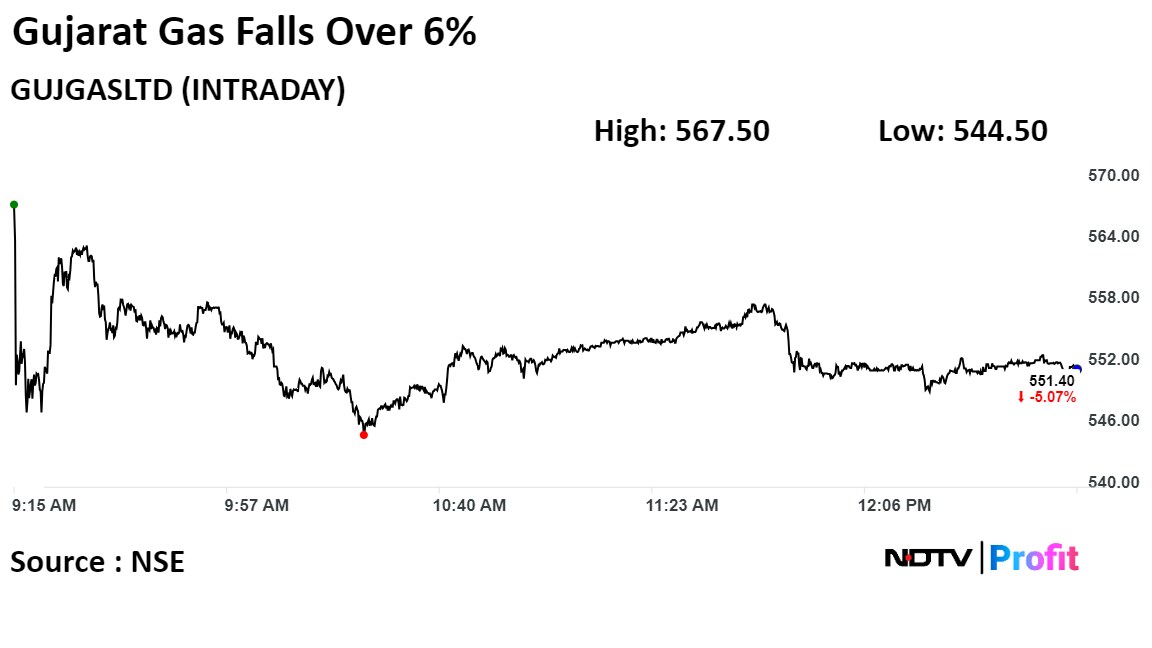

Shares of Gujarat Gas Ltd. dropped over 6% on Friday after some brokerages downgraded the stock following a 41% decline in its net profit in the third quarter.

Brokerages Emkay Global Financial Services Ltd. and Nomura Holdings Inc. downgraded the stock while Jefferies Financial Group Inc. maintained their 'underperform' rating. They see uncertain Morbi volumes as an area of concern.

Meanwhile, Morgan Stanley is cautiously optimistic and maintains an overweight rating. It expects the demand for compressed natural gas to grow at 15–20% year-on-year.

Gujarat Gas Q3 Earnings Highlights (Consolidated, YoY)

Revenue up 6.9% at 3,929.1 crore vs Rs 3,684.3 crore.

Ebitda down 31% at Rs 400.7 crore vs Rs 582.3 crore.

Margin narrows to 10.19% vs 15.8%.

Net profit down 41% at Rs 221 crore vs Rs 371.57 crore.

Here's What Brokerages Say

Jefferies

The brokerage sees Gujarat Gas as operationally weak, but it doesn't think that it can gain back Morbi market share.

The earnings outlook for the fourth quarter is strong but the volume growth guidance for the next financial year is a dampener.

The brokerage has maintained its 'underperform' rating but revised its target price to Rs 470 from the earlier Rs 385, implying a potential downside of 19%

"We note infrastructure bottlenecks have stymied growth in the non-Morbi industrial segment."

The feedstock cost relief price is boosting the company's next quarter's outlook, but the management is looking to defend the PATR instead of maximising volume growth.

The brokerage also tweaked its earnings estimates by 5% upside and a downside of 2% over the current and the next fiscals respectively.

Favourable policy for EV adoption will impact the CNG demand over the medium term, but Gujarat Gas has less than 70% demand from the industrial segment.

"While the ban on coal gasifiers in Morbi is already reflected in the numbers, incremental tile demand from the US could push Morbi volumes above our estimate."

Lower spot prices for liquefied natural gas, higher propane prices limiting switching and higher demand for ceramic in India and exports are some of the key upside risks.

Morgan Stanley

"We continue to remain positive on Gujarat Gas despite the cautious tone as it remains the best play on global gas glut."

The demand has been capped due to destocking in the pharma sector and ceramic consumer exports amid the Red Sea turmoil.

The LNG and alternative fuel prices are in line with ceramic consumers and the management is looking to reach 8–10% volume growth with around 50% growth from industrial demand.

The CNG demand will grow at 15–20% year-on-year as Gujarat Gas has added 200 new stations over next two years.

Morgan Stanley also sees an upside to volumes as spot prices are getting more competitive.

Increased oil-gas differential, favourable global gas prices and higher-than-expected demand growth in new geographies are a few risks to the upside.

The downside risks include lower oil and propane prices, delays in the start of new areas of distribution and the entry of new players.

Nomura

Nomura downgrades Gujarat Gas to 'reduce' due to a weak quarter with an increased target price of Rs 505 from Rs 460.

Gujarat Gas "is one of the most expensive gas utilities, while the outlook isn't rosy".

The results were poor due to lower sales volumes and gross margin.

The net income had also dipped due to lower income and lower interest rates.

The upside risks include sharper-than-anticipated increase in volumes, higher-than-expected margin, a sharp decline in spot/long-term LNG prices and sharper-than-expected increase in Saudi propane prices.

Industrial PNG volume declined 6% quarter-on-quarter and was 35% higher year-on-year on a low base, with Morbi volumes declining 7% QoQ despite natural gas prices being in line with propane.

Emkay

The brokerage downgrades Gujarat Gas to 'sell' from reduce with target price of Rs 440, implying a 24.3% downside.

The decline is due to uncertain Morbi volume outlook and volatile margin profile.

Currently, Morbi volumes stood at 3.7 million standard cubic metres per day against an overall potential of 8–8.5 mscmd.

Emkay has cut the earnings estimates for fiscal 2024–26 by 1–3% each.

Gujarat Gas' stock fell as much as 6.34% during the day to Rs 544 apiece on the NSE. It was trading 5.86% lower at Rs 546.80 per share, compared to a 0.65% advance in the benchmark Nifty 50 at 1:39 p.m.

The share price has risen 9.08% in the last 12 months. The total traded volume so far in the day stood at 3.45 times its 30-day average. The relative strength index was at 48.14.

Fifteen out of the 32 analysts tracking Gujarat Gas have a 'buy' rating on the stock, three recommend 'hold' and 14 suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 15.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.