Shares of Container Corporation of India Ltd. fell nearly 5% on Monday after Kotak Securities said it expected the company to keep losing rail market share even as its pricing is higher than peers.

Kotak Securities has a "sell" recommendation on the stock with a target price of Rs 740, indicating a 29% decline from the previous closing price. The brokerage said that it anticipates the company to keep losing rail market share and that its pricing is higher than that of its competitors.

Container Corp.'s pricing is 5% higher than peers like Gateway Distriparks Ltd. due to a 7% land lease factor against a nil land license fee advantage, potentially affecting competitiveness, the homegrown brokerage firm said.

Kotak Securities also warned that Container Corp.'s deferral in stake divestment may lower interest for certain bidders due to the Railway Ministry's potential deferral beyond fiscal 2025, making the company less attractive.

Seaprately, Nomura highlighted the impact of rising freight rates in Asia, which add to pipeline price pressures and higher costs, leading to a faster pickup in PPI inflation and exerting pressure on profit margins.

The World Container Index composite freight index has increased by over 240% year-on-year as of June 20, driven by tight capacity, strong demand, and the front-loading of shipments, Nomura noted.

The brokerage firm expects these tight supply-demand conditions to persist into 2024, further escalating shipping costs and contributing to import price inflation. While some firms might absorb the increased costs, this would ultimately squeeze profit margins.

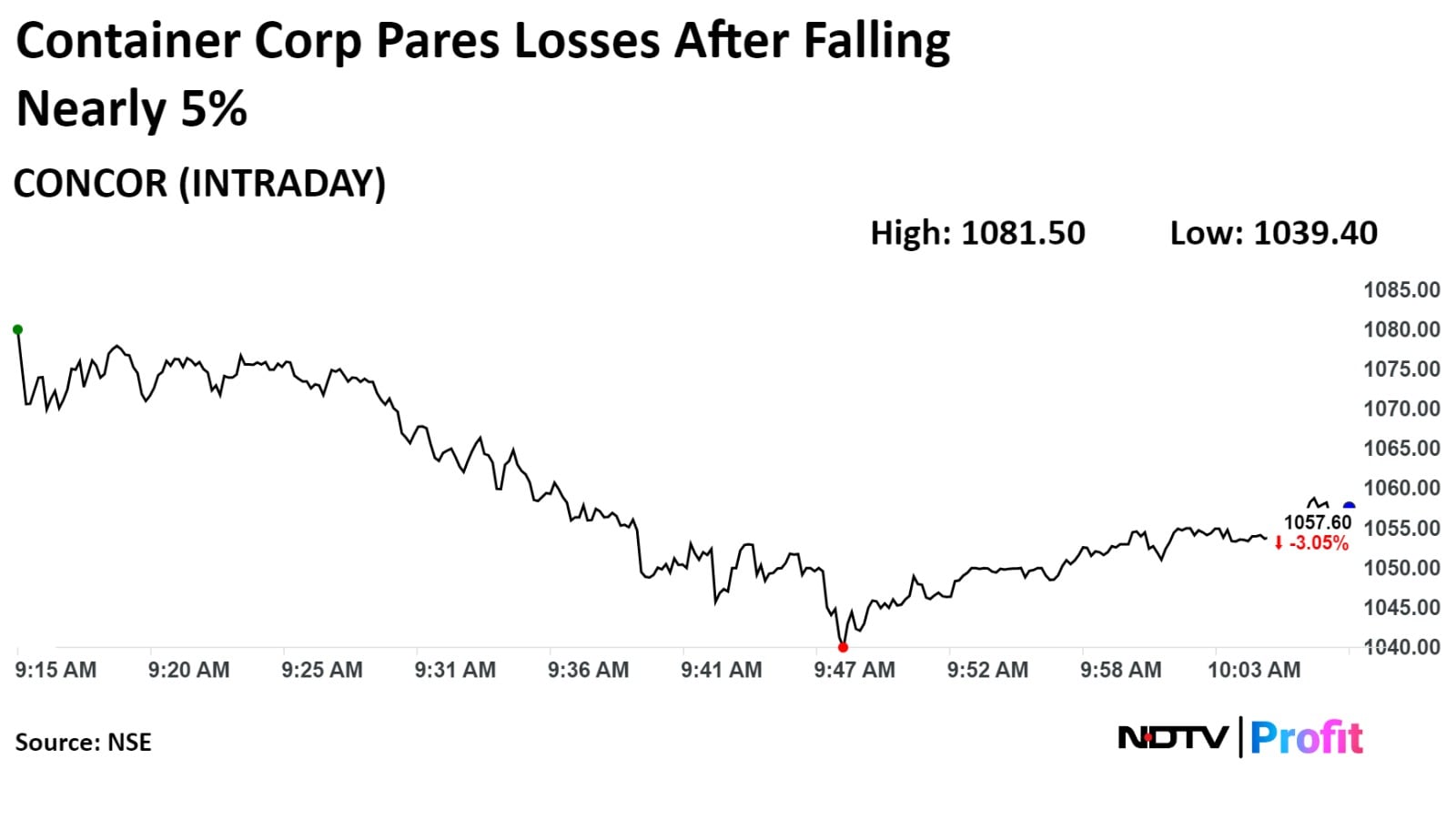

Shares of Container Corporation fell as much as 4.72% during the day to Rs 1039.40 apiece on the NSE. It was trading 3.2% lower at Rs 1,056.10 apiece, compared to a 0.1% gains in the benchmark NSE Nifty 50 as of 12:06 p.m.

The stock has risen 63.96% in the last 12 months. The total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 47.92.

Twelve out of the 28 analysts tracking Container Corporation of India have a 'buy' rating on the stock, 11 recommend a 'hold' and five suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 0.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.