Zydus Lifesciences Ltd. has partnered with Lucknow-based CSIR-Central Drug Research Institute to develop a new treatment for osteoporosis induced by chronic kidney disease. The collaborative research agreement was inked between the parties to develop oral medication through the discovery of small molecule inhibitors of Sclerostin, as per an exchange filing on Friday.

Chronic kidney disease, which affects over 10% of the global population, leads to a gradual decline in kidney function and can result in kidney failure.

Under this agreement, CDRI and Zydus will jointly undertake preclinical research. Any drug candidate emerging from the efforts will be developed by Zydus for India and other markets. The partnership was formalised on Sept. 17 at Zydus Research Centre in Ahmedabad.

"CSIR-CDRI's deep-rooted expertise in biomedical research, coupled with Zydus' innovative approach to drug discovery and development, creates a powerful synergy," said Zydus Lifesciences Chairman Pankaj Patel.

This collaboration aims to explore new treatments for bone metabolism disorders and improve the quality of life for CKD patients through affordable and effective therapies.

"The complementary expertise and capabilities of the two organisations, combined with a shared mission to address India's unmet needs through innovative therapies, has made this collaboration possible," CSIR-CDRI Director Radha Rangarajan said.

Rangarajan further highlighted the role of public-private partnerships in advancing drug research and development in India.

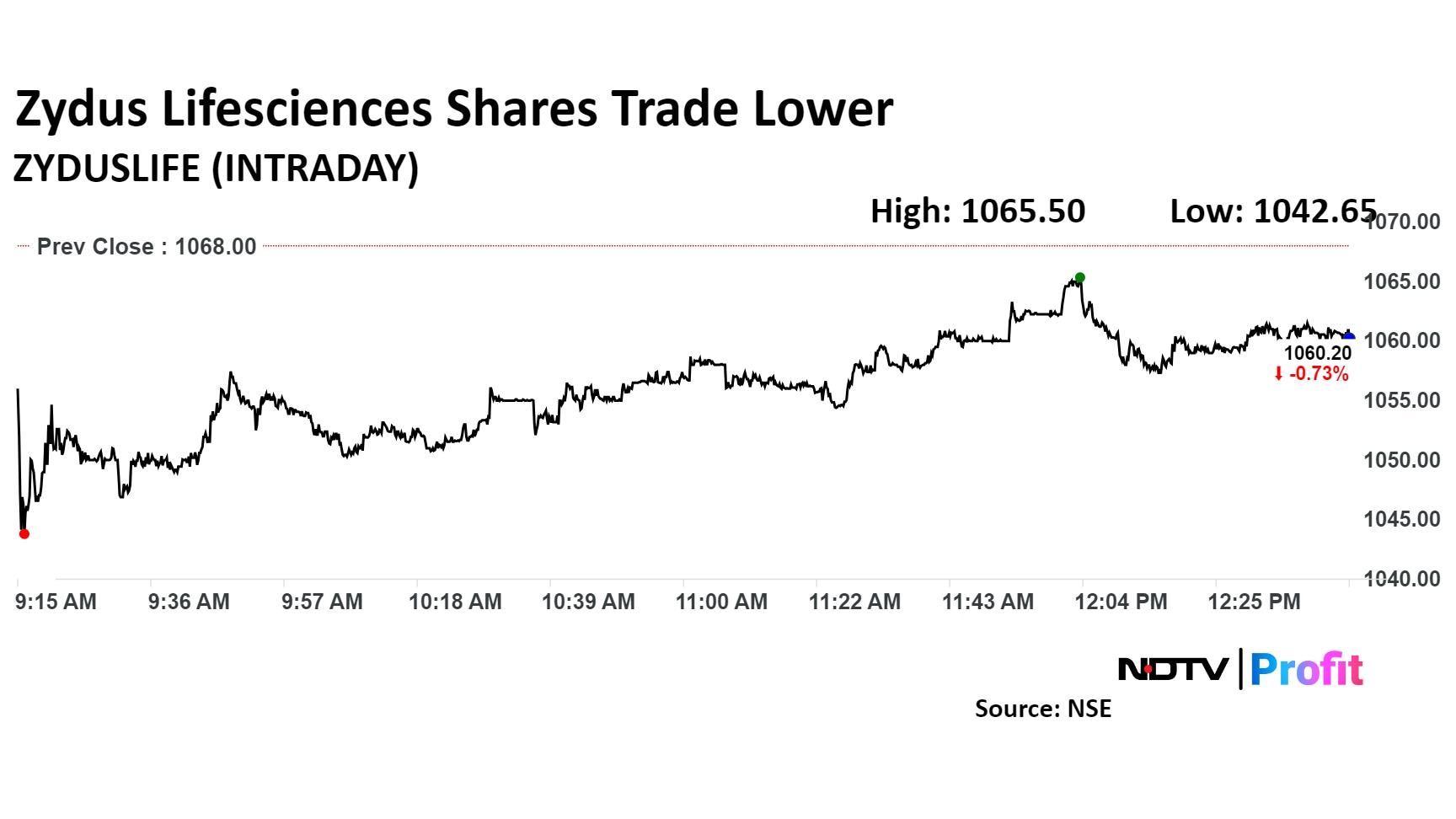

Shares of Zydus Lifesciences were trading 0.64% lower at Rs 1,061.51 apiece, compared to 0.40% advance at benchmark NSE Nifty 50 as of 12:44 p.m.

It has risen 75.25% in the last 12 months and 53.90% year-to-date. The total traded volume so far in the day stood at 1.37 times its 30-day average. The relative strength index was at 41.93.

13 out of the 33 analysts tracking the company have a 'buy' rating on the stock, 10 recommend a 'hold' and 10 suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 13%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.