Nithin Kamath, the founder of Zerodha Broking Ltd., shared a post on 'X' (formerly known as Twitter) opining on the ideal health insurance plan for the average Indian using data points from Insurance Regulatory and Development Authority and the insurance company 'Ditto Insurance' .

Source: Nithin Kamath's 'X' Account (Formerly Known As Twitter)

"Most Indians are just 1 hospitalisation away from bankruptcy. A good health insurance plan is mandatory," Kamath wrote in his post.

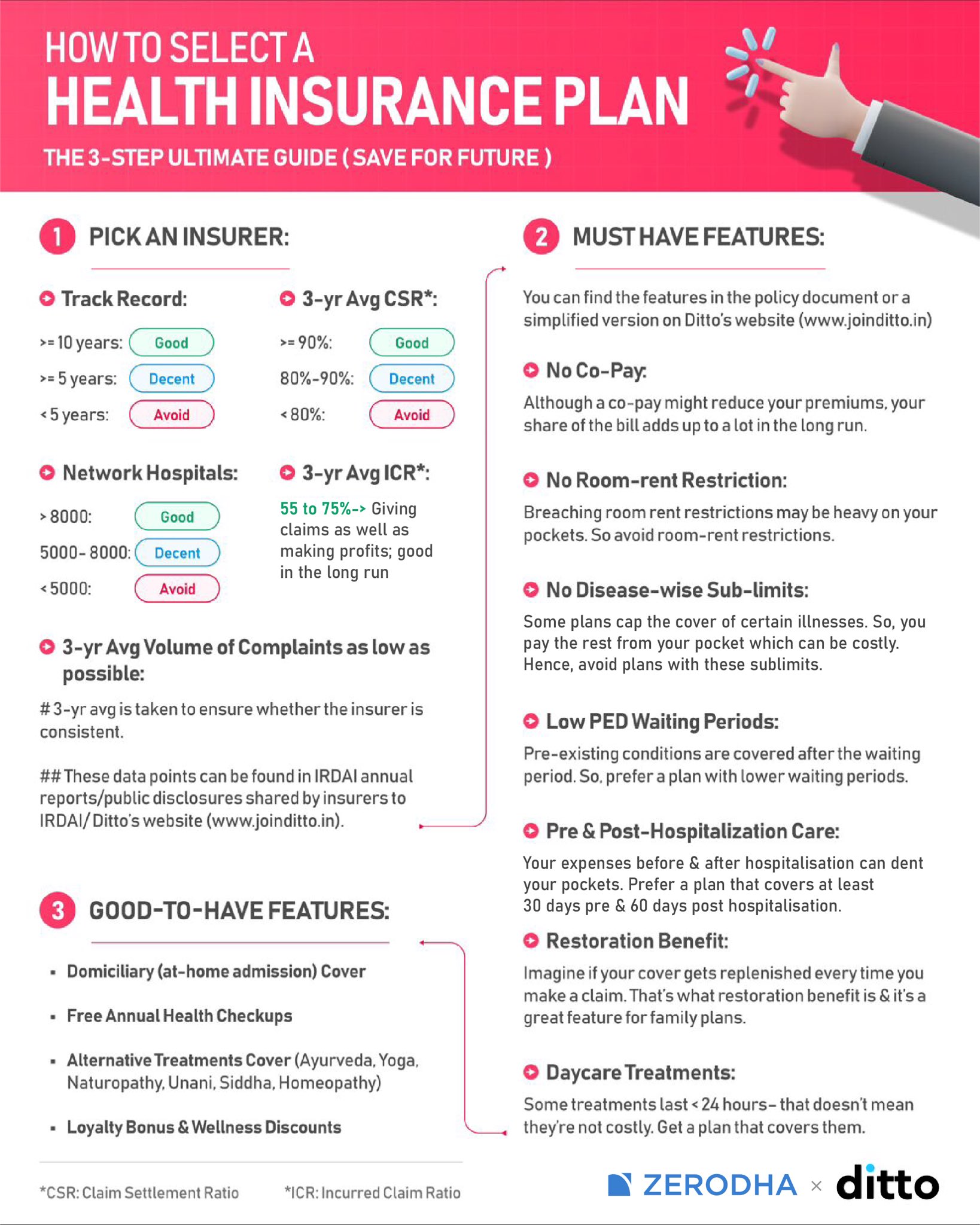

Kamath recommends picking an insurer with a track record of atleast five to 10 years, with five years being desirable and 10 being optimal.

He also recommends that their three-year average claim settlement ratio percentage should be within the range of 80-90%.

He recommends picking an insurer with 5,000-8,000 network hospitals. Kamath also suggests picking an insurer with an incurred claim ratio of 55-75%, stating that an insurer which can settle claims and make profit is good in the long run.

He also advises Indians to make sure that their insurer has their three-year average volume of complaints as low as possible to maintain quality control.

Most Indians are just 1 hospitalisation away from bankruptcy. A good health insurance plan is mandatory. pic.twitter.com/9GzKpT6EE9

August 30, 2024In his list of 'must-have' features for insurance policies he recommends not going for the co-pay feature as this may increase one's share of the bill by a lot in the long run, despite reducing premiums.

He also suggests not having a policy with room-rent restrictions as breaching these can be costly.

He also recommends avoiding policies with disease-wise sub limits that cap the coverage of certain illlnesses making the customer pay out of their pockets

He also advices picking a plan with low waiting periods for pre-existing conditions, restoration benefits and daycare treatments and pre and post hospitalisation care that covers atleast 30-days pre and 60-days post hospitalisation.

Other features he recommends having are domiciliary cover (at home care), free annual health checkups and loyalty bonus and wellnes discounts along with coverage for alternative medicine.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.