There is value in Binani Cement Ltd.'s assets for UltraTech Cement Ltd. even after the billionaire Kumar Mangalam Birla-led company topped Dalmia Bharat-led consortium's offer.

At least that's what brokerages and experts suggest. UltraTech decided to increase its offer to more than Rs 7,200 crore compared with Dalmia-Piramal Group and Bain's combined bid of Rs 6,350 crore. It's still not clear if the revised bid will be accepted or not.

The Dalmia-led bid is yet to receive approval from the Committee of Creditors, UltraTech Chief Financial Officer Atul Daga had told BloombergQuint. The company filed a petition in the National Company Law Tribunal to review the process. Dalmia Bharat was yet to respond to BloombergQuint's emailed queries.

Binani Cement was put on the block by the National Company Law Tribunal after lenders initiated insolvency proceedings. It owed banks Rs 3,608 crore as of March 2017.

Is The Revised Bid Too Aggressive?

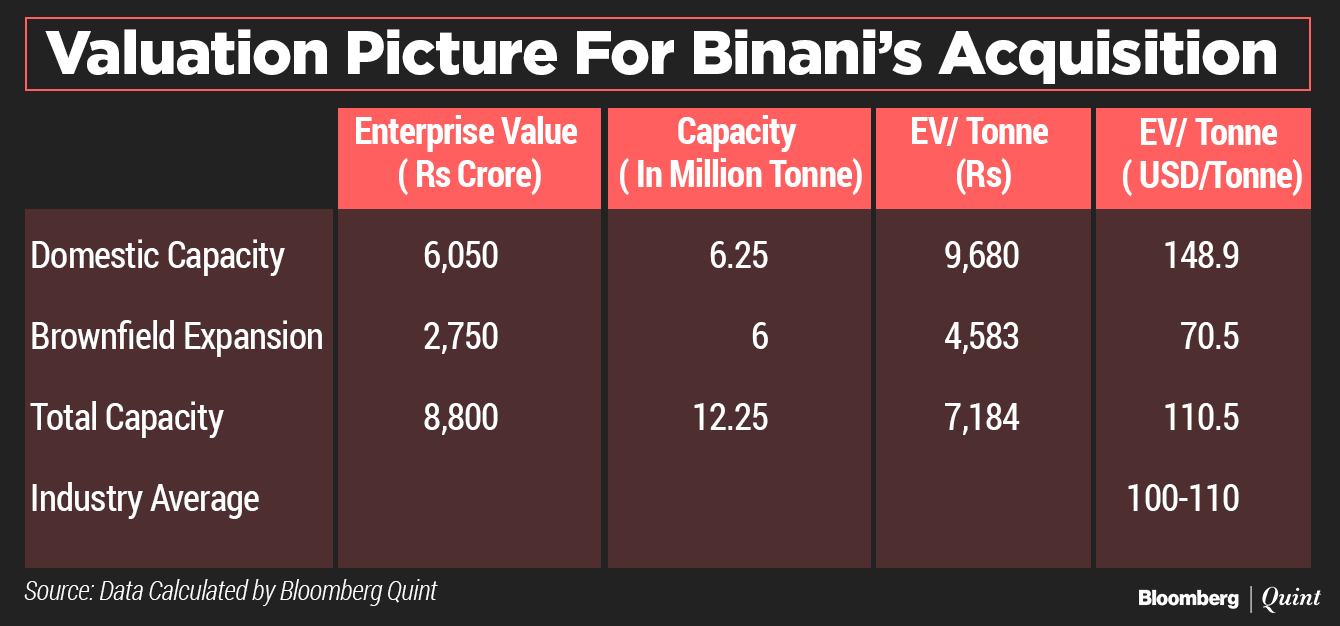

Brokerage CLSA assumes that UltraTech will sell north-based cement maker's non-core assets — 5-million-tonne-a-year capacity overseas and a glass fibre unit — for Rs 800-1,200 crore. That will bring down the enterprise value of Binani Cement's domestic 6.25 MTPA capacity from Rs 7,250 crore to about Rs 6,000 crore or $150 per tonne.

Given the potential limestone reserves, the capacity could be scaled up by another 6 MTPA at a replacement cost of $70 per tonne, CLSA said. That implies a total enterprise value of $110 per tonne, close to the industry standard, according to BloombergQuint's calculations.

Ultratech Cement had in July 2016 proposed to buy Jaypee Group's 21.2 MTPA plants for an enterprise value of Rs 16,189 crore or $117 per tonne. But the replacement cost for Binani Cement's plant, going by UltraTech's bid, is higher at $150 a tonne.

If adjusted for limestone deposits, this seems to be a fair deal since the reserves could feed into the next phase of brownfield expansion, said Hemant Nahata, assistant vice president of research at IIFL Wealth.

Why Acquire Binani Cement?

Apart from its 11.25 MTPA capacity in India and overseas, Binani Cement also has a 70-megawatt captive power plant. So the Rs 7,250-crore enterprise value is fairly reasonable considering the demand for cement in the north, strong branding and limestone deposits, said Vineet Bolinjkar, head of research for Ventura Securities

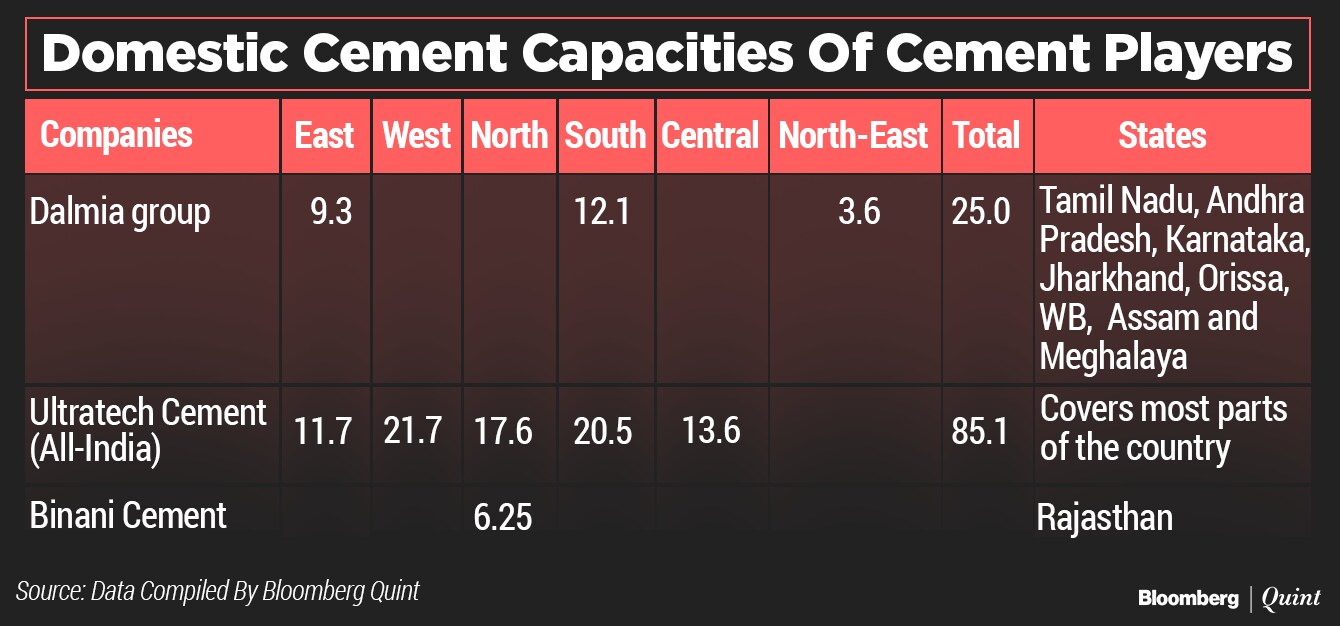

Acquiring Binani Cement, CLSA said, will help UltraTech gain market share and protect its turf. It will also help the company block the entry of other contenders in the region.

Binani Cement is one of the few assets with a sizeable capacity available in land-locked north, independent expert Rakesh Arora agreed. It also has a well-established brand and markets its product in Rajasthan and neighbouring Gujarat, Maharashtra and cement-deficit states of Uttar Pradesh, Bihar, Punjab, Haryana and Delhi.

Heidelberg and JSW Group were also in the fray for Binani Cement, while Rakesh Jhunjhunwala and D-Mart supermarket chain founder Radhakishan Damani had put in a joint bid.

Also Read: Why Jhunjhunwala, Damani Joined The Race For Binani Cement

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.