Vodafone Idea Ltd. will collaborate with Samsung for a virtualised radio access network solution for its 4G and 5G deployment.

To expand its 4G presence and introduce 5G, Vodafone and Samsung have been providing network trials in Chennai for the past 12 to 18 months. Due to a strong response, Vodafone has extended its Samsung deployment in Karnataka and Bihar circles, according to a press release.

The telecom company is proud to provide next-generation radio solutions, said Jagbir Singh, chief technical officer at Vodafone Idea Ltd.

"This vRAN deployment, delivered through Samsung's innovation and joint technological strategic initiatives, is in sync with our technology transformation roadmap and enriched vendor ecosystem," he said.

Vodafone is committed to collaborate with Samsung for the vRan solution to provide cloud benefit in the RAN domain. This engagement will assist the company embrace new technologies and architecture, it said.

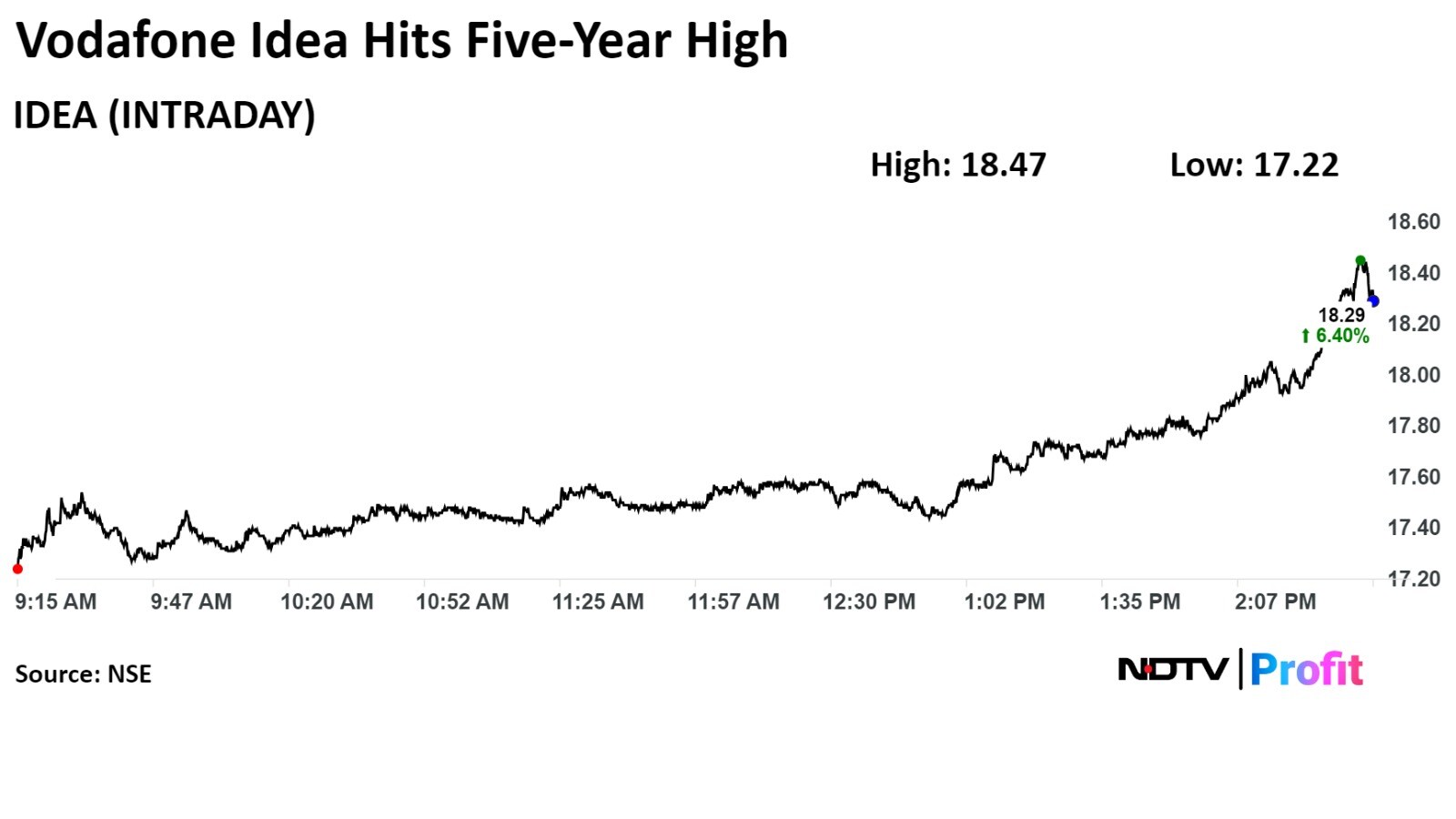

Shares of the telecom company rose as much as 7.45%, the highest level since March 29, 2019, before paring gains to trade 4.7% higher at Rs 18 apiece, as of 3:19 p.m. This compares to a 0.66% advance in the NSE Nifty 50.

The stock has risen 12.56% year-to-date. Total traded volume so far in the day stood at 1.29 times its 30-day average. The relative strength index was at 69.1.

Out of 20 analysts tracking the company, three maintain a 'buy' rating, six recommend a 'hold' and 11 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 36.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.