Tata Motors Ltd. is seeking to split its passenger and commercial vehicle businesses into two listed companies as India's most valuable automaker looks to unlock value and turn debt-free over the next couple of years.

The CV business and its related investments will be housed in one entity, while the other will include passenger cars, electric vehicles and Jaguar Land Rover, according to an exchange filing on Monday.

The demerger proposal—which will be presented to the board of directors in the coming months and subject to necessary regulatory and shareholder approvals—is likely to be completed in 12–15 months.

Shareholders of Tata Motors will continue to have identical shareholding in both the listed entities, the filing stated, and it'll be business as usual post-demerger.

“The three automotive business units are now operating independently and are delivering consistent performance,” Natarajan Chandrasekaran, chairman at Tata Motors, said in the statement.

“This demerger will help them better capitalise on the opportunities provided by the market by enhancing their focus and agility. This will lead to a superior experience for our customers, better growth prospects for our employees, and enhanced value for our shareholders.”

The Tata Motors stock has been on a tear over the past couple of months, so much so that the Nexon SUV maker emerged as India's most valuable carmaker, building on the outsized sales of its cars—traditional and electric—and outperformance by Jaguar Land Rover.

In 2023, its monthly sales often rivalled those of India's second-largest carmaker, Hyundai Motor India Pvt. Ltd. The company sold 5,50,871 cars all of last year—a growth of 4.6% over the previous year—even as Hyundai India shipped 6,02,111 units.

Tata Motors is the clear leader in the electric mobility space, accounting for nearly three out of four electric cars sold in the country. Additionally, the company is planning to invest as much as $2 billion in electric models by 2027.

Jaguar Land Rover, which at present retails only one electric SUV, plans to launch the first electric Range Rover this year and has already had more than 16,000 sign-ups for the model since opening the waiting list last year, Bloomberg reported.

Tata Group is also building a £4 billion battery plant in the UK, which has Tata Motors and JLR as anchor customers. On Nov. 29, 2023, group firm Tata Technologies Ltd. debuted on the stock exchanges with the best listing day gains for an Indian stock.

Clearly, the demerger is a case of value-unlocking.

The demerger is an excellent move and will be leveraged at both operational and financial levels, according to Gurmeet Chadha, managing partner at Complete Circle. “This move will lead to more value creation in different subsidiaries and have the business in focus.”

According to Deven Choksey of KRChoksey Investments, the PV business—particularly the EV segment—is demanding more investment. “This demerger is a value-unlocking proposition... It looks like an extremely promising prospect for investors.”

The demerger reflects confidence in the mainstay business.

“This (the demerger) signifies the management's confidence that the two businesses can operate independently with self-sustaining cash flows,” Emkay Global said in a note.

And while the brokerage does not see any major fundamental changes, it has revised its SOTP-based target price marginally to Rs 950 from Rs 925 earlier, factoring in a 10% premium multiple to the CV business. The recent run-up in the stock price limits upside.

The demerger also plays into Tata Motors' debt picture.

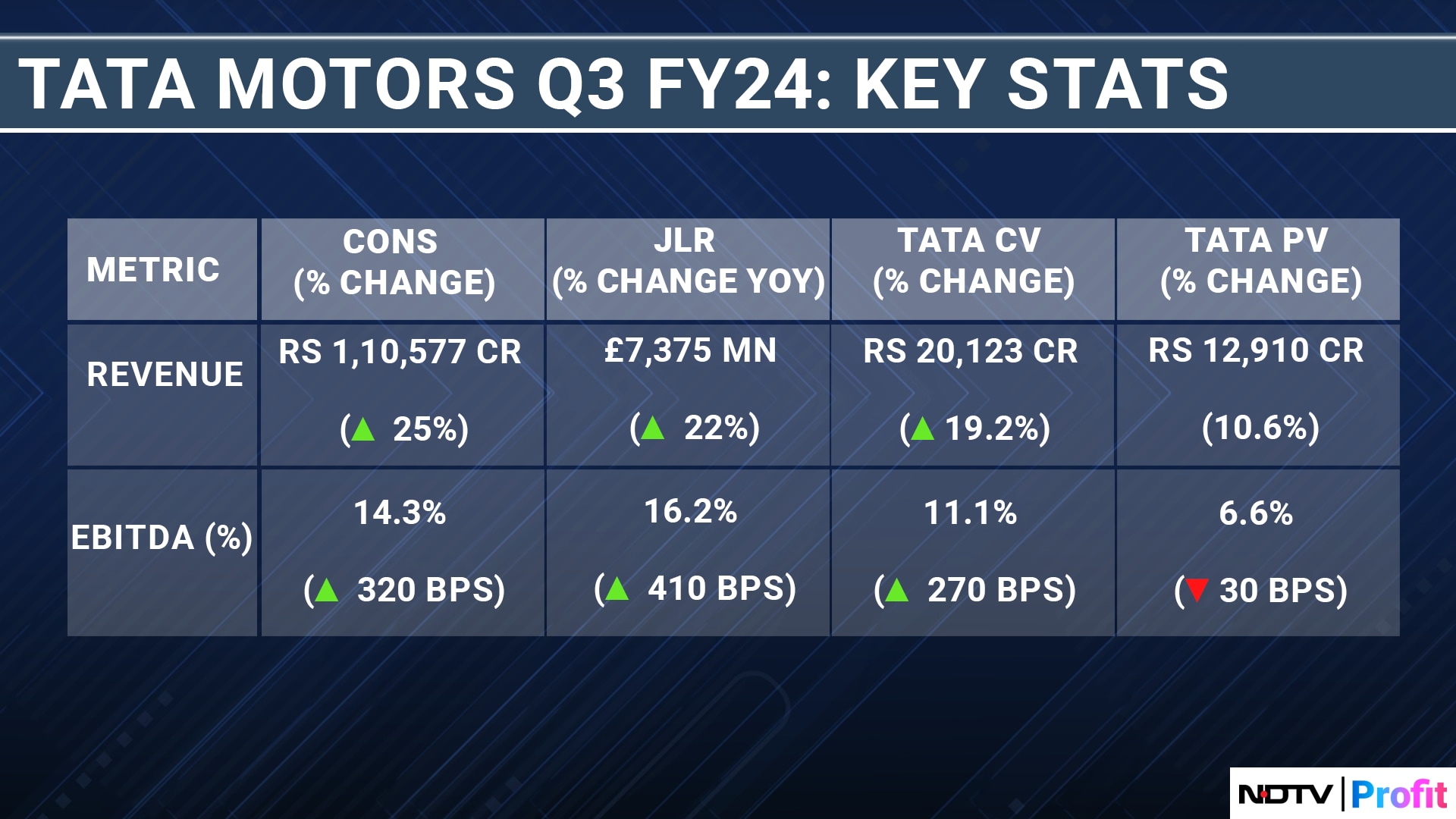

As of Dec. 31, 2023, Tata Motors had a net automotive debt of Rs 29,200 crore even as the free cash flow has improved—Rs 6,400 crore in Q3 FY24 from Rs 5,300 crore a year ago. At JLR, free cash flow stood at £626 million in Q3 FY24 and £1.4 billion in the nine months to Dec. 31, even as debt almost halved year-on-year to £1.6 billion, according to the company's third-quarter financials.

“On our net debt journey, I expect Tata Motors' domestic business to become near net debt zero in FY24 and JLR the following year,” Chandra had said at the car company's annual general meeting in August last year.

As of Dec. 31, Tata Motors had a debt-to-equity ratio of 1.58, down from 3.68 a year earlier.

Then there's the matter of synergies.

According to Tata Motors, the demerger is a natural progression of the “subsidiarisation” in 2022. While there are limited synergies in the CV space, there is considerable overlap in the PV business—for example, JLR's electrified modular platform will underpin Tata Motors' EV-first models under the ‘Avinya' brand. The current generation of the Harrier and Safari SUVs is built on an old Land Rover chassis.

Shares of Tata Motors have more than doubled in the past year, making it the NSE Nifty 50's top performer. Year-to-date, the stock is up 27%, making it more valuable than Maruti Suzuki India Ltd. On Monday, the stock ended 0.12% lower at Rs 987.20 apiece.

Of the 34 analysts tracking the company, 26 recommend a ‘buy' rating, five suggest a ‘hold' and three have a ‘sell' call, according to Bloomberg. The average of twelve-month analyst price targets implies a potential downside of 3.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.