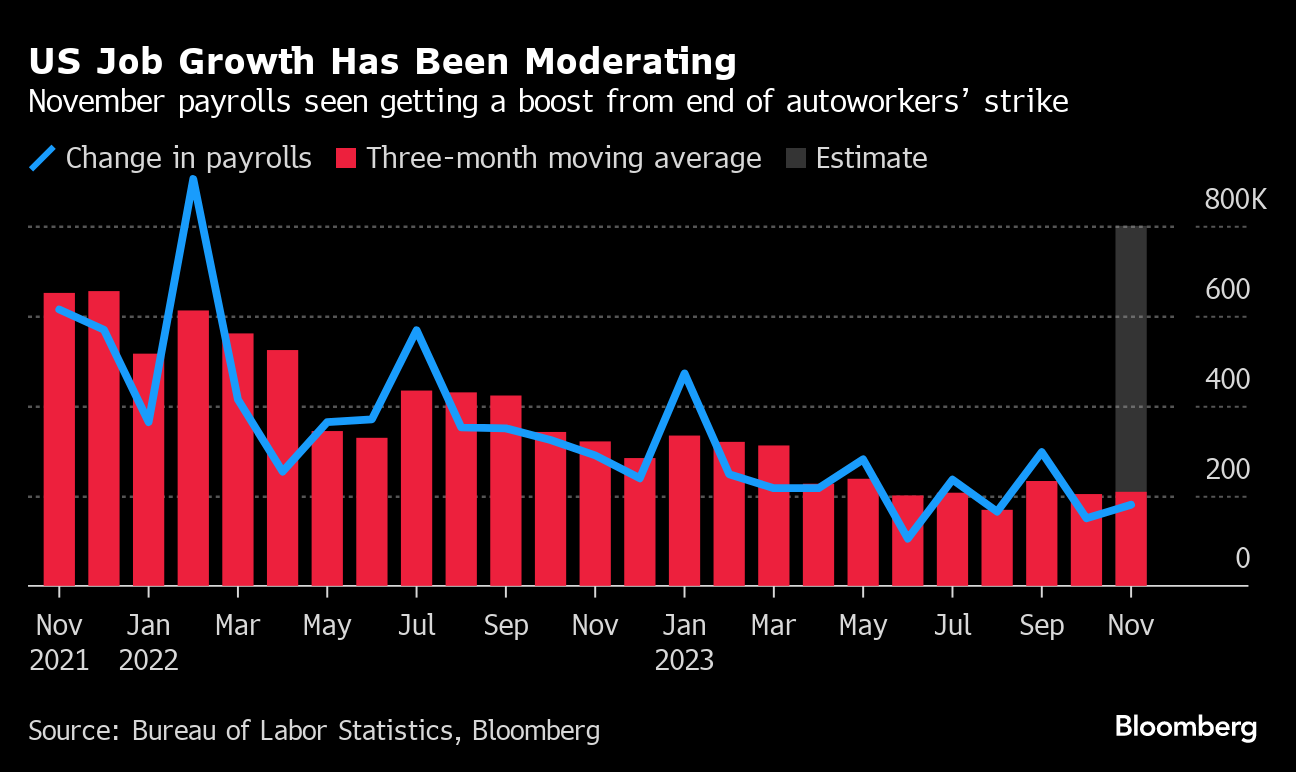

(Bloomberg) -- The return of striking United Auto Workers to vehicle assembly lines is seen driving a pickup in November payrolls, representing a pause in the recent trend of moderating US employment growth.

Government data on Friday are projected to show payrolls in the world's largest economy increased by 180,000 after a 150,000 October advance. Such a print would still leave average job growth over the past three months down about 100,000 from the pace seen earlier in the year.

The unemployment rate is forecast to hold at 3.9%, the highest since the start of 2022. That's also consistent with softer labor-market conditions and more restrained wage growth, helping soothe concerns about inflation and supporting assessments that the Federal Reserve is done raising interest rates.

The jobs report is forecast to show November average hourly earnings increased 4% from a year ago, the smallest annual advance since mid-2021.

What Bloomberg Economics Says:

“November's job report will send mixed signals about the state of the labor market. A solid nonfarm payroll print following a resolution to the UAW strikes will contrast with a weak household survey, where we expect the unemployment rate to edge up to 4.0%. Our view is that the economy is likely in a turning point toward a recession.”

—Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists. For full analysis, click here

Fed officials will observe a blackout period ahead of their Dec. 12-13 policy meeting, the last for 2023. Fed Chair Jerome Powell pushed back on Friday against growing expectations for interest-rate cuts in the first half of 2024.

Read more: Powell Brushes Off Rate-Cut Speculation as Fed Moves Carefully

Resilient hiring and wage gains have been at the root of robust consumer spending in recent months. While the current pace of job gains is consistent with further economic growth, any broader and deeper hiring slowdown would raise the risk of a recession.

Separate figures are projected to show a three-month low in job openings, indicating a gradual loosening of labor demand. Weekly jobless claims will also be watched closely for signs of a pickup in outright dismissals.

Already, the number of people on jobless benefit rolls stands at a two-year high, indicating out-of-work Americans are finding it more difficult to secure another job.

- For more, read Bloomberg Economics' full Week Ahead for the US

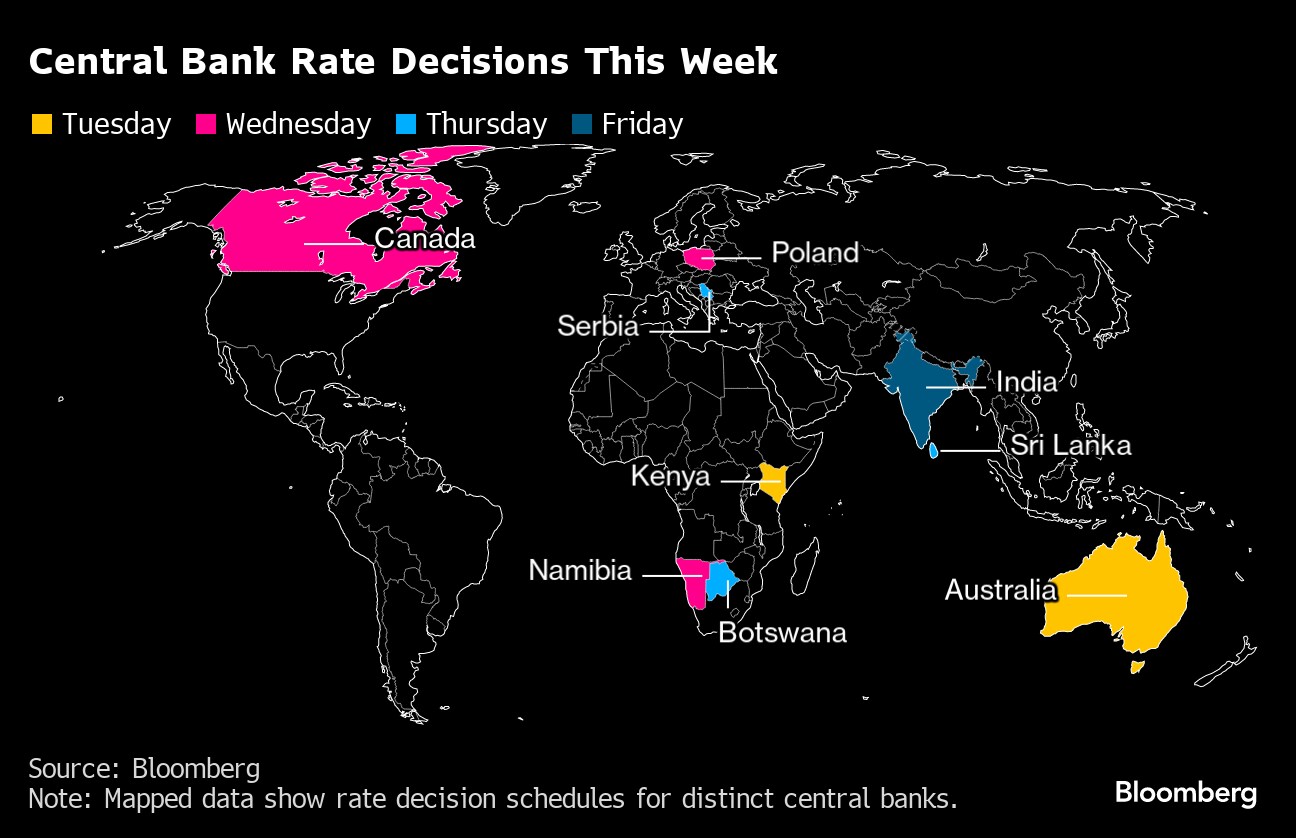

Further north, the majority of forecasters in a Bloomberg survey expect the Bank of Canada on Wednesday to hold rates steady at 5% for a third straight meeting. The Canadian economy unexpectedly shrank in the third quarter and consumer spending has stalled, confirming the central bank's aggressive rate increases are working to curb growth.

Elsewhere, borrowing costs are also predicted to stay unchanged in India, Australia, Poland and across Africa. Beyond central banking, China's President Xi Jinping hosts the European Union's Ursula von der Leyen, and the bloc's finance chiefs will try to agree on new fiscal rules.

Click here for what happened last week and below is our wrap of what's coming up in the global economy.

Asia

European Commission President von der Leyen travels to China for the first in-person summit with Xi in four years, starting Thursday, a meeting that could offer another sign that Beijing is looking to improve relations with its major trading partners.

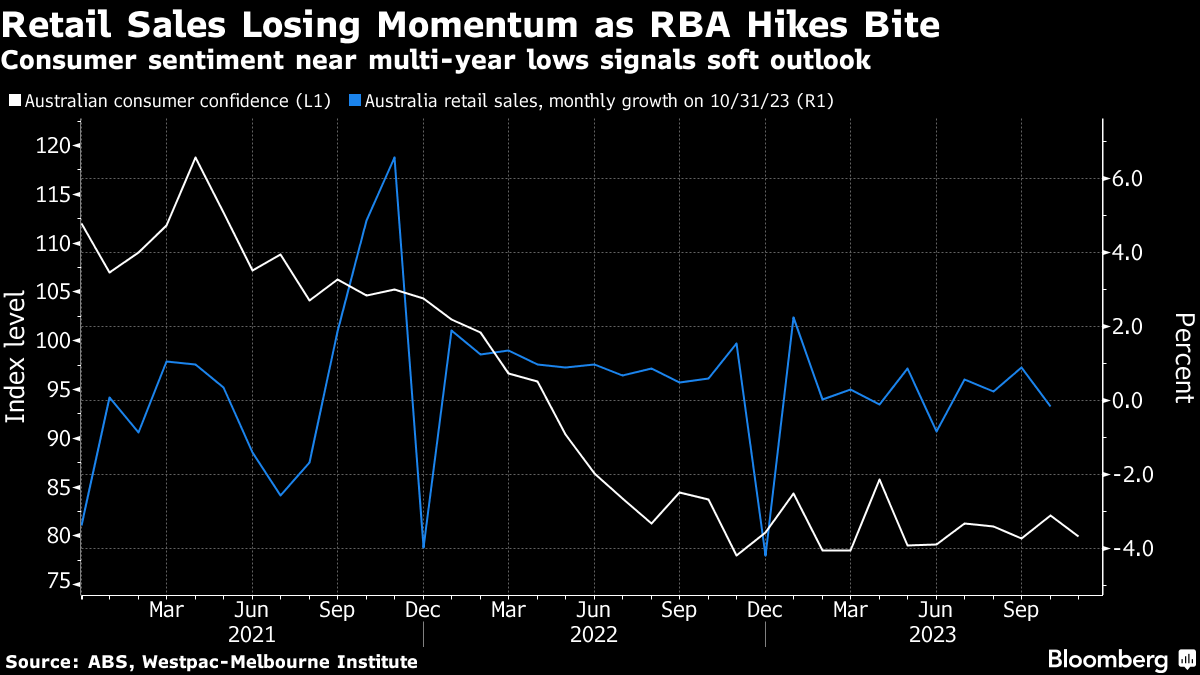

On Tuesday, the Reserve Bank of Australia is expected to leave rates on hold following last month's hike. Growth figures for the economy come out the following day.

South Korea releases its revised gross domestic product figures on Tuesday alongside price data for November. Taiwan and Thailand will follow with inflation reports on Wednesday and Thursday.

Investors will get more information on Japan's inflation dynamics, with Tokyo CPI out on Tuesday followed by wages on Friday.

Those figures, along with revised GDP, could have implications for Bank of Japan policy as the central bank gears up for another meeting later in the month.

The week draws to a close with the Reserve Bank of India likely to stand pat Friday.

- For more, read Bloomberg Economics' full Week Ahead for Asia

Europe, Middle East, Africa

Following surprise data that showed France's economy shrank in the third quarter while Italy eked out some growth, the overall euro-zone contraction for the period could be revised when new data are released on Thursday.

Meanwhile, industrial production numbers for October, the start of the year's final quarter, will be released in all four of the region's biggest economies, starting on Tuesday with France and Spain, and followed on Thursday by Germany and Italy.

German factory orders on Wednesday may also give a signal on whether manufacturing there has pulled through the worst of its downturn.

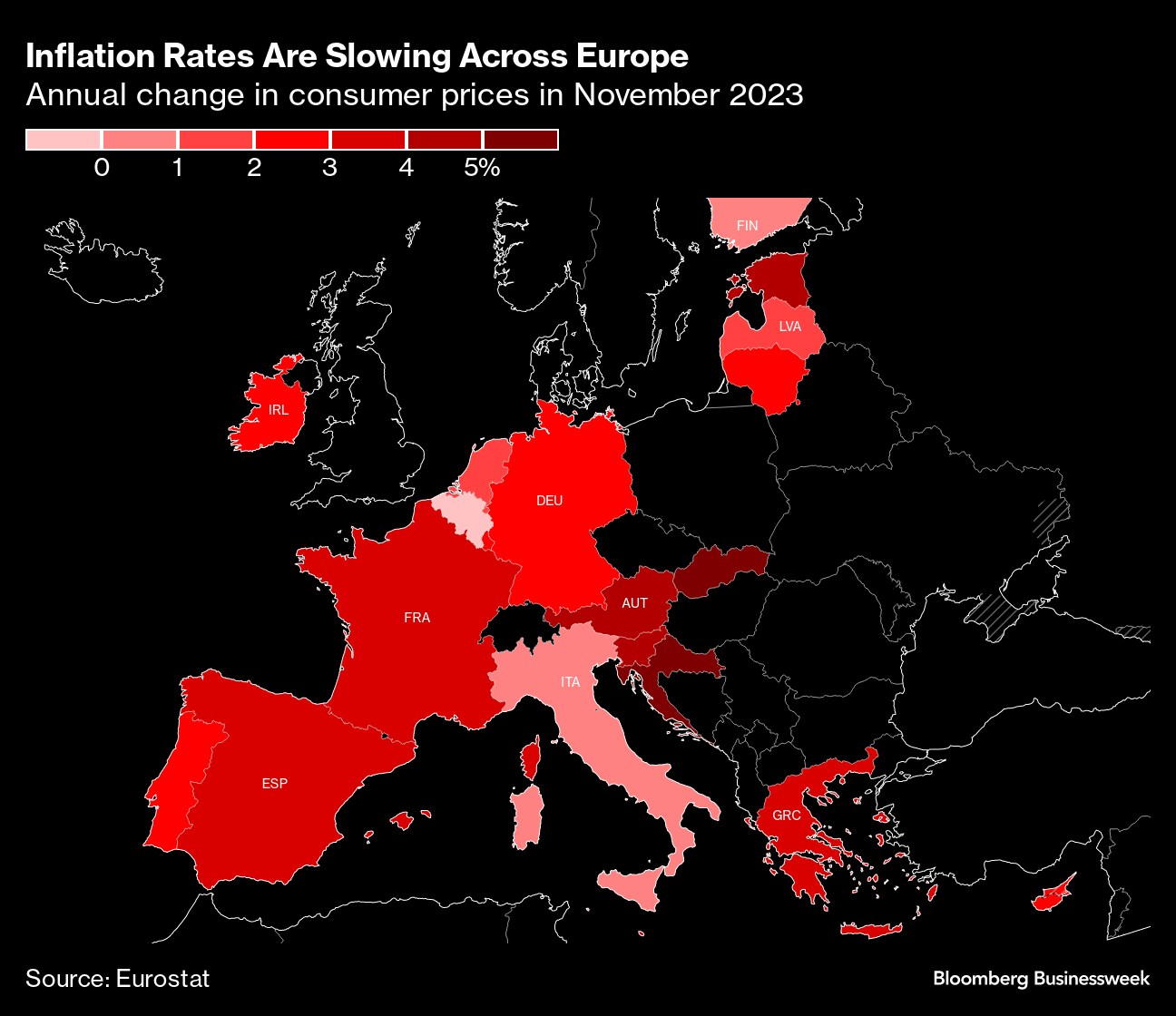

European Central Bank officials are watching such data as they gauge the impact of prior rate hikes, at a time when investors have firmed bets on a cut in borrowing costs as soon as April after lower-than-expected inflation data.

The institution's consumer-price expectations survey is due on Tuesday, and remarks this week, including a speech by President Christine Lagarde on Monday, will be scrutinized for clues on the ECB's intentions ahead of its Dec. 14 meeting.

A pre-decision blackout period kicks in on Thursday, the same day Lagarde attends a crucial meeting of euro-zone finance ministers who are in a standoff over how to apply EU debt and deficit limits when those rules are reinstated in January.

Germany's fiscal turmoil — triggered by last month's constitutional court finding — continues, with Finance Minister Christian Lindner saying this weekend that he plans cuts in areas including unemployment payments to close the €17 billion ($18.5 billion) gap in the country's 2024 budget.

In the UK, the Bank of England will release its latest financial stability report on Wednesday, with a press conference hosted by Governor Andrew Bailey. His institution will publish the survey it commissions on consumers' inflation attitudes two days later.

Swiss statisticians will reveal the country's consumer-price reading for November on Monday. Economists see that figure staying below the central bank's 2% ceiling for the sixth month in a row.

The same day in Sweden, the Riksbank publishes minutes of its most recent decision, where officials defied market expectations for a rate hike by keeping borrowing costs on hold. Governor Erik Thedeen and his four deputy governors will speak on successive days.

Multiple central banks around the region are anticipated to keep borrowing costs on hold:

- In eastern Europe, Polish rates will likely be maintained at their current level for a second month on Wednesday, amid uncertainty over fiscal plans of the incoming coalition.

- The following day, Serbian officials may also keep borrowing costs on hold.

- In Africa, with Kenyan inflation within target, no change is anticipated on Tuesday for a third straight meeting as policymakers monitor a steep depreciation of the shilling.

- Neighboring Uganda is also likely to keep borrowing costs on hold on Wednesday, after inflation quickened and the currency dropped to more than a year-low against the dollar.

- And in Botswana, policymakers are poised to leave their key rate unchanged on Thursday.

Elsewhere, consumer-price data will draw attention. In Turkey on Monday, inflation is predicted to have accelerated slightly to about 62% in November. And on Friday in Russia, consumer-price growth is also likely to have increased.

- For more, read Bloomberg Economics' full Week Ahead for EMEA

Latin America

Brazil's GDP data due on Tuesday will be one of the highlights of the week, showing how much Latin America's largest economy slowed during the third quarter.

After beating forecasts in the first half of the year, Brazil's economy is expected to have stalled between July and September as high rates finally take their toll.

Brazil's central bank has lowered its benchmark rate by 150 basis points since August, and promised to deliver at least 100 basis points more in cuts over its next two policy meetings.

Thursday will bring a barrage of consumer-price data, with Mexico, Chile and Colombia all posting numbers for November. While inflation is expected to further slow in Chile, Mexico is likely to see a more mixed picture, with the headline figure ticking up but core prices rising at a slower pace.

Mexico's central bank chief Victoria Rodriguez Ceja said on Wednesday that it was possible a rate cut in early 2024 may be discussed, although other board members expressed doubts that it could come so soon.

Meanwhile, Colombia's annual inflation is expected to remain above 10% in November, although an unexpected economic contraction in the third quarter has raised expectations that the central bank may soon begin unwinding its record monetary tightening cycle.

- For more, read Bloomberg Economics' full Week Ahead for Latin America

--With assistance from Walter Brandimarte, Laura Dhillon Kane, Monique Vanek, Paul Wallace, Yuko Takeo, Tony Halpin and Piotr Skolimowski.

(Updates with Germany in EMEA section)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.