(Bloomberg) -- Markets are expecting turbulent trading in the wake of Thursday's key inflation data as investors recalibrate big bets on Treasuries that helped spur 2023's year-end bonanza.

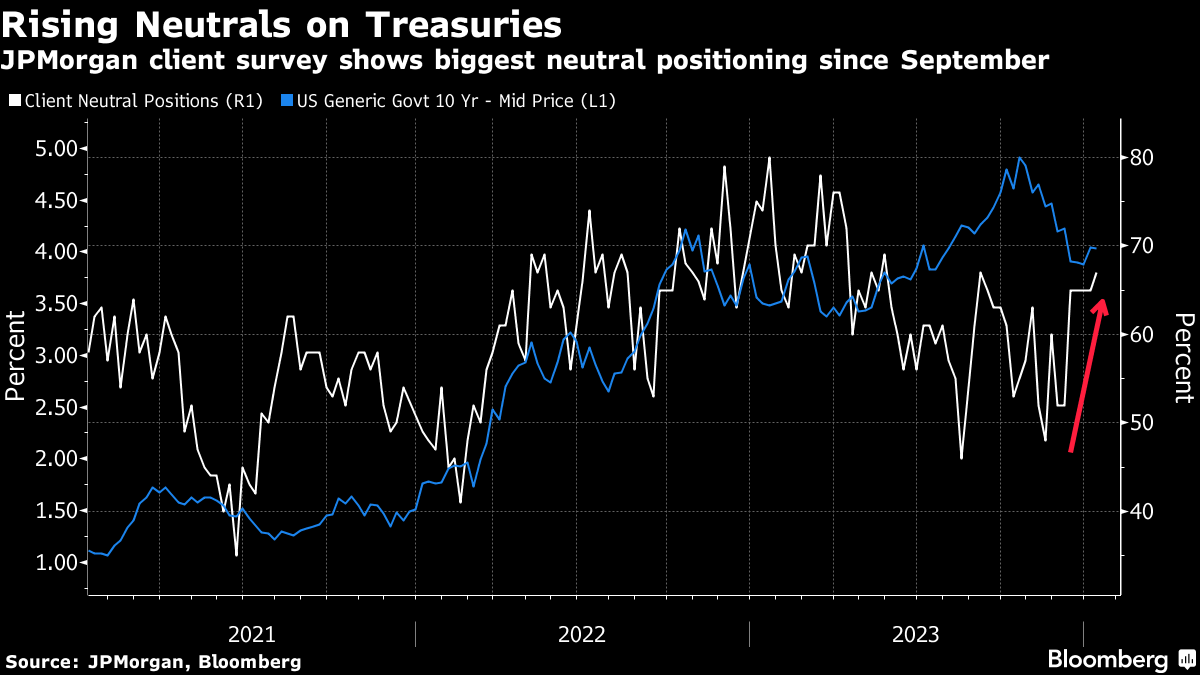

Traders have trimmed their wagers on US bond gains this month and instead added bets that stand to benefit from any slide in Treasuries. While the consensus is still skewed toward the rally continuing, market positioning is now the most neutral in four months, according to a JPMorgan Chase & Co. survey of clients. That backdrop suggests many investors are waiting to pick a side — long or short — when the next act for bonds becomes clearer.

Treasuries have so far struggled to find a clear direction in 2024. That lack of conviction stems from a sharp rally through the final few weeks of last year that saw US bonds eke out a return for the first time since 2020. But with 10-year yields down about a percentage point from their October high above 5%, and the swaps market already pricing more than five interest-rate cuts this year, the focus is on data prints to reinvigorate the market.

Economists surveyed by Bloomberg expect the consumer-price index to show core inflation excluding food and energy eased to 3.8% in the 12 months through December.

Structural long positions are most vulnerable to being overtaken, action in the options market suggests. Demand has soared for options hedging higher yields via contracts that expire at the end of this week.

Bond Traders Pile Into Short-Term Wagers Targeting Higher Yields

Still, complicating matters, Tuesday's rally in Treasuries appeared to be driven by a new round of fresh long positions, shown by a rise in open interest — or the amount of risk — in futures.

“New long risk in USTs has been added for the first time since the start of the year,” Citi strategists Edward Acton and Bill O'Donnell wrote in a note to clients.

Citi sees positioning as now “tactically neutral but structurally long.” Its strategists are watching the 112-06 level in US 10-year note futures — equivalent to a yield of around 3.985% — for signs that bets against Treasuries are being squeezed.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.