(Bloomberg) -- Turkey's consumer inflation accelerated to its highest level this year as household energy use exceeded state support for natural gas consumption.

Prices rose an annual 62% through November, less than the median estimate of 62.6% in a Bloomberg survey of economists. Monthly inflation was 3.28%, Turkey's state statistics bureau said, with housing including gas bills the leading contributor.

Colder weather has pushed household gas use beyond the volume promised by President Recep Tayyip Erdogan before May elections. The gas giveaway covers up to 25 cubic meters per month – about half of average household consumption at this time of year.

What Bloomberg Economics Says..

Turkey's slow inflation gain for November is a temporary respite, with the battle against high prices still far from over. We maintain our view that price gains will peak at 73% in the second quarter of next year. Risks to this view are tilted to the upside, based on strong underlying trends and a likely stimulus boom ahead of local elections in March.

— Selva Bahar Baziki, economist. Click here to read more.

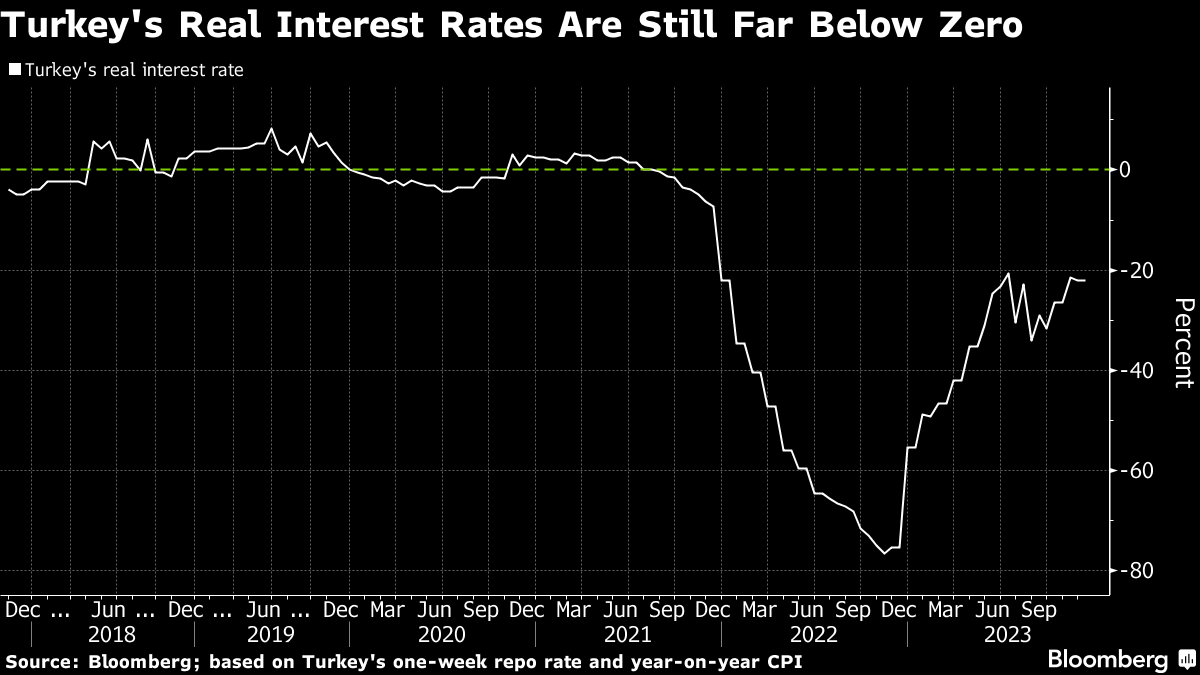

The monetary authority has raised interest rates sharply since President Recep Tayyip Erdogan's reelection in May, rolling back some of its earlier, unconventional measures that were blamed for driving away foreign investors and causing a series of currency crises.

But even as monthly hikes since June have nearly quintupled the key rate to 40%, it remains deeply negative when adjusted for current prices. Real rates are now above zero relative to projected inflation at the end of 2024, a gauge that's preferred by policymakers when talking about monetary tightening.

Municipal elections in March are raising the possibility that the focus will shift back to supporting the economy. Other risks abound for inflation, including an expected increase in the minimum wage next month.

“Inflation will remain a challenge,” Deutsche Bank AG analysts including Yigit Onay said in a report before the data release. “The upcoming minimum wage decision, expected to be sizable given the approaching local elections, adds an additional layer of uncertainty for next year.”

Central bank Governor Hafize Gaye Erkan, who was appointed in June, has acknowledged that temporary factors outside the reach of monetary policy — including gas consumption in November — may push up price gains. Still, she said in a speech last week that “a decline in the underlying trend of inflation has started.”

The central bank anticipates price growth will peak next May at as high as 75% then fall to 36% by the end of 2024.

(Updates with highlights, chart, more context.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.