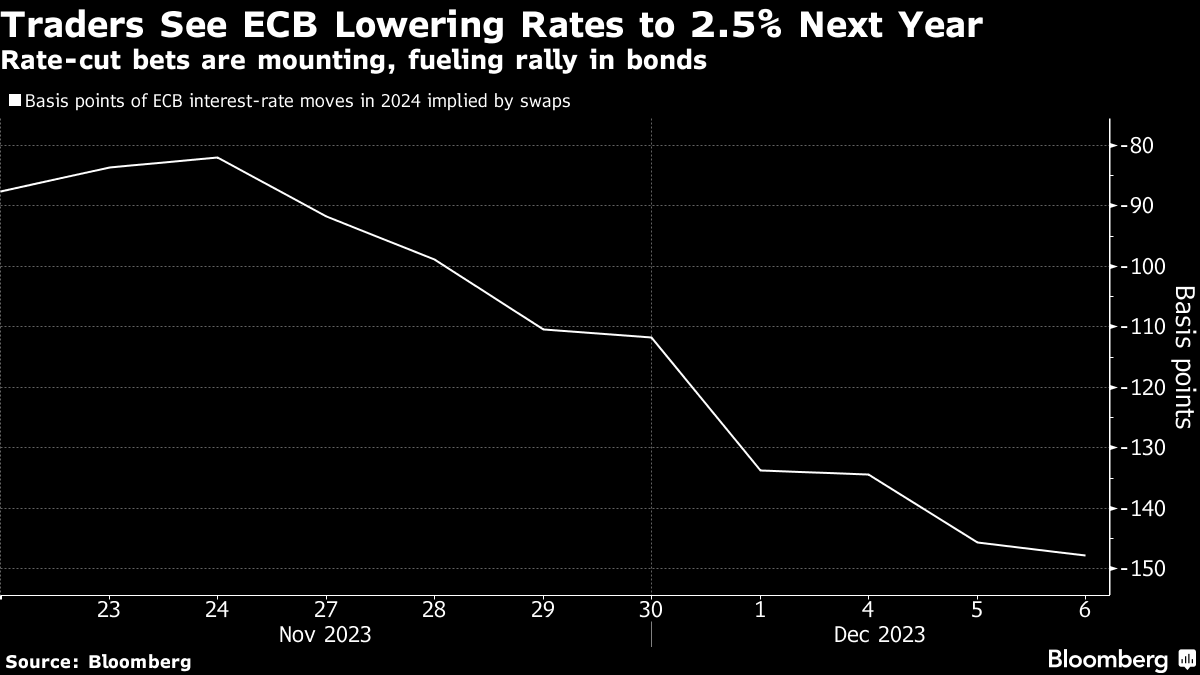

(Bloomberg) -- Traders are ramping up bets on the extent of monetary easing from the European Central Bank in 2024 as policymakers signal they've probably tightened enough to bring inflation back to target.

Markets fully priced six quarter-point rate cuts by the European Central Bank in 2024 for the first time, a move that would take the key rate down 150 basis points to 2.5%. There's also an almost 90% chance of the easing cycle starting in the first quarter of next year, a scenario that was barely contemplated just three weeks ago.

While policymakers are still warning of the threat posed by inflation, they've also increasingly acknowledged that further hikes above 4% will likely not be needed. Isabel Schnabel, regarded as one of the governing council's most hawkish members, said in a recent interview with Reuters that the decline in inflation has been “remarkable” and “encouraging.”.

“The European economy has been steadily deteriorating over the past 12 months as financial conditions have tightened,” said Gareth Isaac, head of multi sector portfolio management at Invesco. He expects labor markets soften next year, “providing the ECB with the cover to begin cutting rates sharply as inflation falls back to target.”

ECB Governing Council member Martins Kazaks, cited by Econostream Media on Wednesday, said while there's no need to cut rate cuts in the first half of 2024, the policy decision might change if the “balance of risks for price stability shifts”. Last week Francois Villeroy de Galhau — considered a centrist — said “barring any shock, rate hikes are now over,” and raised the prospect of cuts next year.

The slew of ECB comments acknowledging the progress in the fight against inflation comes days after data showed euro-area consumer prices grew less than expected in November, by 2.4% year-on-year from 5.3% in August. That's closer to the ECB's 2% target than at any point since mid-2021.

At the same, economic data shows further signs of weakness. German factory orders unexpectedly fell in October, highlighting how manufacturing in Europe's largest economy remains stuck in a rut.

If traders are right, the ECB will be the first among major central banks to cut rates next year, and will deliver the most aggressive easing cycle.

The Federal Reserve is expected to deliver its first move in May and lower rates by 125 basis points. In the UK, markets are currently pricing three Bank of England quarter-point cuts starting in June, and a 40% chance of a fourth move. A month ago, just two cuts were priced.

Rates markets in Australia have switched from betting on another hike by mid-2024 to pricing in a better than 75% chance for a cut by then. And even New Zealand's central bank — which last week said it may need to hike rates next year — is now seen as a strong chance to reduce its benchmark by May.

The view that the ECB and other major central banks will have to ease monetary conditions to support their economies next year has boosted bonds. The yield on 10-year German bonds has dropped about 80 basis points to 2.23% over the past two months, the lowest level since May.

(Updates with context, comment and fresh pricing throughout.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.