The NSE Nifty 50 is heading towards the psychological barrier of 25,000, according to analysts, as the benchmark index concluded the last day of the month on a positive note at 24,951. Among sectors, metal was the top performer, followed by pharma and media, while the PSU banking sector underperformed.

The sustainable move above 25,000 will push the index further higher to 25,200, whereas on the downside, 24,800 will be considered immediate support, according to Aditya Gaggar, director of Progressive Share Brokers Pvt.

If the index remains above 25,000, the surge could extend to 25,200–25,300 levels. On the downside, 24,770 and 24,600 will provide significant support for the Nifty in the immediate term, said Hrishikesh Yedve, AVP, technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd.

On the higher side, above 24,980/81,800, the market could rally to 25,050-25,125/82,200-82,500. However, below 24,800/81100, the sentiment could change. Below the same, the market could retest the level of 24,700-24675/80,800-80,500, said Shrikant Chouhan, head of equity research at Kotak Securities Ltd.

Bank Nifty ended the day on a positive note at 51,553.

"Technically, the index is facing rejection from a falling trend line at 52,300 levels. Thus, 52,000–52,300 will serve as a resistance zone for the Bank Nifty, while 51,000 will work as strong support," said Yedve.

F&O Activity

The Nifty August futures are up 0.42% to 25,013 at a premium of 62 points, with open interest up by 5.48%.

Nifty Bank August futures are up by 0.06% to 51,858 at a premium of 325 points, while its open interest is up by 25%.

The open interest distribution for the Nifty 50 Aug. 1 expiry series indicated most activity at 25,500 call strikes, with 24,500 put strikes having maximum open interest.

For the Bank Nifty options August 7 expiry, the maximum call open interest was at 51,500 and the maximum put open interest was at 51,500.

FII/DII Activity

Overseas investors stayed net sellers of Indian equities on Wednesday for the third consecutive session.

Foreign portfolio investors offloaded stocks worth Rs 3,462.4 crore, while domestic institutional investors stayed net buyers for the seventh session and bought equities worth Rs 3,366.5 crore, the NSE data showed.

Market Recap

India's benchmark stock indices continued their gains for the fourth consecutive session to end at fresh record closing highs on Wednesday, ahead of the Federal Open Market Committee's meeting later in the day. Shares of Maruti Suzuki India Ltd. and Bharti Airtel Ltd. led to gains.

Both indices closed at their highest levels. The NSE Nifty 50 closed up 93.85 points, or 0.38%, at 24,951 and the S&P BSE Sensex closed 285.94 points, or 0.35%, higher at 81,741.

Broader markets ended on a mixed note. The S&P BSE Midcap ended 0.86% higher and Smallcap ended 0.14% lower.

On BSE, 17 out of 20 sectors advanced and three declined. The S&P BSE Utilities rose the most, and the S&P BSE Realty declined the most.

Major Stocks In News

Tata Steel: The company will keep Rs 17,347 crore as contingent liability in its financial statements, following a recent Supreme Court judgment that upheld the state government's power to levy cess on minerals. Besides, the steel-maker's consolidated net profit rose 75% in the June quarter of fiscal 2025, but missed analysts' estimates as exceptional items weighed.

Infosys: The company is under GST Intelligence scanner for alleged evasion of over Rs 32,000 crore. Responding to the allegation, Infosys has issued a statement saying, that the company paid all its GST dues and is fully in compliance with the central and state regulations on this matter.

Coal India: The company's consolidated net profit rose 4.2% in the first quarter of fiscal 2025. The state-run coal producer posted a profit of Rs 10,943.5 crore in the April–June period.

Vedanta: The company received approval from BSE and the National Stock Exchange of India to split into six independent listed companies.

Wipro: The company has secured a multi-year contract with global automotive supplier MAHLE to upgrade its IT infrastructure with hybrid cloud solutions.

Global Cues

Stocks in the Asian markets are on the rise following Federal Reserve chair Jerome Powell's optimism in cutting US interest rates this September.

On the other hand, Japan markets fell during early trade after its central bank hiked its interest rates to 0.25%, the country's highest since 2008. The Nikkei 225 was trading 858.19 points or 2.19% lower at 38,243.63, while the S&P ASX 200 was 35.87 points or 0.44% up at 8,128.20 as of 06:35 a.m.

The US markets closed with all major benchmarks in the green. The Nasdaq Composite rose as much as 3.19% during the day as the Fed meeting announced that they plan to wait for inflation rates to come down to 2%.

Numbers from the US in the past few weeks have suggested lower inflation rates and a cooler job market driving the Fed to a dovish stance. It noted that the committee needs to see further progress in inflation before the September meet in order to announce the rate cuts.

The Fed's comments extended the US market rally with tech company's Nvidia Corp. and Meta shares surging as much as 14.08% and 2.87% respectively.

The S&P 500 Index and Nasdaq Composite advanced 1.58% and 2.64%, respectively as of Wednesday. The Dow Jones Industrial Average rose 0.24%.

Brent crude was trading 0.99% higher at $81.52 a barrel. Gold was 0.15% up at $2,451.21 an ounce.

Key Levels

US Dollar Index down 0.12% at 103.9720.

US 10-year bond yield at 4.05%.

Brent crude up 0.99% at $81.52 per barrel.

Bitcoin was down 0.14% at $64,468.1300.

Gold spot was up 0.15% at $2,451.21 an ounce.

Money Market Update

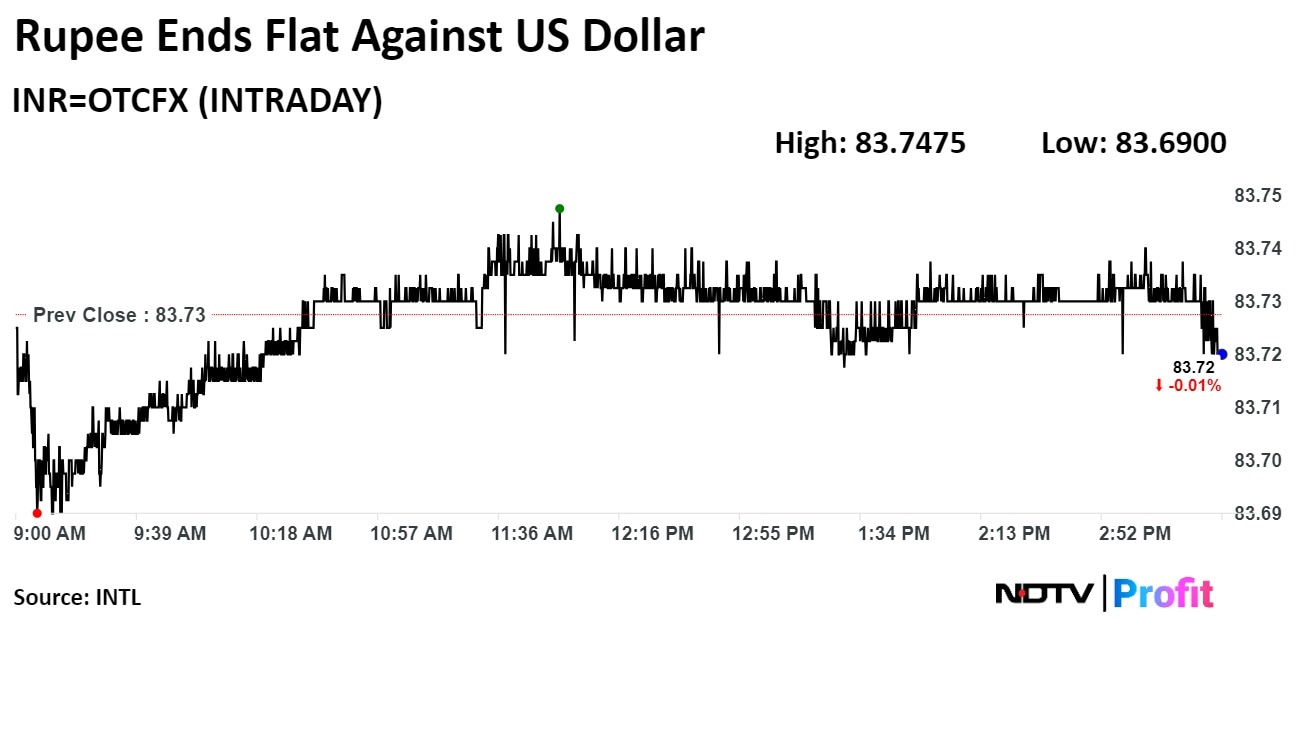

The Indian rupee closed flat against the US dollar on Wednesday, ahead of policy announcements by the Federal Reserve.

The Indian currency closed at Rs 83.73 after opening at Rs 83.72 against the greenback. It opened unchanged from Tuesday's close.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.