When it comes to the stock market, investors tend to be a fickle bunch. They love companies when they're hot and have crazy narratives spinning around. But they'll turn on a dime when things go south.

The hot tech IPOs of 2021 and 2022 are proof of this.

Zomato, Paytm, CarTrade Tech among other companies, which were high on growth, saw massive response when they launched their initial public offers (IPO).

Skip forward to present and shares of these companies are beaten down big time.

In short, nothing adds up.

While the global markets are near their 52-week lows and reeling under the effects of inflation, the Indian stock markets are a just shy off their all-time highs.

This has prompted some companies, which were waiting in line to launch their IPOs, to make the most of the current situation.

No wonder IPOs are back in vogue. Just last week, we saw four companies successfully raise funds while Keystone Realtors concluded its IPO this week.

Before you get carried away, there are a few things you should know.

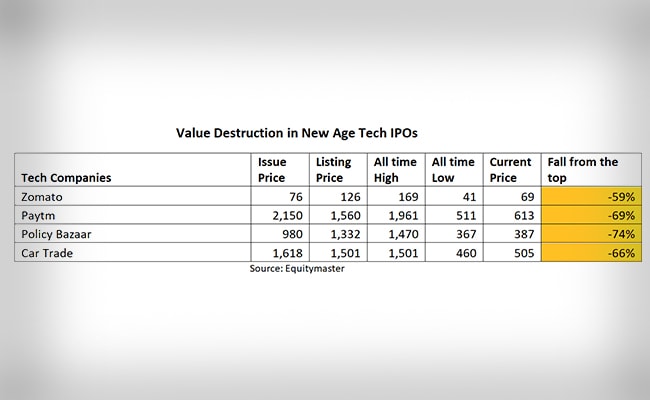

First, let's start with discussing the top 5 IPOs in recent times and the amount of wealth they destroyed.

Over Rs 3.5 Lakh Crore Wiped Off!

Zomato, a loss-making company which burns cash every year, had a market capitalization of Rs 1.4 lakh crore at its peak. The company's current marketcap stands at Rs 592.6 billion (bn) (around Rs 59,263 crore).

That's a wealth destruction of over Rs 80,000 crore.

Paytm, which has one of the most complex business models and tries to do everything at the same time, was valued at Rs 1.2 lakh crore at its peak. Today's its marketcap stands at Rs 39,600 crore.

Again, a wealth destruction of around Rs 80,000 crore.

LIC, India's biggest IPO, shattered dreams when it made a muted debut, but that's the case with big IPOs…they never perform.

LIC had a marketcap of Rs 5.5 lakh crore at its peak. Today, the insurance behemoth's marketcap stands at Rs 4.1 lakh crore.

Add another 1.4 lakh crore to the wealth destruction…

The next IPO which attracted investors and saw a massive response was by Policybazaar's parent firm PB Fintech. Policybazaar had a marketcap of over Rs 65,000 crore bn at its peak. Its current marketcap is 17,400 crore.

So that's over Rs 47,600 crore in wealth destruction.

Finally, we have CarTrade Tech, which had a marketcap of over Rs 7,200 croreat its peak. Today, the company has a marketcap of Rs 2,300 crore.

Add another Rs 5,000 crore to the wealth destruction.

If we add all this up, the wealth destruction comes to Rs 3.5 lakh crore.

There are other companies too which you can add to this list and the wealth destruction amount will increase.

Take for instance, Delhivery or Nykaa, both of which are reeling under pressure since their IPOs.

Despite the fate of these IPOs, we won't be surprised if you are tempted. After all, there is an army working to hype them up as future multibagger stocks. And as the cycles of greed suggest, good stories are hard to resist.

The lesson here for you is to check whether the IPO you are considering investing in has enough promoters' skin in the game.

Did you know that the founders' stake in stocks like Zomato, Paytm, Policybazaar, CarTrade Tech, and Delhivery is less than 10 per cent?

None of these are under promoter category. Hence, there is no compulsion to disclose buying and selling of shares in the open market.

Most of these names took a sharp hit as pre-IPO investors (promoters, employees, and institutional shareholders) rushed to exit post the expiry of the lock-in period. They did not find value in these stocks even at beaten down levels.

Do not just go for listing gains or by grey market premium

We're not totally saying no to this approach. But you might want to reconsider on the basis of the reasons below…

Yes, we get it. You want to invest in IPOs and make a quick buck from listing gains. But if you're looking at IPOs on the basis of listing gains, you won't be getting what you bargained for.

First, these investments are risky and volatile. You have to be prepared to lose your investment if things don't go as planned.

An example in recent times could be of Paytm. The grey market premium (GMP) of Paytm indicated that the shares may list at a discount of 0.7 per cent to its issue price.

Yes, that's right. A discount of 0.7 per cent was all the grey market expected.

But we all know what happened on listing day. It was a debacle.

Also, listing gains (or losses) are based on speculation more than on actual performance of the stocks after they go public. So while some companies do end up doing very well after their IPO, there are many others that don't perform as expected. Investors can lose money as a result of this volatility.

So how does one know which IPOs will give good returns?

You don't! That's why we always recommend investing in IPOs for their potential long-term growth potential rather than short-term profits.

Investors looking for long term gains should evaluate the business model very carefully to identify some key metrics they would want to keep tracking. Poor performance on those metrics should be taken as a warning.

Most importantly, buying stocks at steep valuations during IPOs, could mean a compulsion to hold on to them for many years without meaningful returns.

Valuations

Irrespective of how good a company is, overpaying for the stock is never a good idea.

The biggest risk with IPOs is overvaluation. When a company goes public, it is selling shares on the open market for the first time, and this means there's no telling what the price will be until after it happens.

The price could end up being too high or too low, which can lead to losses for investors who bought too soon or sold too late.

The IPO is just the first opportunity to invest in the business. So it would be wiser to wait until you understand the long term prospects of the company better or until the stock trades at valuations that offer some margin of safety.

Comparing the valuations of the company's peers or the industry average is a good way to make decisions.

It's okay to avoid IPOs…

What if the IPOs are priced in such a way that most of the future gains are already priced into the stock?

Here's the greatest investor Warren Buffett to sums this up best:

It's almost a mathematical impossibility to imagine that, out of the thousands of things for sale on a given day, the most attractively priced is the one being sold by a knowledgeable seller (company insiders) to a less-knowledgeable buyer (investors).

We are not saying all IPOs are bad investments. But in most cases, the listing price is so high that investing in them is not a productive use of one's money.

Instead, you can invest in a fundamentally strong stock with a proven history in the secondary market.

To give you proof, check the example below…

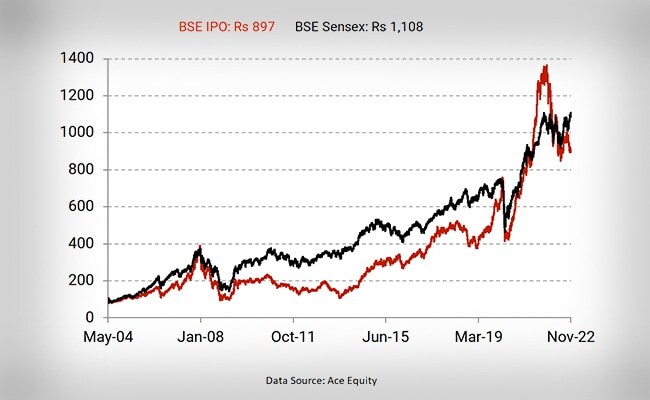

The BSE has an IPO index that is constructs to represent the performance of IPOs.

From the time the start of the index about 17 years back in May 2004 to now, the index has majorly underperformed even the benchmark BSE Sensex.

While Rs 100 invested in the BSE Sensex then would today be Rs 1,108, the same investment in the BSE IPO index would today be Rs 897.

In Conclusion

Treat an IPO as anything buy yet another stock that you could consider for long term investment.

There's no reason to compromise on the moat, management quality, and valuations of the company.

Happy Investing!

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

This article is syndicated from Equitymaster.com.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.