(Bloomberg) -- Tesla Inc. shares have wiped out nearly one-fifth of their value in less than two weeks amid growing concerns that demand for electric cars is starting to weaken.

The selloff started earlier this month when the electric-vehicle giant dialed back growth expectations during its third quarter earnings call. That was followed by grim commentary from several global automakers, as well as Wall Street analysts. This week, battery-maker Panasonic Holdings Corp. and chipmaker ON Semiconductor Corp. also sounded alarms for the EV industry.

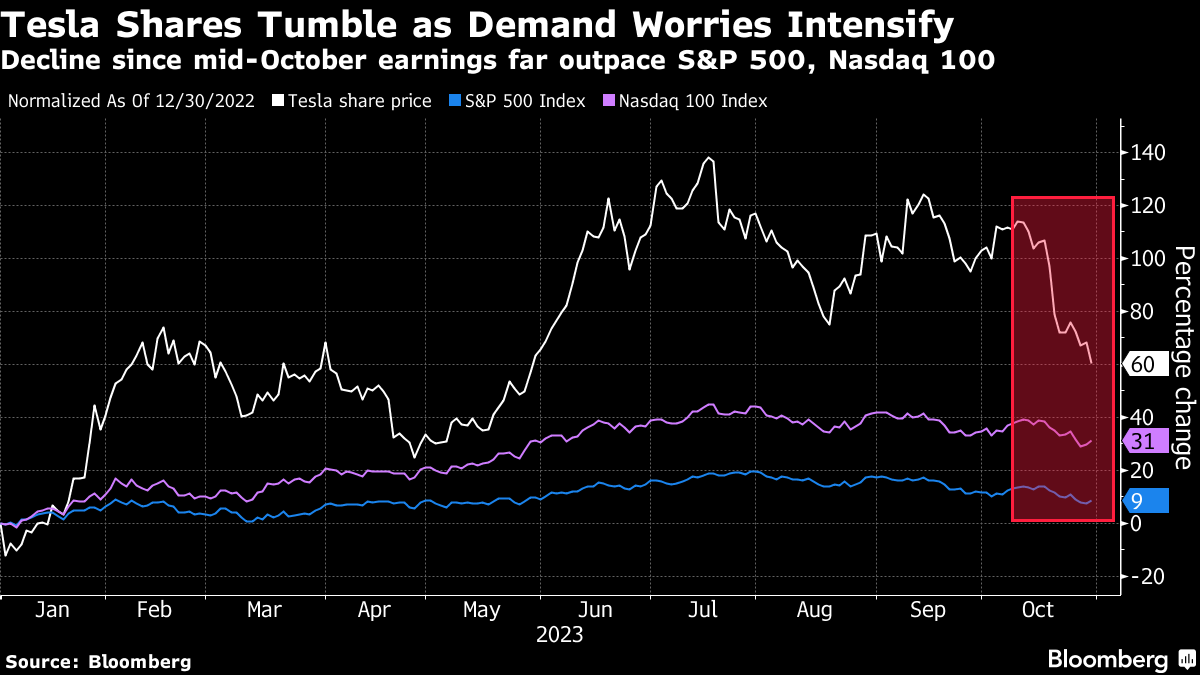

The warnings have weighed on stocks across the US automotive sector, which has also been battling extensive negotiations with its labor unions over wages. Still, Tesla's decline stands out: shares have sunk over 17% since the Oct. 18 report, compared to a 2.8% drop in the S&P 500 Index, and a 3.4% decline in the Nasdaq 100. The retreat in the EV-maker's stock price has erased about $130 billion from the company's market capitalization.

“At the crux of the problem is a capital-intensive sector investing in unproven EV strategies amid a world of rising costs, lower prices, rising rates and slower demand,” Morgan Stanley analyst Adam Jonas wrote in a note discussing the wider industry weakness Tuesday. “What investors seem to be waking up to today is the idea that the tens of billions of dollars invested in EVs may be value destructive rather than value accretive.”

The outlook for autos overall has been darkening as high interest rates have sent the cost to own a car soaring. When coupled with rising inflation, consumers' ability to afford big purchases has been squeezed. EVs, still a relatively new technology with an underdeveloped charging ecosystem, are getting hit first.

As a pureplay EV maker with an eye-watering valuation, the stakes are high for Tesla. While some part of its expensive share price reflects its potential to develop self-driving cars, a large part depends on the company's ability to maintain its current dominant position in the EV industry and its profit margins.

As EV demand tapers and Tesla's aggressive price cuts seem to be losing their ability to boost demand much further, investors are starting to get jittery, reflected in the sharp slide in the share price.

Still, the stock staged a sharp rebound around midday in New York after the company convinced a jury that its Autopilot technology wasn't responsible for a crash that killed a California driver four years ago. The shares closed up 1.8% at $200.84 on Tuesday.

(Updates stock move, valuation in third paragraph and headline, adds more stock detail in eighth.)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.