Tata Consultancy Services Ltd. showed good execution in the third quarter, but deal wins were weak, with a sharp headcount decline suggesting that demand recovery is not yet in sight, according to brokerages.

However, most brokerages hiked target price on the stock, citing better-than-expected topline results with decent deal wins.

TCS' third-quarter revenue rose meeting estimates, even as macro headwinds and furloughs weighed in a seasonally weak quarter.

"Management commentary regarding the spending environment in IT services remains unchanged, with continued pause in discretionary deals adversely affecting business," Motilal Oswal said. "While the company views its deal pipeline and booking as robust, it continues to expect improvement in client sentiment after the positive commentary by the US Fed in Dec'23."

Revenue of the Mumbai-based IT major rose 1.49% over the previous three months to Rs 60,583 crore in the quarter ended Dec. 31, according to an exchange filing on Thursday. That compares with the Rs 58,229-crore consensus estimate of analysts tracked by Bloomberg.

TCS Q3 Results: Key Highlights (QoQ)

Revenue up 1.49% at Rs 60,583 crore (Bloomberg estimate: Rs 60,109 crore).

EBIT up 4.6% at Rs 15,155 crore (Bloomberg estimate: Rs 14,787 crore).

EBIT margin at 25.01% (Bloomberg estimate: 25.39%).

Net profit down 2.5% at Rs 11,097 crore (Bloomberg estimate: Rs 11,498 crore).

TCS has announced a third interim dividend of Rs 9 and a special dividend of Rs 18 per equity share for FY24. The record date for the dividend is on Jan. 19. The third interim dividend and the special dividend shall be paid on Feb. 5.

Here's What Brokerages Say On Q3 Results

Jefferies

Jefferies maintains a 'hold' rating with a target price of Rs 4,000 apiece.

The third quarter earnings were in line, but the broad-based trend continues to prevail. Deal bookings were soft, and a sharp headcount decline suggests that demand recovery is not yet in sight.

The IT company witnessed broad-based weakness in four of its eight-verticals. Communication, Technology, Consumer and BFSI are registering a QoQ revenue decline.

TCS bookings at $8.1 billion grew by a modest 4% YoY, which disappointed. Management highlighted that while new deals are ramping up, re-prioritisation of spend by clients continues to impact growth.

Demand recovery in the near term looks unlikely given the decline of 5,600 in headcount and management looking to reduce subcontracting further.

"We maintain our FY24-26 revenue estimates and expect TCS to deliver a 6.6% CAGR in cc revenues over FY24-26".

Motilal Oswal Financial Services

The research firm has reiterated its 'buy' rating with a target price of Rs 4,250, implying a 14% upside potential.

The growth was aided by strong Indian performance. TCS reported deal wins of $8.1 billion, with a book-to-bill ratio of 1.1 times, in line with the research firm's expectations.

Given its size, order book, exposure to long-duration orders, and portfolio, TCS is well positioned to withstand the weakening macro environment and ride on the anticipated industry growth.

Owing to its steadfast market leadership position and best-in-class execution, the company has been able to maintain its industry-leading margin and demonstrate superior return ratios.

The overall demand environment remains positive (baring furlough impact), with strong deal-signing across the board. The deal ramp-ups and execution have been timely with few exceptions, and the revenue conversion remains strong.

The softness in BFSI was due to furloughs and the closure of a large programme in North America. Hence, revenue growth declined in Q3. TCS expects BFSI to gain momentum in Q4 and will continue to strengthen going forward.

HSBC Global Research

The research firm has a 'hold' rating with a price target raised to Rs 3,640 per share from earlier Rs 3,625 apiece.

TCS margin performance was quite impressive as it expanded margin by 50 basis points quarter-on-quarter, despite the large-deal impact.

The company reported better-than-expected topline results with decent deal wins.

Nomura

The research firm's earnings per share estimate is 2–5% lower than consensus. But its target price was raised marginally to Rs 3,160 from Rs 3,120 earlier while maintaining a 'reduce' rating on the stock.

Headcount declined by 1% in the third quarter, and attrition moderated to 13.3%.

Attrition is in a comfortable range of 11–14%. While TCS noted it will hire freshers (earlier target was 40,000) in FY24, the hiring pace will depend on demand revival as it focuses on utilisation.

Key headwinds, including furlough and higher third-party expenses of 80 basis points, were offset by tailwinds from higher efficiency, lower subcon and currency.

"We believe weak growth, limited scope in subcon expenses (already below pre-Covid) and return-to-office for staff will limit a large improvement," the research firm said in a Jan. 11 note.

There were no mega deals in Q3. TCS noted that it has not seen any change in customer sentiment and behaviour on a QoQ basis as clients continue to prioritise projects with upfront cost savings.

A significant pickup in demand could return once there is more certainty in the minds of the clients, as per TCS. "We see no evidence of pickup in discretionary demand yet.".

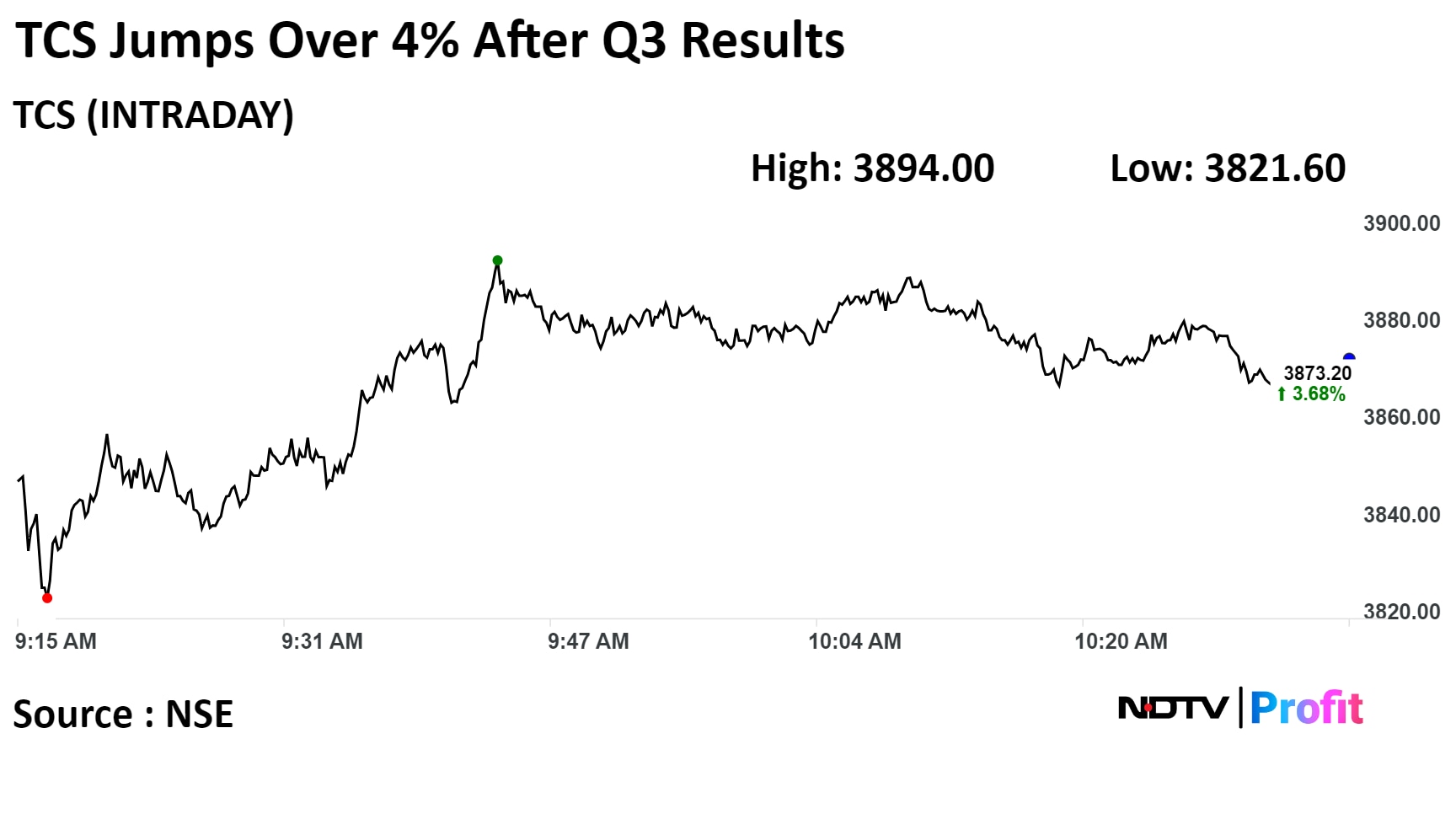

On the NSE, TCS's stock rose as much as 4.24% during the day to Rs 3,894 apiece, the most since Dec. 15, 2023. It was trading 3.5% higher at Rs 3,866.40 apiece, compared to a 0.75% advance in the benchmark Nifty 50 as of 10.36 a.m.

Of the 45 analysts tracking the company, 24 have a 'buy' rating on the stock, 12 recommend a 'hold' and nine suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies a upside of 5%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.