While international and domestic steel prices are seeing an uptick in recent weeks, signalling a positive trend for Tata Steel, the company's third quarter performance might not be better than the second quarter, said TV Narendran, chief executive officer and managing director of the company.

The industry is not out of the woods yet, and Q2 realisations would be Rs 2,000 per tonne lower on a sequential basis, he said.

Why Will Q3 Be Weak?

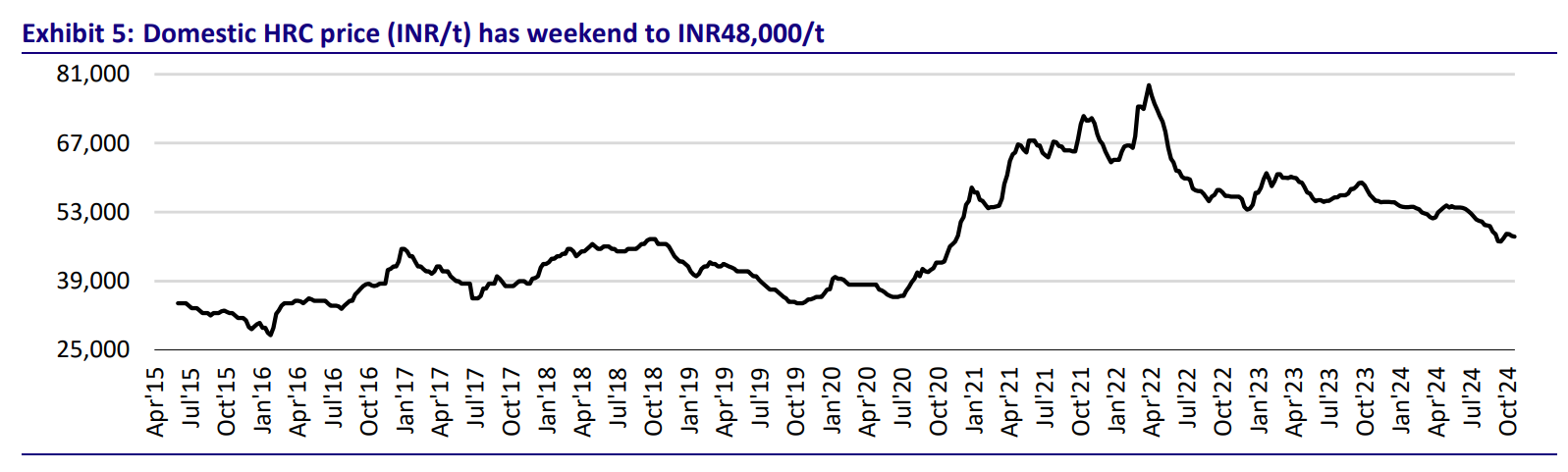

Narendran noted while domestic steel prices had risen in October, they were nowhere close to the July levels. Prices were unlikely to reach July levels until December, which would lead to average steel prices in the third quarter remaining lower than in the July-September quarter.

While domestic demand remained strong, construction demand continued to be lacklustre this year, due to the impact of elections, the CEO said. However, he expects the situation to improve between January-June 2025.

Auto demand had slipped in the last few quarters, he noted but hopes it will pick up in the next few months.

All these factors would cause Tata Steel's realisations to be lower by Rs 2,000 per tonne quarter-on-quarter in Q3. However, the company could get some benefit on the cost front, as it was expecting coking coal prices to be $20 per tonne lower on a quarterly basis in the next quarter.

Source: Motilal Oswal

International Business

While the Ebitda of Tata Steel's Netherlands plant had improved on an annual basis to $19 per tonne in Q2, performance was weak on a sequential basis due to lower realisations, and higher emission and bulk gas related costs.

This sequential weakness is expected to continue in the third quarter, the management stated in its second quarter earnings concall. It expects the next two quarters to be volatile. The company has, however, initiated several cost-saving measures. Furthermore, the management also stated that earnings recovery at the Netherlands plant has been pushed to fiscal 2026.

The Ebitda of Tata Steel's UK operations per tonne widened in the July-September period to $300 versus $168 in the previous quarter. Management expected Q3 realisations to be 55 pounds lower per tonne. Additionally, expectations of a break-even in UK operations in third quarter have been delayed to first quarter of fiscal 2026 now.

Narendran told NDTV Profit it was important for the German economy to kickstart again for Europe to do well.

Near Term Brokerage View

As per Motilal Oswal, while Tata Steel's India business is expected to continue strong performance, it expects improving performance of the Europe business to support overall earnings growth.

Nuvama Research expects earnings to only see a recovery in fiscal 2026, and has thus increased Tata Steel's FY26 Ebitda forecast by 61% year-on-year. Citi has cut its FY25, FY26 and FY27 Ebitda estimates by 24%, 7% and 3% respectively, due to European trends.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.