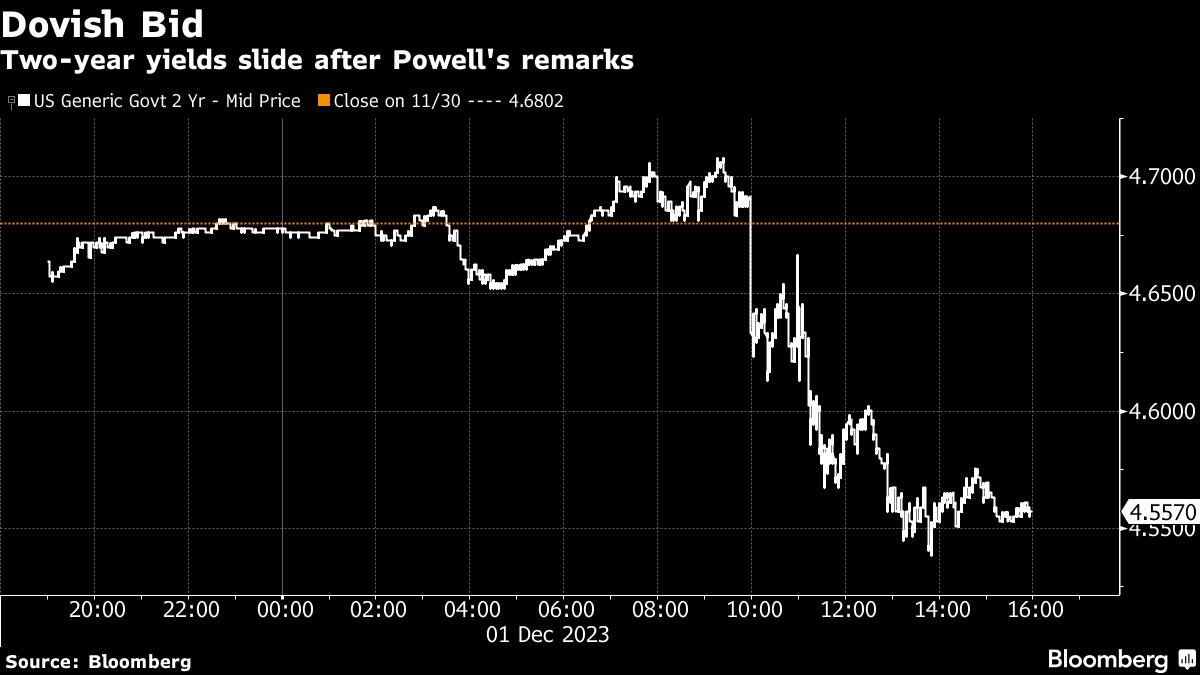

(Bloomberg) -- Wall Street turned a blind eye on Jerome Powell's attempt to curb bets on rate cuts, with stocks and bonds climbing on speculation the Federal Reserve will stay put this month and ease policy in 2024.

While the Fed chief said officials are ready to hike further if needed, he also noted policy is “well into restrictive territory.” Two-year yields sank 13 basis points to 4.55%. The S&P 500 hit the highest since March 2022 — up a fifth straight week. The dollar slid. Trader bets on a quarter-point Fed cut in March have risen, with swaps fully pricing in a reduction in May. They project over a full point of easing by December 2024.

Read: Five Takeaways From Powell's Spelman College Remarks

“Powell tried to push back, but that lasted only ‘a few seconds' in Treasuries,” said Peter Boockvar, author of the Boock Report. “Whereas the market thinks it's as easy as the Fed is done and cuts are coming next year, the speech he's giving today is purposely meant, I believe, to try to keep the markets offsides. I say ‘somewhat' because it wasn't forceful and the markets aren't being swayed.”

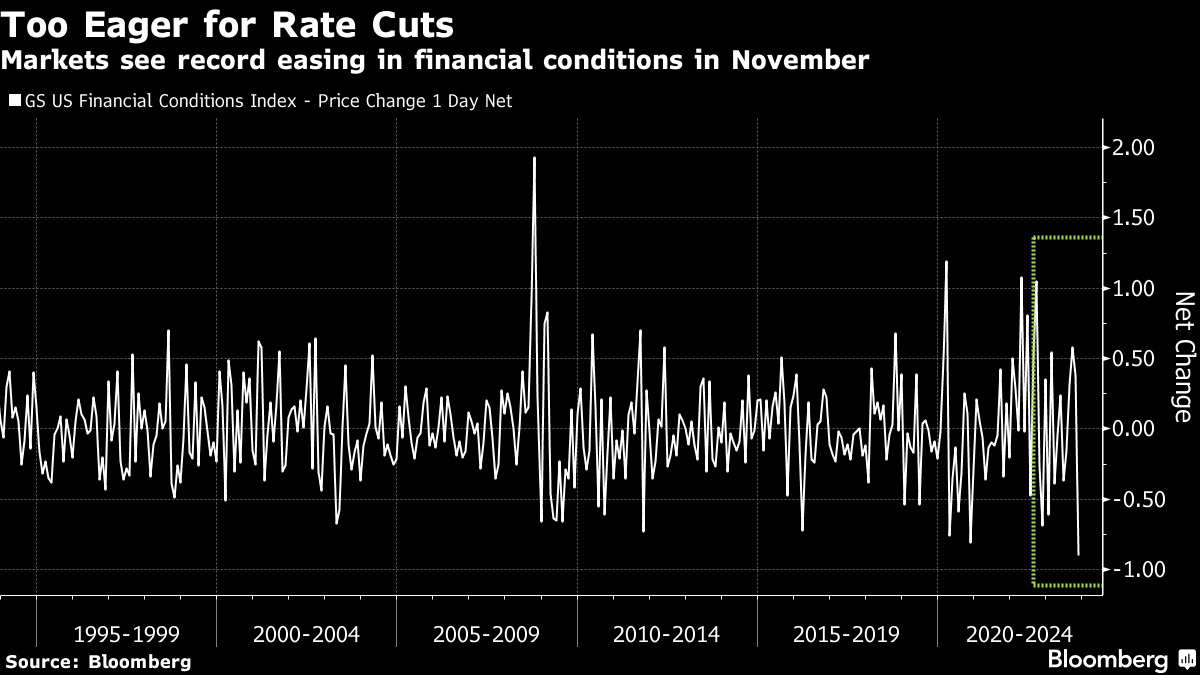

The “higher for longer” mantra has been countered by the markets' conviction the Fed delivered a “dovish” pivot in November, and will begin a rate-cutting cycle by mid-2024 — if not sooner, said Quincy Krosby at LPL Financial.

“Although both wings of the FOMC — the doves and the hawks — appear to have coalesced around a more ‘careful' approach to policy, with an acceptance that policy remains appropriate, markets clearly do not agree that it will be sufficient,” she noted.

“Market players don't believe Powell,” said Jose Torres at Interactive Brokers. “Perhaps investors have dismissed his presentation with hopes that he is on the verge of becoming more dovish and will reflect such sentiment at the next Fed meeting. In the meantime, the next two weeks of economic data could potentially drive market volatility.”

The bond market's biggest monthly rally in years gathered pace this week after more dovish comments by several Fed officials, most notably Governor Christopher Waller on Tuesday. Known for a relatively hawkish mindset, Waller said he's increasingly confident the policy rate is well positioned to bring down price growth to the Fed's goal.

“Not surprising, Powell walks back Waller,” said Jeffrey Roach at LPL Financial. “Markets view today's comments as inching toward the dovish camp. A few weeks ago, Powell said policy is restrictive, but today he believes policy is “well into restrictive territory.” I think it's fair for markets to latch on to that subtlety.”

Powell's comments were pretty much consistent with recent messaging, according to Ian Lyngen and Ben Jeffery at BMO Capital Markets. The language of moving “carefully” and “more balanced” translates into no action for the foreseeable future — and this is exactly the point when market participants begin to diverge in terms of timing, they noted.

“The camp assuming a March cut should be on the table is apparently growing even as taking the Fed at face value would imply the first rate reduction shouldn't be on the radar until the second half of 2024 (at the earliest),” they said. “We're sympathetic to investors' collective view that if there is a surprise, it will be to the downside; although this has been the case throughout much of the last several months. One aspect that has changed recently is the price action itself. Friday's bid was a great example of this dynamic.”

To Gennadiy Goldberg at TD Securities, the rates market is “getting ahead of itself” when it comes to pricing in cuts in 2024.

Read: Fed Should End QT Before Repo Facility Empties, Ex-Official Says

“You are starting to see soft data, hard data, inflation data all surprising to the downside,” Goldberg said in a Bloomberg Television interview. “That is the big driver and the market has gotten it into its head that no hikes equals cuts.”

A measure of US factory activity shrank for a 13th straight month in November as high interest rates continue to hammer the goods-producing side of the economy. Fed Bank of Chicago President Austan Goolsbee voiced confidence that inflation is still on track to return to the US central bank's 2% target, praising the latest data that showed receding price pressures.

Signs are piling up — in recent data, in warnings from top retailers and in anecdotes from local businesses across the country — that after defying expectations all year and splurging over the summer, American households are starting to pull back.

Meantime, a Bank of America Corp. strategist who correctly predicted this year's rebound in the widely-followed 60/40 portfolio strategy has warned that the trade could now be set for a sharp reversal.

The strategy that involves placing 60% of a portfolio in stocks and 40% in bonds had its best month in November since a rally that followed the break up of the Soviet Union more than 30 years ago, according to BofA. An analysis of historical data conducted by the strategist Michael Hartnett and his team shows that typically “pullbacks follow monster months.”

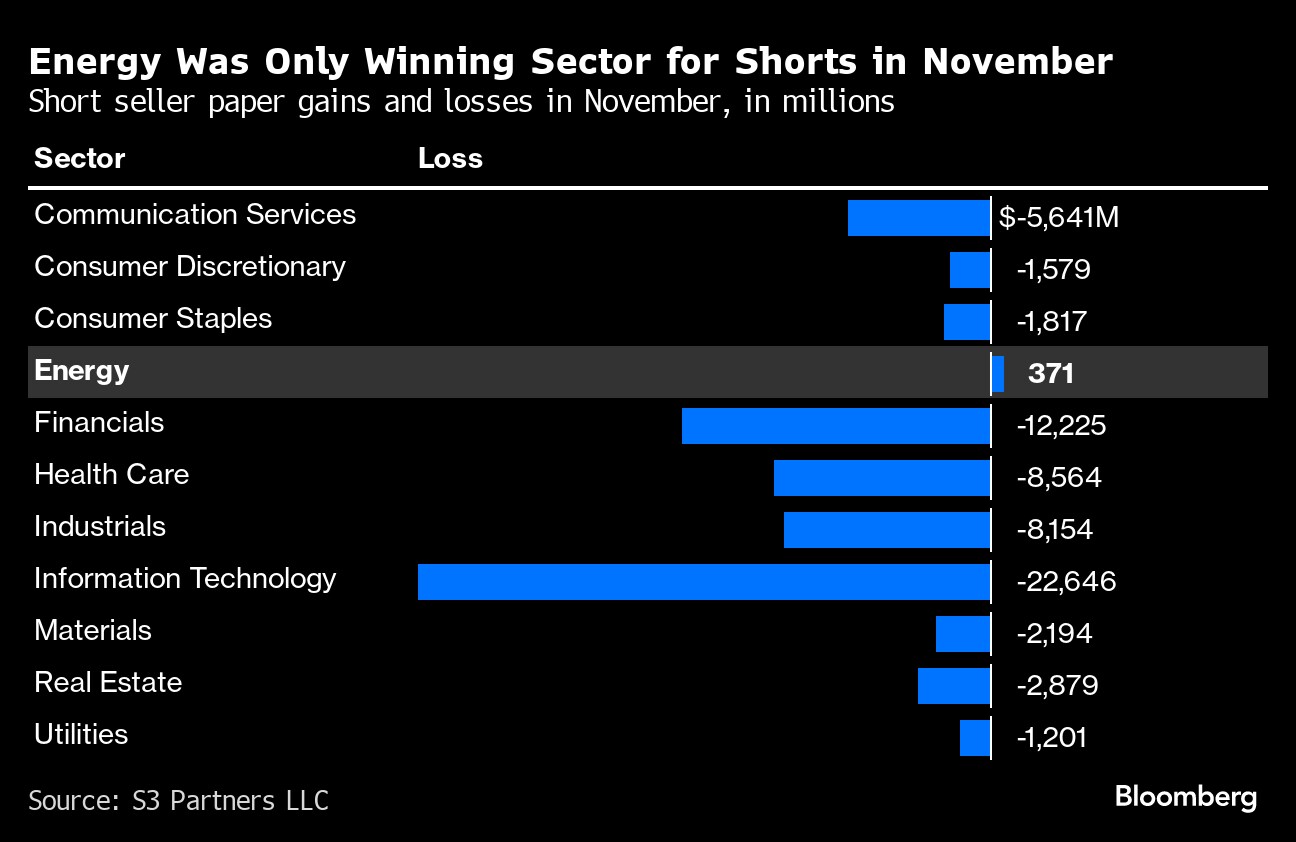

And November was also a brutal month for those betting against the US stock market.

Short-sellers were caught flat-footed as the S&P 500 roared back from a three-month slump with the strongest gain since July 2022, hammering them with mark-to-market losses of over $80 billion, according to data from S3 Partners LLC. That's the biggest hit since January, when equity prices staged a surprisingly strong rebound from last year's rout.

Elsewhere, oil extended declines, closing out a sixth straight weekly drop, as the OPEC+ output cuts announced this week failed to dispel the market's gloom over swelling global supplies. Copper rallied after comments by Powell and the looming shutdown of a large mine in Panama emboldened bulls.

Corporate Highlights:

- Cryptocurrency-linked shares like Coinbase Global Inc. and Marathon Digital Holdings Inc. rallied as Bitcoin climbed.

- Amazon.com Inc. has signed a contract with rival SpaceX for three launches of Elon Musk's Falcon 9 rocket, grabbing additional capacity to loft the company's internet-from-space satellites into orbit.

- Pfizer Inc.'s second weight-loss setback this year is a warning sign that breaking into the lucrative obesity market isn't going to be easy.

- Dell Technologies Inc. reported revenue that declined more than expected, buffeted by continued sluggish corporate demand for personal computers.

- Johnson & Johnson was upgraded to buy at UBS Group AG.

- Marvell Technology Inc.'s fourth-quarter revenue forecast fell short of expectations and its third quarter also missed estimates.

- Ulta Beauty Inc., a cosmetics retailer, reported forecast-beating comparable sales growth in the third quarter.

- American International Group Inc. sold $717.5 million worth of shares in Corebridge Financial Inc., the life and retirement business it spun off last year.

- Commerzbank AG is talking to sovereign wealth funds about becoming an anchor investor to shore up its defenses against any opportunistic takeover bid and preserve its independence, people familiar with the matter said.

- Cineplex Inc., Canada's largest theater chain, is weighing the sale of its digital advertising business, which operates electronic displays at restaurants and shopping malls, according to people familiar with the matter.

- Bank of Montreal missed analysts' earnings estimates as the company reported higher expenses related to the integration of Bank of the West and a drop in wealth-management income.

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.6% as of 4 p.m. New York time

- The Nasdaq 100 rose 0.3%

- The Dow Jones Industrial Average rose 0.8%

- The MSCI World index rose 0.6%

Currencies

- The Bloomberg Dollar Spot Index fell 0.4%

- The euro was little changed at $1.0879

- The British pound rose 0.7% to $1.2708

- The Japanese yen rose 0.9% to 146.87 per dollar

Cryptocurrencies

- Bitcoin rose 2.7% to $38,776.49

- Ether rose 2.2% to $2,091.6

Bonds

- The yield on 10-year Treasuries declined 11 basis points to 4.21%

- Germany's 10-year yield declined nine basis points to 2.36%

- Britain's 10-year yield declined four basis points to 4.14%

Commodities

- West Texas Intermediate crude fell 2.3% to $74.24 a barrel

- Spot gold rose 1.7% to $2,070.70 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Alexandra Semenova, Carmen Reinicke, Krystof Chamonikolas, Michael Msika and Tatiana Darie.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.