Asian markets follow the Wall Street lower after the latest inflation data bolstered bets on Federal Reserve rate hikes.

Shares slipped in Australia, South Korea and Japan. The Golden Dragon index of Chinese companies listed in the U.S. fell the most in a month.

Elsewhere, U.S. equity futures contracts were little changed after the S&P 500 fell for the first time in five days, with banks underperforming ahead of earnings from JPMorgan Chase & Co., Citigroup Inc. and Wells Fargo & Co. Friday.

Meanwhile, the yield on the 10-year U.S. bond was trading at 4.69% and Bitcoin was below 27,000-level. Brent crude was trading beyond $86 a barrel, whereas WTI Crude was above $83-mark.

At 5:53 a.m., the GIFT Nifty, an early indicator of the Nifty 50 Index's performance in India was up 150 points or 0.75% at 19,685.

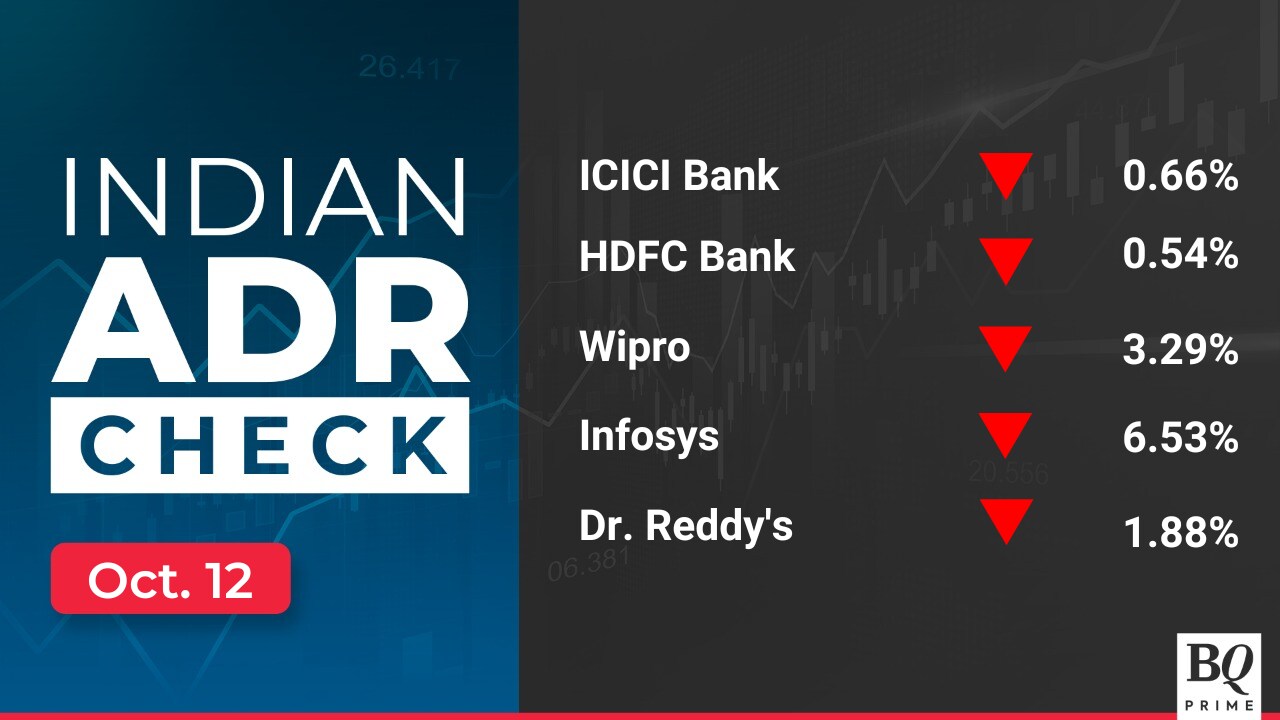

India's benchmark stock indices closed lower, snapping two days of gains after swinging between gains and losses for most of Thursday. Media, metals and energy led the advance, whereas the information technology sector was under pressure.

Overseas investors remained net sellers of Indian equities on Thursday for the 17th consecutive session. Foreign portfolio investors offloaded stocks worth Rs 1,862.6 crore, while domestic institutional investors mopped up equities worth Rs 1,532.1 crore, according to provisional data from the National Stock Exchange.

The Indian rupee weakened 6 paise to close at Rs 83.25 against the U.S. dollar on Thursday.

Stocks To Watch: Infosys, HCLTech, Maruti Suzuki, Sun Pharma, Tech Mahindra, Vedanta, Dr. Reddy's, Lupin In Focus

Infosys: Temasek has extended the Infosys-Temasek digital services JV by five years. Infosys' Q2 FY24 attrition fell to 14.6% vs. 17.3% QoQ. An interim dividend of Rs 18 per equity share was declared, with the record date set for Oct. 25.

HCLTech: The company clocked the highest ever new bookings of $4 billion in Q2. Its attrition fell to 14.2% vs. 23.8% YoY. An interim dividend of Rs 12 per equity share was declared, with the record date set for Oct. 20.

Tech Mahindra: Company to sell a 33% stake in a South African unit for ZAR 23.95 million (approximately Rs 10.5 crore). Divestment is undertaken to comply with South African Broad-Based Black Economic Empowerment guidelines.

Maruti Suzuki: The company will consider a preferential issue of equity to Suzuki Motor Corp. as consideration for acquiring Suzuki Motor Gujarat.

Airline Stocks: Air passenger traffic grew 18.3% to 1.22 crore in September. Indigo's market share increased to 63.4% in September from 63.3% in August; Vistara's share increased to 10% from 9.8%; and AirAsia India's share fell to 6.7% from 7.1%.

IRB Infrastructure Trust: The company has executed definitive agreements with affiliates of Singaporean sovereign wealth fund GIC as financial investors and SPV Samakhiyali Tollway to implement the Rs 2,092 crore Samakhiyali Santalpur BOT project in Gujarat. The Trust will acquire a 99.96% stake in STPL for a total consideration of Rs 116.2 crore.

GMR Airports Infrastructure: September passenger traffic was up 23% YoY at 94.16 lakh and aircraft movements were up 14% YoY at 62,230.

Dr. Reddy's Laboratories: The company has been issued Form 483 with nine observations from the U.S. FDA for Bachupally Manufacturing Plant, Hyderabad. The inspection was conducted from Oct. 4 to Oct. 12.

Sun Pharmaceuticals: Sun Pharma's CEQUA 0.09% phase 4 study data shows sustained improvement in dry eye disease signs and symptoms in patients who switched from Restasis 0.05%.

Lupin: The company has received tentative approval from the US FDA to market a generic equivalent of Xywav Oral Solution, of Ireland's Jazz Pharmaceuticals. The product will be manufactured at Lupin's Somerset facility in the U.S.

Panacea Biotec: The company has been issued Form 483 with nine observations from the U.S. FDA for the Baddi facility in Himachal Pradesh. The inspection was conducted from Oct. 3 to Oct. 12.

Glenmark Pharma: Company's subsidiary Ichnos Sciences Inc has entered into an exclusive worldwide licensing agreement for its OX40 antagonist monoclonal antibody portfolio with Astria Therapeutics, a biopharmaceutical company.

Zaggle Prepaid Ocean Services: The company has entered into a $20 million growth agreement with Visa Worldwide for 5 years to further their alliance in support of the issuance of Forex CoBrand Cards.

BGR Energy Systems: The company wins an order worth Rs 112.75 crore from Mangalore Refinery and Petrochemicals for the supply of air-cooled heat exchanges to be delivered by Oct. 9, 2024.

One 97 Communication: RBI imposes a monetary penalty of Rs 5.39 crore on Paytm Payments Bank for non-compliance on multiple fronts

SJVN: Unit SJVN Green Energy received an LoA from Rajasthan Urja Vikas Nigam for the development of a 100 MW solar power project worth Rs 600 crore to be executed over 18 months. The project will be developed on a build-own-operate basis.

IRCON: The company has been granted 'Navratna' status by the Department of Public Enterprise.

RITES: The government granted 'Navratna' status to RITES.

Vedanta: Odisha's customs commissioner officer imposes a customs duty of Rs 1.56 crore and a penalty and fine of Rs 2.9 crore on Vedanta's Aluminum business (and BALCO) for the sale of goods without obtaining necessary approvals. The company also incorporates a wholly-owned subsidiary named Vedanta Iron and Steel as part of its demerger plan.

Kesoram Industries: Sales volume grew 16.9% to 3.73 million tonnes in the first half of FY24.

Steel Strips Wheels: The acquisition of AMW Autocomponent under CIRP has been approved verbally by NCLT, Ahmedabad.

Angel One: Total orders rise 36.1% QoQ to 338 million in Q2. The company added 2.1 million clients in Q2, the highest in a quarter. The Board has recommended an interim dividend of Rs 12.7 per share.

IDBI Bank: The bank has hiked the 2-year to 3-year MCLR by 10 bps and the overnight to one-year MCLR by 15 bps.

Bank of Maharashtra: One-year MCLR has been revised upwards to 8.7% from 8.6%.

Aditya Birla Fashion & Retail: The company invests an additional Rs 75 crore in subsidiary Aditya Birla Digital Fashion Ventures via partly paid equity and preference shares.

REC: Khavda IVA Power Transmission, Rajasthan IV A Power Transmission, and Rajasthan IV C Power Transmission have been incorporated as wholly owned subsidiaries of REC Power Development & Consultancy, each with an authorised share capital of Rs 5 lakh.

Earnings Post Market Hours

Infosys Q2 FY24 (Consolidated, QoQ)

Revenue is up 2.8% at Rs 38,994 crore vs. Rs 37,933 crore (Bloomberg estimate: Rs 38,503.14 crore).

EBIT is up 4.8% at Rs 8,274 crore vs. Rs 7,891 crore (Bloomberg estimate: Rs 8,087.59 crore).

EBIT margins are at 21.22% vs. 20.80% (Bloomberg estimate: 21%).

Net profit is up 4.5% at Rs 6,215 crore vs. Rs 5,945 crore (Bloomberg estimate: Rs 6,266.5 crore).

Note: FY24 revenue growth guidance was revised lower to 1-2.5% from 1-3.5%.

HCLTech Q2 FY24 (Consolidated, QoQ)

Revenue is up 1.4% at Rs 26,672 crore vs. Rs 26,296 crore (Bloomberg estimate: Rs 29,644.76 crore).

EBIT is up 10.8% at Rs 4919 crore vs. Rs 4438 crore (Bloomberg estimate: Rs 4,748.53 crore).

EBIT margin at 18.4% vs. 16.88% (Bloomberg estimate: 17.62%)

Net profit is up 8.6% at Rs 3,833 crore vs. Rs 3,531 crore (Bloomberg estimate: Rs 3755.47 crore).

Note: FY24 revenue growth guidance was revised lower to 5-6% from 6-8%; FY24 EBIT margin guidance was 18–19%.

Angel One Q2 FY24 (Consolidated, YoY)

Revenue is up 40.6% at Rs 1047.9 crore vs. Rs 745.3 crore (Bloomberg estimate: Rs 668.9 crore).

Net profit is up 42.62% at Rs 304.5 crore vs. Rs 213.5 crore (Bloomberg estimate: Rs 283.2 crore).

Kesoram Industries Q2 FY24 (Consolidated, YoY)

Revenue is up 12.83% at Rs 953.8 crore vs. Rs 845.27 crore.

Ebitda is up 32.54% at Rs 69.08 crore vs. Rs 52.12 crore.

Margins at 7.24% vs. 6.16%

Net loss of Rs 58.37 crore vs. net loss of Rs 59.05 crore

Anand Rathi Wealth Q2 FY24 (Consolidated, YoY)

Revenue is up 34.19% at Rs 182.58 crore vs. Rs 136.06 crore.

Net profit is up 34.29% at Rs 57.68 crore vs. Rs 42.95 crore.

AUM grew 33.8% to Rs 47,957 crore vs. Rs 35,842 crore.

Earnings in Focus

Den Networks, HDFC Life, Tata Steel Long Products, Sai Silks (Kalamandir), Som Distilleries & Breweries

Bulk Deals

360 One Wam: Norges Bank bought 32.76 lakh shares (0.91%) for Rs 511.2 apiece. Morgan Stanley sold 24.42 lakh shares (0.68%) at Rs 511.2 apiece.

Shalimar Paints: Hella Infra Market bought 24.1 lakh shares (3.33%) at Rs 168.06 apiece, Rajasthan Global Securities bought 22.85 lakh shares (3.16%) at Rs 168.72 apiece, and Graviton Research Capital bought 8.22 lakh shares (1.13%) at Rs 175.12.

Pledge Share Details

Mangalore Chemicals & Fertilizers: Promoter Zuari Agro Chemicals released pledge of 25 lakh shares on Oct 9 and has created a pledge of 30.69 lakh shares on Oct 10.

Aurobindo Pharma: Promoter RPR Sons Advisors and P Suneela Rani released pledge of 20 lakh shares on Oct 10.

Who's Meeting Whom

UTI Asset Management: To meet analysts and investors on Oct. 19.

Jupiter Wagons: To meet investors from Oct. 16 to Oct. 19.

Medplus Health Services: To meet analysts and investors on Oct. 27.

Tube Investments of India: To meet analysts and investors on Oct. 31

PCBL: To meet analysts and investors on Oct. 17.

IIFL Finance: To meet analysts and investors on Oct. 19.

360 One Wam: To meet analysts and investors on Nov. 3.

Can Fin Homes: To meet analysts and investors on Oct. 18.

CIE Automotive: To meet analysts and investors on Oct. 18.

Huhtamaki: To meet analysts and investors on Oct. 23.

Tata Elxsi: To meet analysts and investors on Oct. 17.

Vishnu Chemicals: To meet analysts and investors on Oct. 13.

Inox Green Energy Services: To meet analysts and investors from Oct. 17 to Oct. 19.

Trading Tweaks

Move Into Short-Term ASM Framework: Shilchar Technologies, SEPC

Price Band Revised From 10% To 5%: Omaxe

Price Band Revised From 20% To 10%: Prakash Industries

F&O Cues

Nifty October futures fell 0.04% to 19,842.05, at a premium of 48.05 points.

Nifty October futures' open interest rose 0.38% by 733 shares.

Nifty Options Oct 19 Expiry: Maximum call open interest at 19,800 and Maximum put open interest at 19,800.

Nifty Bank October futures rose 0.13% to 44,744.00, at a premium of 144.8 points.

Nifty Bank October futures' open interest fell 3.38% to 4,881 shares.

Nifty Bank Options Oct 18 Expiry: Maximum call open interest at 45,000 and Maximum put open interest at 44,500.

Securities in the ban period: Balrampur Chini Mills, BHEL, Delta Corp., Hindustan Copper, India Bulls Housing Finance, India Cements, Manappuram Finance, L&T Finance, Punjab National Bank and Sun TV Network

Money Market Update

The Indian rupee weakened 6 paise to close at Rs 83.25 against the U.S. dollar on Thursday.

Research Reports

Pharma Q2 Results Preview - See Margin Recovery Underway: ICICI Securities

Consumer Durables Q2 Results Preview - Softer Demand, Higher Ad-Spend To Curb Margins: Nirmal Bang

Healthcare Q2 Results Preview - Seasonality May Spurt Volumes: ICICI Securities

Siemens - Focus on Digitalisation, Decarbonisation: Prabhudas Lilladher

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.